Will Solana Price Crash? Institution Dumps $19.5M of SOL

The post Will Solana Price Crash? Institution Dumps $19.5M of SOL appeared first on Coinpedia Fintech News

Market sentiment suggests that Solana’s (SOL) price may crash to the $80 level. On August 31, 2024, the on-chain analytic firm Lookonchain made a post on X (previously Twitter) that Crypto Whale or Institution dumped a significant 139,532 SOL worth $19.5 million to Binance at a loss of $5.5 million.

Solana Whale Sell-off 140K SOL

According to a post on X, the whale wallet address “FkVrB” initially unstaked 139,532 SOL worth $19.5 million and later deposited it to Binance two days ago. The data shows that the wallet address “FkVrB” purchased this significant SOL when it was trading at the $180 level in July 2024, potentially in anticipation of a spot Solana Exchange Traded Fund (ETF) in the United States.

Since then SOL has never revisited the $180 level and currently, it looks bearish.

Solana Price Prediction

According to expert technical analysis, Solana (SOL) is currently at a crucial support level of $127. Additionally, it is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a downtrend.

Based on the historical price momentum, whenever SOL reaches the support level of $127, it tends to see a massive upside rally. This time, there is a high chance it could soar by 40% to the $180 level.

However, if SOL fails to hold this support level and closes a daily candle below the $120 level, there is a high possibility that SOL could fall to the next support level at $80.

SOL’s Bearish On-chain Metrics

Today’s CoinGlass SOL OI-weighted funding rate signals that short-sellers are highly dominating and liquidating the long positions. Currently, SOL’s OI-weighted funding rate stands at -0.0034%, indicating bearish sentiment and a price decline in the coming days.

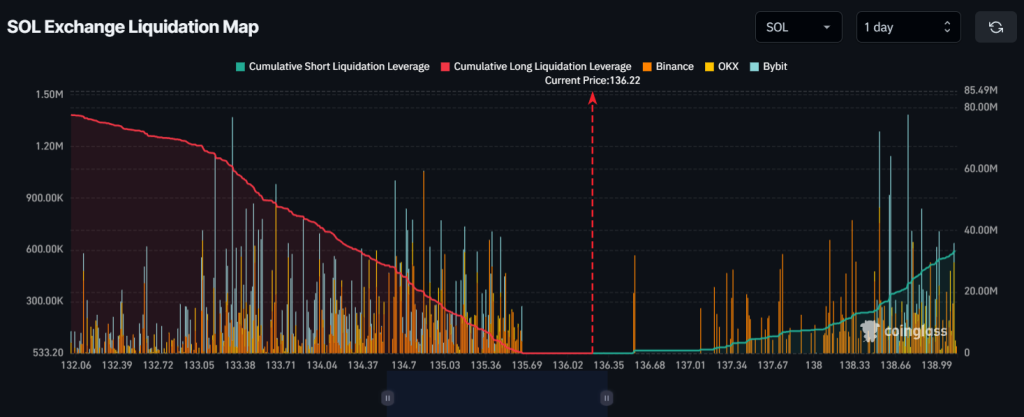

As of now, the major liquidation levels are near $133.3 on the lower side and $139 on the upper side, indicating traders are over-leveraged at these levels, according to CoinGlass data.

If the sentiment remains bearish and SOL’s price falls to the $133.3 level, nearly $60 million worth of long positions will be liquidated. Conversely, if sentiment shifts and the price rises to the $139 level, approximately $21.5 million worth of short positions will be liquidated.

Solana Price Analysis

At press time, SOL is trading near $135 and has experienced a modest price surge of over 1% in the last 24 hours. Meanwhile, its open interest has declined by 2% during the same period, indicating lower interest from traders amid the market downturn.