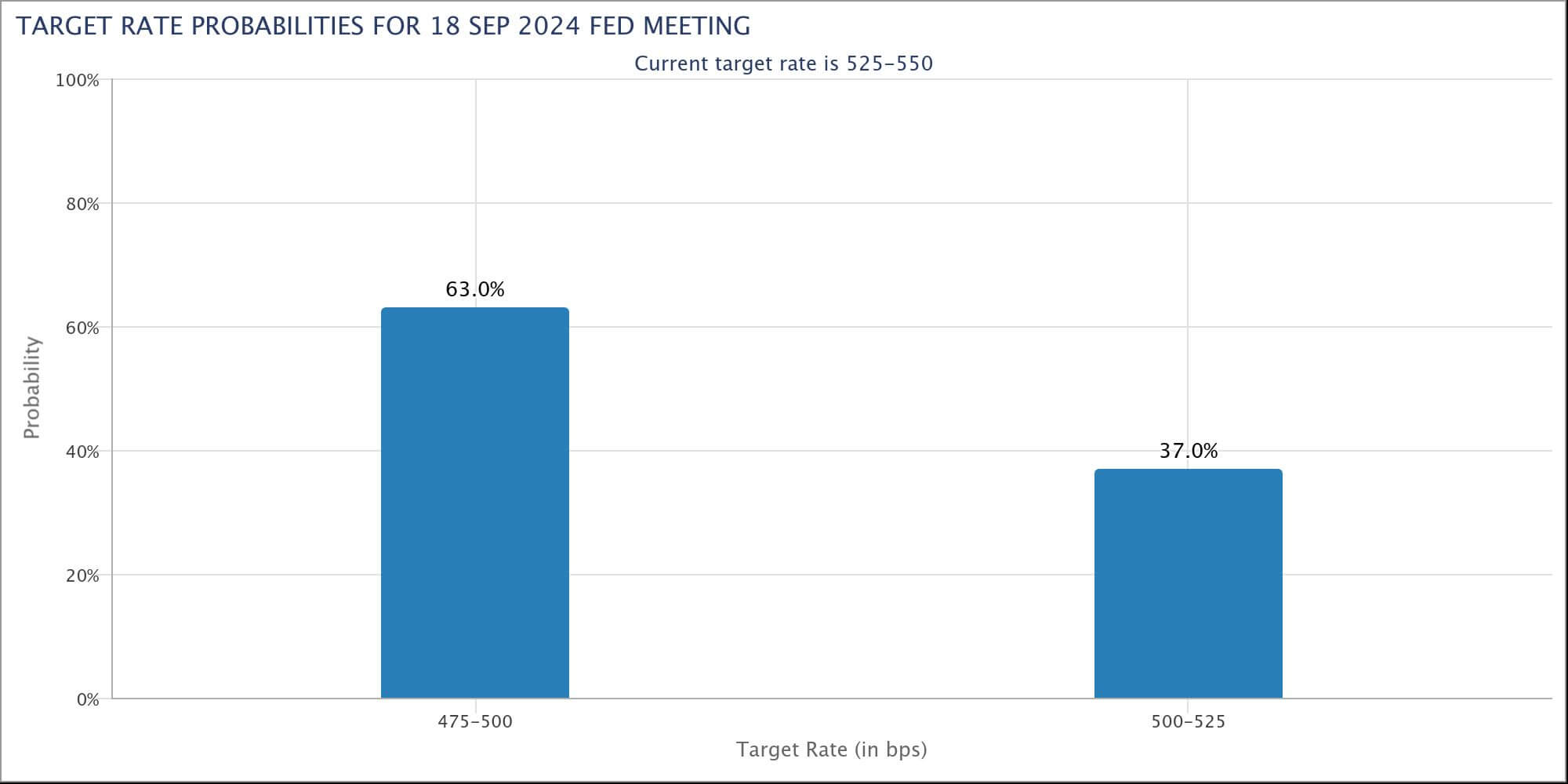

Fed’s rate decision looms with 63% odds favoring a cut

The central bank’s Federal Open Market Committee (FOMC) will vote on whether or not to lower the base interest rate on Sept. 18 and recent shaky jobs reports have increased speculation that the Fed might pivot from its tightening stance to support employment.

