Bitcoin whale holdings steady at 1,600 entities, post-ETF surge stabilizes price

Onchain Highlights

DEFINITION: The number of unique entities holding at least 1,000 coins.

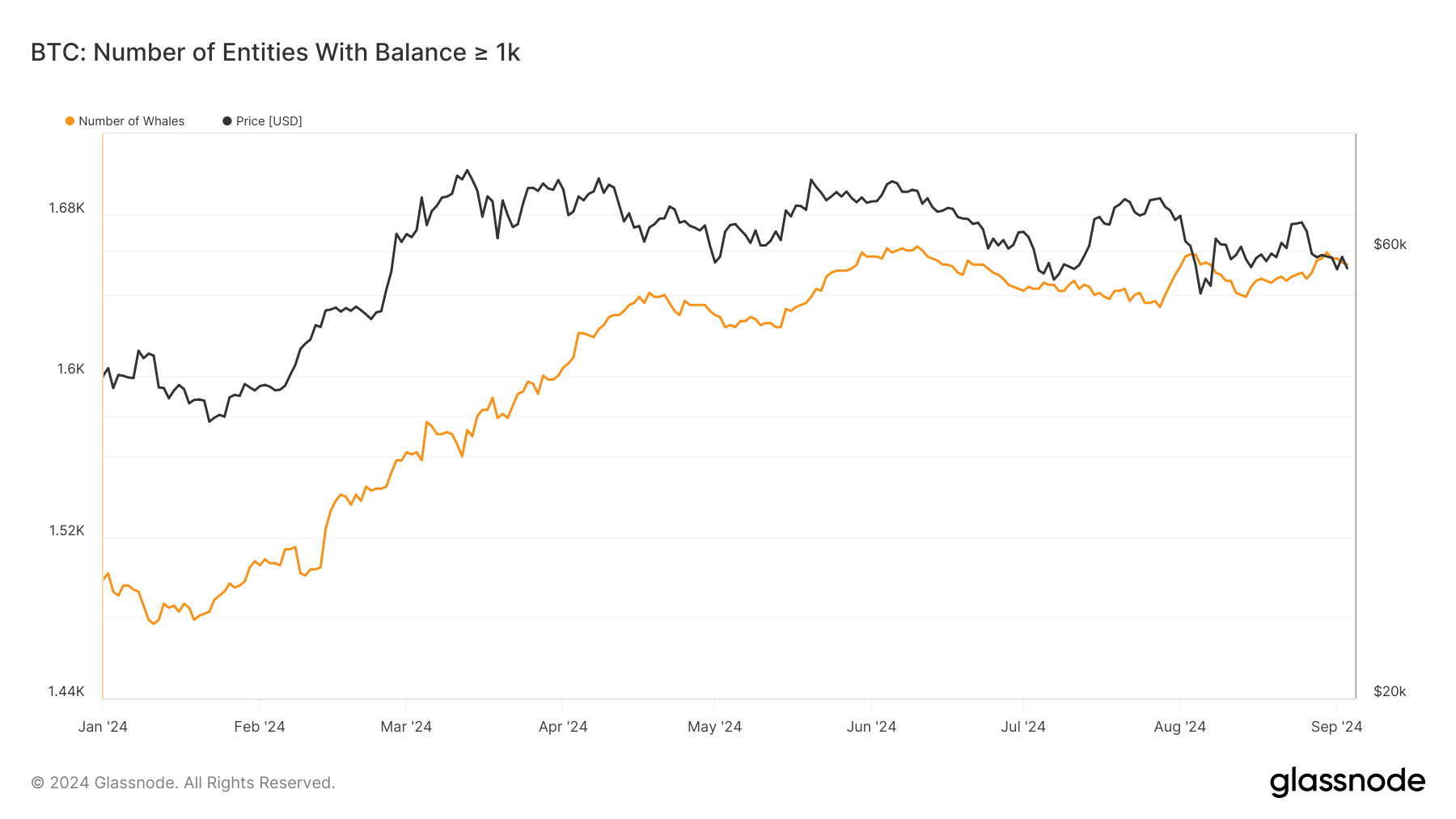

Bitcoin’s price has seen fluctuations alongside the number of entities holding over 1,000 BTC throughout 2024.

According to Glassnode data, whale activity surged in the first half of the year due to the Bitcoin ETFs, with over 1,600 entities accumulating large BTC holdings by April. This coincided with a notable price rise, as Bitcoin approached $73,000 before the April halving.

