Ethereum Option Trader Big Bet, $3,000 Target on Radar

The post Ethereum Option Trader Big Bet, $3,000 Target on Radar appeared first on Coinpedia Fintech News

The recent data from QCP Capital has gained massive attention from crypto traders, especially Ethereum traders, as it suggests that Ether is poised for a significant upside rally before December 2024. According to the data, Ethereum options traders have bought over 20,000 contracts targeting the $3,000 level, set to expire on December 27, 2024.

Ethereum Option Traders Hope for $3,000

It appears that Ether option traders are speculating that the ETH price will rally to the $3,000 psychological level by December 27, 2024. This latest data sparked hope among traders and investors that there is a high possibility that ETH could hit the $3,000 level.

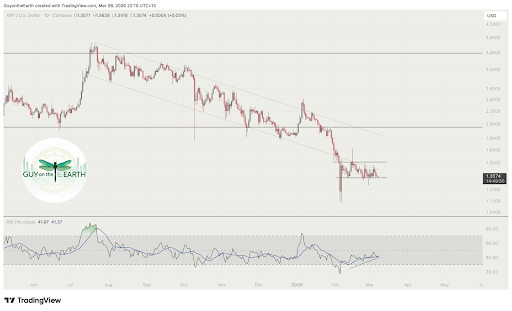

Ethereum has been in a downtrend since July 23, 2024, following the approval of spot Ethereum Exchange Traded Funds (ETFs) in the United States. Since then, it has experienced a price decline of over 30%, dropping from $3,500 to $2,400. Additionally, it has been in a range-bound between the $2,840 and $2,200 levels since August 2024.

Ethereum Technical Analysis and Key Levels

Despite the market downtrend, expert technical analysis hints that the current state of ETH is quite bullish. Recently it experienced a breakout of a descending trendline, successfully retested the breakout level, and is now poised for a massive rally. In addition to the trendline breakout, ETH has also breached its $2,400 resistance level.

Based on the historical price momentum, if ETH closes a daily candle above the $2,470 level there is a strong possibility it could soar by 20% to the $2,900 level.

Current Price Momentum

As of writing, Ether is trading near the $2,407 level and has experienced a price decline of over 1% in the last 24 hours. During the same period, its trading volume dropped by 25%, indicating lower participation and potential fear among traders and investors.