POPCAT Price Retests Breakout Level, Bull Run Incoming?

The post POPCAT Price Retests Breakout Level, Bull Run Incoming? appeared first on Coinpedia Fintech News

A popular Solana-based meme coin, Popcat (POPCAT) has experienced a significant 65% upside rally following its listing announcement on Binance. Amid this rally, it recently witnessed a breakout of a bullish double-bottom price action pattern and is currently retesting its breakout level that hints potential upside rally ahead.

POPCAT Price Prediction

According to expert technical analysis, POPCAT looks bullish as it has experienced a strong breakout of double bottom price action pattern. Based on the historical price momentum, whenever an asset breaks out any bullish price action pattern it always tends to experience a significant upside rally.

However, the experts suggest that the current price retest is a bullish sign and could propel POPCAT to skyrocket in the coming days. There is a high possibility, it could surge by 35% to the $1 or even higher level.

Rising Open Interest and Price Analysis

With this bullish breakout, POPCAT’s open interest (OI) has skyrocketed by 22% in the last 24 hours, according to the on-chain analytic firm CoinGlass. This rise of OI suggests growing interest from traders and investors potentially due to the bullish breakout.

At press time, POPCAT is trading near $0.752 and has experienced a price surge of over 10% in the last 24 hours. Meanwhile, its trading volume has increased by 8% during the same period, indicating higher participation due to the recent breakout.

Major Liquidation level

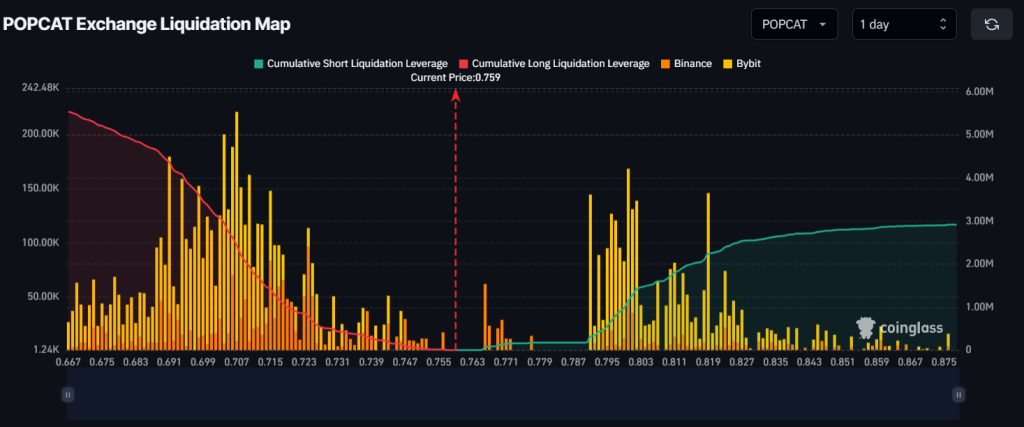

As of now, the major liquidation levels are near $0.707 on the lower side and $0.8 level on the upper side, as traders are over-leverage at these levels, according to the on-chain analytic firm CoinGlass.

If the sentiment remains bullish and the price rises to $0.8 level, nearly $1.15 million worth of short positions will be liquidated. Conversely, if the sentiment shifts a price falls to the $0.707 level, nearly $2.43 million worth of long positions will be liquidated.

This data shows that bulls currently taking control of the upward rally, while bears look exhausted.