However, by mid-year, both the number of whales and Bitcoin price saw a period of consolidation, remaining within a tighter range during the summer months.

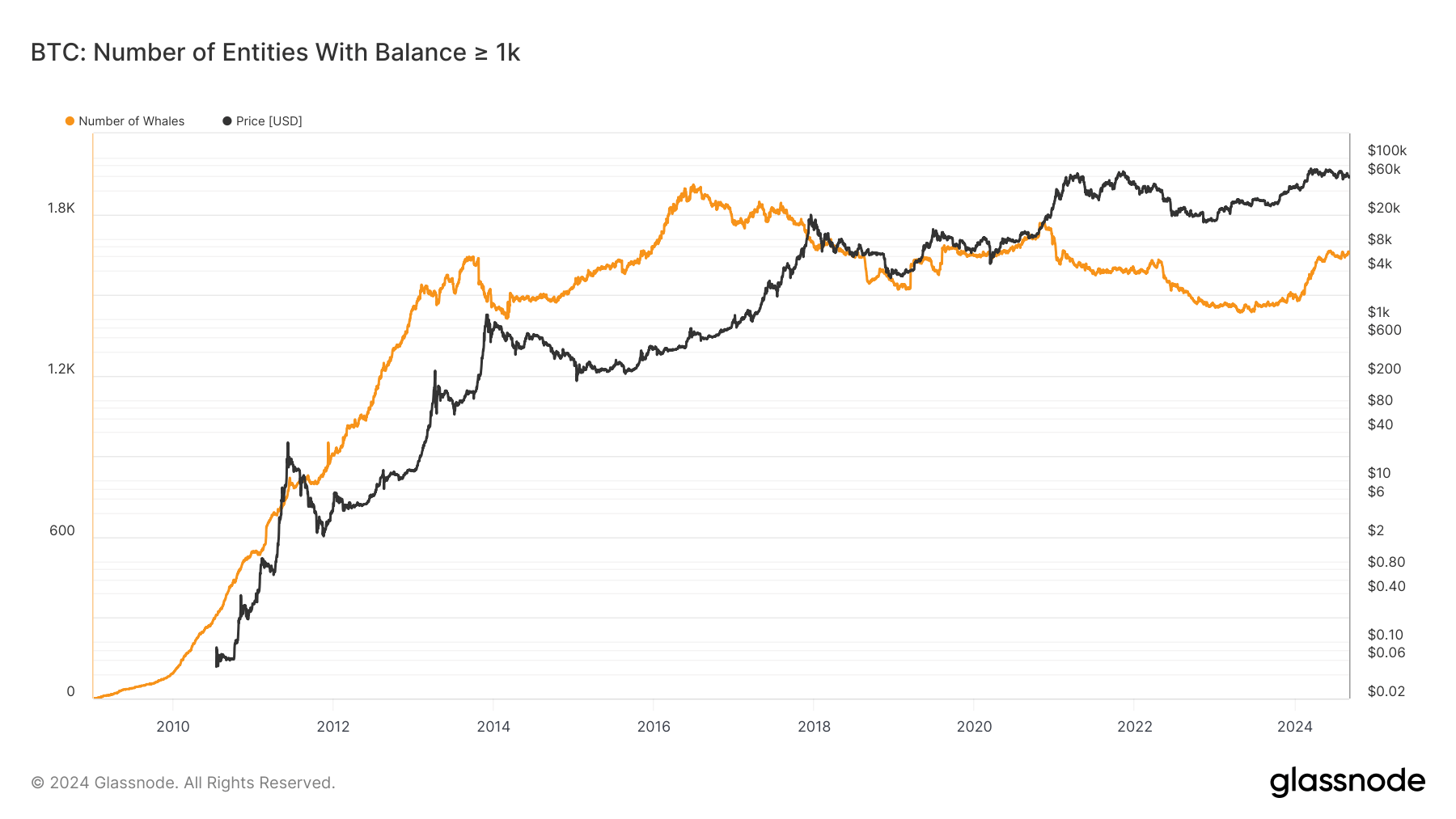

Historically, whale accumulation trends have played a pivotal role in Bitcoin’s price movements. The longer-term chart reveals a consistent correlation between whale holdings and market cycles, with notable surges in 2013, 2017, and 2021 corresponding with prior bull runs.

As of September, Bitcoin is hovering near $56,000, with whale holdings stabilizing at approximately 1,600 entities, reflecting the market’s cautious sentiment.

The post Bitcoin whale holdings steady at 1,600 entities, post-ETF surge stabilizes price appeared first on CryptoSlate.