The Stablecoin Waterfall as Investors Explore Its Transformative Power – Margex Report

The post The Stablecoin Waterfall as Investors Explore Its Transformative Power – Margex Report appeared first on Coinpedia Fintech News

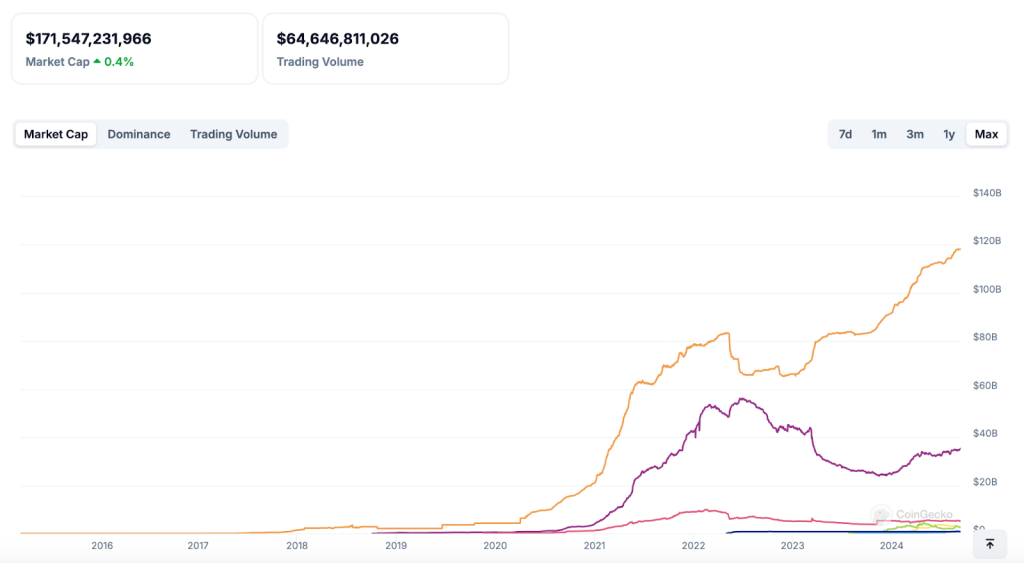

August 2024 recorded the highest market capitalization for stablecoins as it rose by 2.89%, hitting an eleventh consecutive monthly record high of $169 billion market capitalization. The volume of stablecoins on centralized exchanges fell by 14.2% despite hitting a new all-time high of $117 in August alone.

This new record is the highest market capitalization since April 2022 and can be attributed to many technological, financial, and crypto companies, which have all joined the rush to explore the potential and cash in on the digital dollar.

American companies such as Mercado Libre, Banking Circle, and crypto business Paxos have all made their intentions clear to unveil their own stablecoins in recent times, following the likes of PayPal, which has benefitted from the stablecoin market with a recent record of $169 billion of stablecoins in circulation.

The data from Coingecko shows stablecoins’ astronomical growth from 2022 to 2024 as the market capitalization hit a new record high of over $171 billion, with many companies looking to explore the endless potential of the stablecoin.

In this article, we will dive deep into how many companies are looking to leverage the transformative power of stablecoins, their impacts on the cryptocurrency space, leveraging on different stablecoins on the Margex exchange, and the potential to earn Kaspa airdrop rewards on Margex.

Traditional Finance and Technological Companies Leverage the Stablecoin Boom

Payment giant Paypal is seeing a surge in its stablecoin market capitalization. Its stablecoin PYUSD on centralized exchanges rose to 80%, hitting a region of $200 million. It is the sixth stablecoin by market capitalization of $829 million, with price hitting new highs in the past few months.

This recent spike in volume for Paypal’s stablecoin can be linked to its attractive incentives offered on decentralized (DEX) lending protocols for PYUSD and dApps. For example, Drift Protocol offers an 18% APR on yield. On-chain data suggest that 50% of PYUSD stablecoin is used as collateral for lending protocols.

Stablecoins remain a key form of digital cash with prices linked to the physical dollar as traders and users track the price of the reserve sovereign currency and for users to trade effectively with different digital assets.

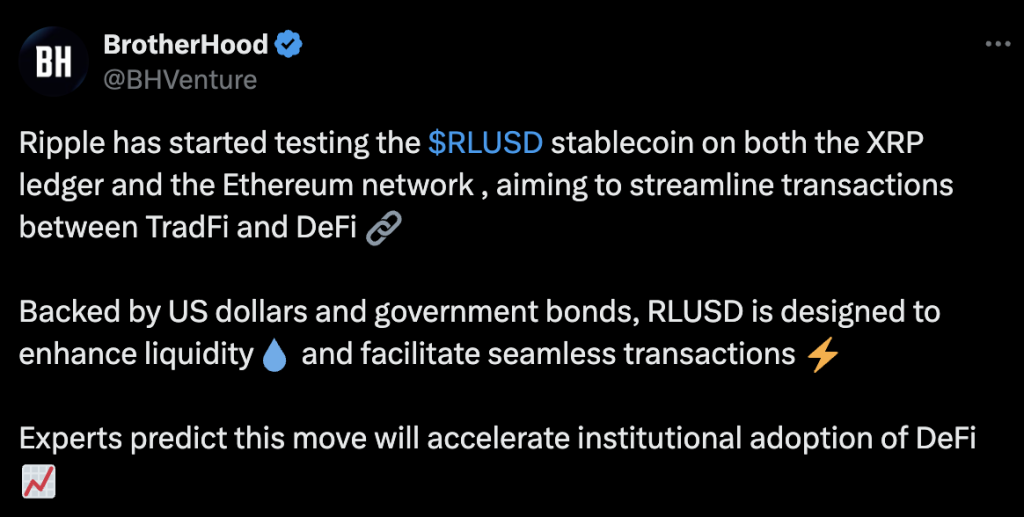

Also, Ripple (XRP) and a leading blockchain company have indicated their interest in launching their own stablecoin and have commenced their testing phase on the Ethereum mainnet and XRP ledger.

