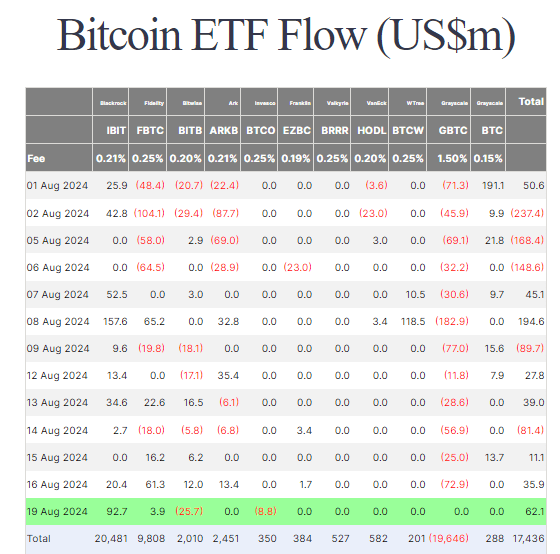

BlackRock’s IBIT boosts Bitcoin ETFs with $92.7 million inflow, total now $20.5 billion

Quick Take

Bitcoin

Data from Farside shows that Bitcoin ETFs experienced a net inflow of $62.1 million, marking the largest since Aug. 8. The primary contributor to this surge is BlackRock’s IBIT, which alone attracted an impressive $92.7 million, bringing its total net inflow to a staggering $20.48 billion. Fidelity also saw a modest inflow of $3.9 million. However, not all Bitcoin ETFs performed positively—Bitwise’s BITB and Galaxy Invesco’s BTCO were the only issuers to experience outflows, losing $25.7 million and $8.8 million, respectively.

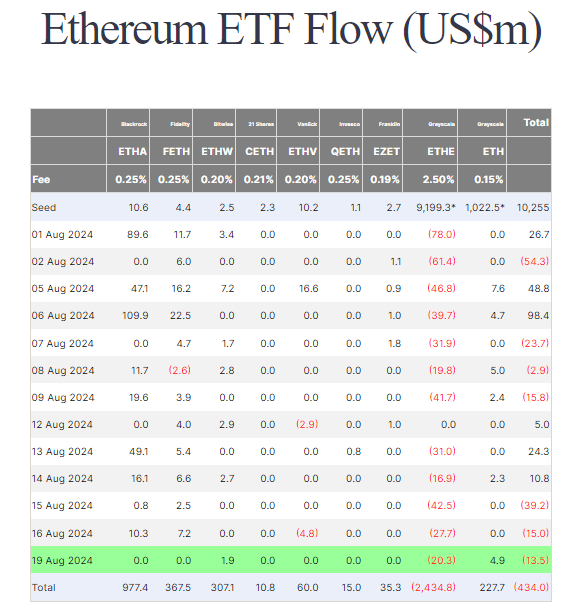

Ethereum

In contrast, Ethereum ETFs are struggling, with a net outflow of $13.5 million. Grayscale’s ETHE was the most affected, suffering a $20.3 million outflow, which increased its total outflows to $2.4 billion. Overall, Ethereum ETFs have now recorded total outflows of $434 million.

The post BlackRock’s IBIT boosts Bitcoin ETFs with $92.7 million inflow, total now $20.5 billion appeared first on CryptoSlate.