Why AAVE Price Is Up Today?

The post Why AAVE Price Is Up Today? appeared first on Coinpedia Fintech News

AAVE, the native token of the decentralized lending platform Aave, has experienced a significant price surge, climbing 45% to $135 over the past four weeks. This impressive rally has outpaced all other top 100 cryptocurrencies, including major players like Bitcoin and Ethereum. Despite recent gains, AAVE’s total TVL remains below its October 2021 peak of over $32 billion. The uptick in activity is part of a broader trend in the DeFi space.

Will this recovery run in AAVE result in a 60% surge before Q4 begins?

The Catalysts Behind AAVE’s Rally

Interestingly, AAVE’s recent price surge has been fueled by game-changing proposals that have reignited investor excitement. One of the standout ideas came from Marc Zeller, founder of the Aave-Chan Initiative. Zeller’s proposal to introduce a fee switch mechanism, which would redistribute excess platform revenue to key ecosystem players, has been a major catalyst.

Plus, Web3 agency Deelabs said that the plan to buy back AAVE tokens from the secondary market has created a positive feedback loop, driving up the token’s value.

Joshua de Vos, a research lead at CCData, highlighted that speculation around this fee switch has significantly boosted market sentiment. Investors are buzzing with optimism, anticipating new incentives for holding and staking AAVE, which only adds to the token’s growing appeal.

The “Umbrella” Proposal: Easing Market Pressures

Another key reason for AAVE’s price surge is the “Umbrella” proposal, which aims to improve how the platform handles risky loans. Instead of selling off AAVE tokens when loans go bad, the plan is to burn them, reducing the supply. Katie Talati, head of research at Arca, noted that this change could lessen the pressure to sell AAVE tokens, helping to keep the price stable during market swings.

Institutional Interest and Market Sentiment

Moreover, these proposals have not just caught the eye of retail investors; they’ve also drawn significant attention from institutional players. Algorithmic trading firm Wintermute observed a surge in interest from large funds and institutional investors, with over-the-counter (OTC) trades highlighting the growing demand for AAVE. Adding to its appeal, Aave has emerged as the top revenue-generating protocol, pulling in over $27 million in fees as per the latest data. This performance has reinforced AAVE’s status as a “blue chip” DeFi asset, making it a key player in the crypto space.

Is AAVE Undervalued?

Given its recent price surge, strong performance, and increasing institutional interest, many in the crypto community believe AAVE is still undervalued. The ongoing protocol improvements suggest that AAVE may continue to thrive in the months ahead.

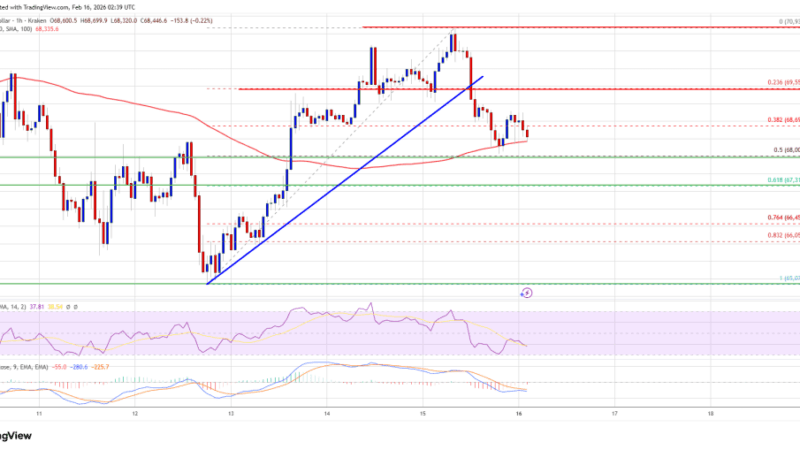

Presently, the AAVE price is advancing to test the interim resistance at $145 and a breach above the yearly highs may offer a fine push towards the higher targets.