Crypto Crash: Why Crypto Whales are Selling Bitcoin, Ethereum, and XRP?

The post Crypto Crash: Why Crypto Whales are Selling Bitcoin, Ethereum, and XRP? appeared first on Coinpedia Fintech News

Today’s market crash has yet again raised concern about crypto assets movement in the coming months since it is expected that the market will break out in Q4. However, the relief is not on sight, especially in September. Altcoin Buzz’s latest video analysis highlights a concerning trend among major cryptocurrencies as Bitcoin, Ethereum, and XRP whales show signs of bearish sentiment.

Let’s dive into these ripples and see what’s brewing for these digital assets.

Bitcoin’s Struggle in September

Bitcoin has started September on a weak note, with both its monthly and weekly closes reflecting a lack of bullish momentum. Historically, September has been a challenging month for Bitcoin, often dubbed a “red patch” for returns. Despite this, some analysts still see the potential for Bitcoin to reach the mid-$60,000 range in the short term. The $56,000 and $54,000 levels are being eyed by traders as possible short-term targets before any relief rally. A clear spot buyer around $57,000 has provided some support, but the overall lack of interest in derivatives markets indicates that funding rates may remain low or negative.

Ethereum Whales: Preparing for a Sell-Off?

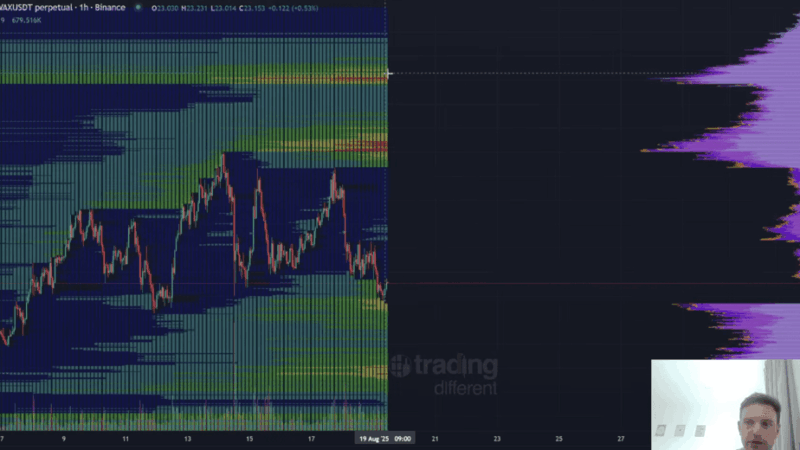

Ethereum is also under pressure, with the amount of ETH sent to exchanges gradually increasing. This coincides with Ethereum facing strong resistance at the $2,750 price level. Currently trading below $2,500, Ethereum could see further declines if the selling pressure continues. Exchange reserves have risen, with 19 million ETH valued at $47 billion now held on exchanges. A significant drop in large holders’ net flow, down 17% over the past 30 days and 36% in the past week, suggests that whales are reducing their positions. This trend is a bearish signal, as it often leads to retail investors following suit, potentially pushing ETH’s price down to $2,100. However, a resurgence in demand could push the price back up to $2,600.

XRP: Whales Dump Ahead of Key Event

XRP is experiencing similar bearish activity, with significant whale movements causing concern among investors. Recent on-chain data shows that 1 billion XRP was shifted to Ripple, and a 20 million XRP dump occurred on the Bitstamp exchange. These large transactions have sparked a rise in selling pressure and a bearish sentiment among market participants. With a looming $125 million settlement between Ripple and the SEC, the future price movements of XRP remain speculative, but the current trend suggests increased volatility.

What’s Next? Preparing for a Fatal Month

In short, the market trend reveals a rough September. While the analyst warns of potential downside risks, especially for altcoins, there’s a silver lining—this could be the final dip before a strong comeback. He urges viewers to brace for a rough month but remains hopeful for a Q4 turnaround.