Ripple-backed USD is in its beta stages, which is important to ensure the stablecoin RLUSD meets the security, efficiency, and reliability standards before it begins to gain adoption and regulatory approval.

Ripple’s (XRP) plans to enter the stablecoin growing market have long been laid out in April. The current stablecoin market hit a new high of over $170 billion in market capitalization as it remains the key infrastructure for trading in the cryptocurrency market.

The stablecoin market is currently dominated by Tether’s USDT and Circle’s USDC, the two largest stablecoins in cryptocurrency. Ripple’s USD (RLUSD) is soon to be approved and backed by U.S. Treasuries, dollar deposits, and cash equivalents. A third-party accounting firm will audit its activities and report its attestations monthly.

Ripple’s (RLUSD) could be a game changer for the cryptocurrency community and would open opportunities for global services and clients.

MiCA Regulatory Compliance a Game Changer

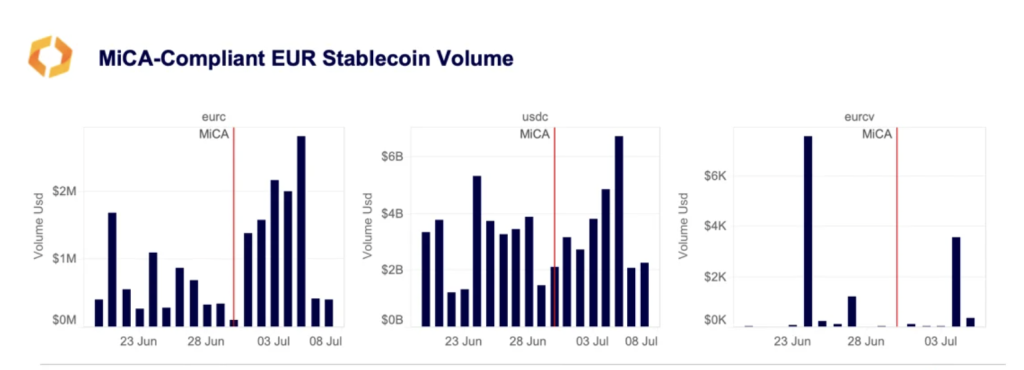

On June 30th, European Markets in Crypto-Assets (MiCA) regulations took effect, marking a pivotal change in the cryptocurrency space and for other companies. These regulations by MiCA will impose stringent compliance requirements on Circle’s USDC and EURC and other issuers of stablecoins in Europe.

Circle’s announcement, in compliance with the European Markets in Crypto-Assets Regulation (MiCA), followed by the issuer of Euro-convertible SocGen Forge, saw USDC and EURC increase with strong daily volume since June 30, 2024, as seen in the chart above.

The existing legal framework and regulations will allow institutional investors and other companies to explore the stablecoin market and other derivative markets. The emergence of institutions has boosted the adoption of stablecoin in recent times.

Larger portions of USDT and USDC have all come from exchange trading activities in the past months as users find it easy to carry out transactions within minutes on cheaper blockchain networks. Among these exchanges is Margex, a leading copy trading platform that has strived to promote a good trading environment for all users.

Margex Exchange Provides Better Trading Experience to Users

The cryptocurrency space continues to gain much attention and adoption, with regulatory policies being a huge factor for users, investors, and institutions entering the space to explore opportunities to leverage.

New and old users coming into the cryptocurrency space looking for the best trading platform to test the waters of the crypto world have always leaned towards the Margex Exchange platform, which provides one of the best experiences for users with little or no experience.

Margex is a leading crypto copy trading platform that allows users to mirror the trades of experienced traders while building a sustainable strategy that will boost profitability. With a sleek copy trading platform, users can easily place trades and navigate the platform without prior cryptocurrency experience.

Margex users also have access to the past trading history of copy trading experts; analyzing this data will help users make informed decisions. The Margex exchange has also included some key features, such as a zero-fee converter to enable seamless swapping of crypto pairs and different instant deposits and withdrawals; these include Kaspa and Margex TON.

Additionally, Margex is currently running Kaspa (KAS) airdrop for its users. This is to remind all Margex users that the Kaspa (KAS) airdrop is in progress, and you can still participate up to September 23, 0:00 UTC, 2024. Margex high-volume users can claim up to $5,000 in Kaspa (KAS) token airdrop. Eligibility for new and existing Margex users is as follows:

How to join Margex Kaspa (KAS) Airdrop Claim:

- Sign in On Margex or Login for existing users

- Trade actively on Margex up to 23 of September 0:00 UTC 2024.

- Claim airdrop at the end of Kaspa (KAS) airdrop frenzy campaign

Prize Pool

- $100,000 – $10 in KAS tokens

- $250,000 – $20 in KAS tokens

- $500,000 – $30 in KAS tokens

- $1M – $50 in KAS in tokens

- $5M – $250 in KAS tokens

- $10M – $500 in KAS tokens

- $25M – $1,500 in KAS tokens

- $50M – $3,000 in KAS tokens

- $100M – $5,000 in KAS tokens

Reward Distribution

Margex high volume users at the end of the Kaspa (KAS) airdrop campaign from now up to 23 September 0:00 UTC 2024 who meet Kaspa (KAS) airdrop requirements will be airdropped Kaspa (KAS) tokens claimable instantly.