The current target rate probabilities indicate a 63% chance of dropping the rate at 475-500 basis points and a 37% chance of keeping it at 500-525 basis points.

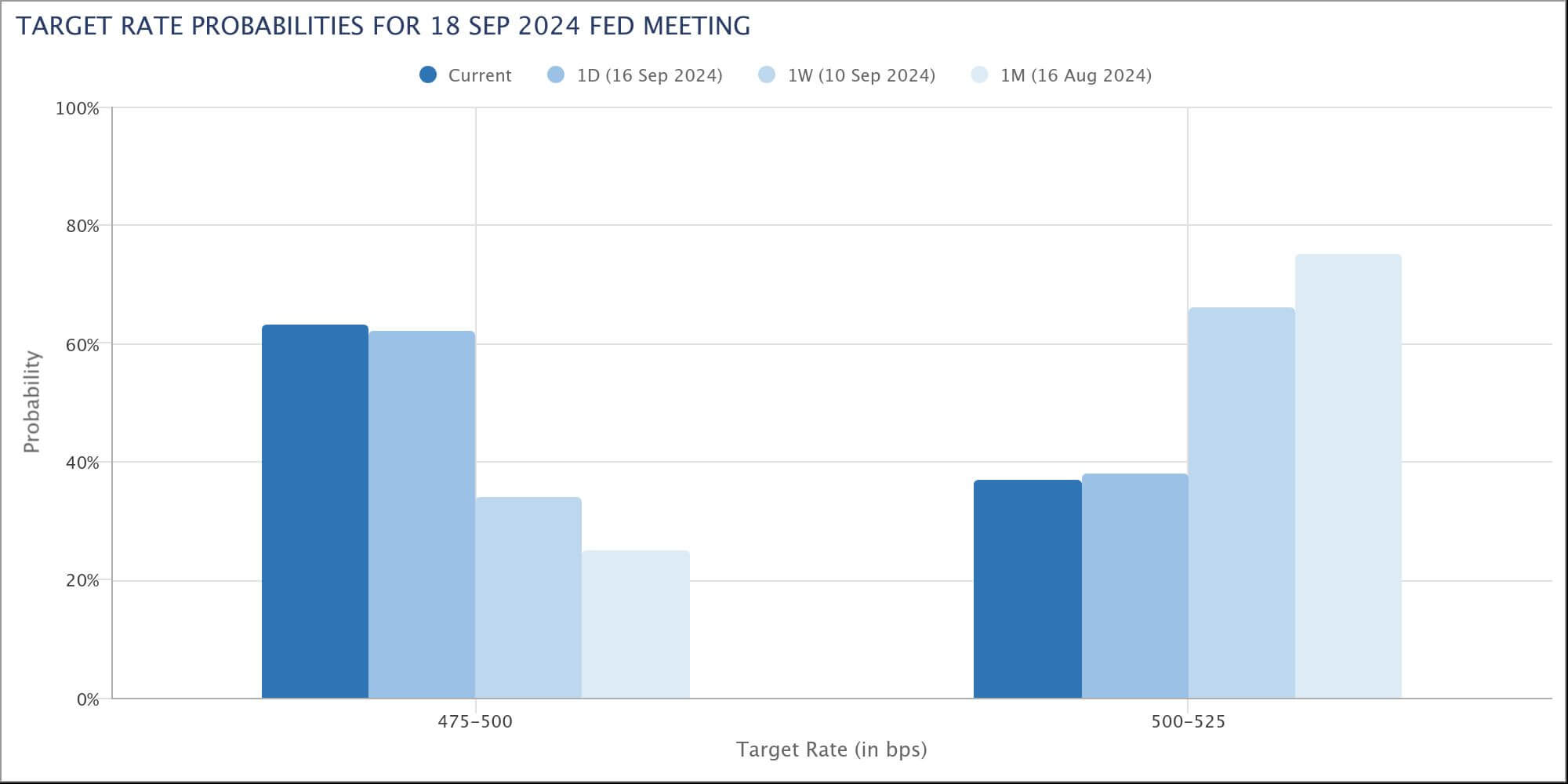

This is a significant change in market sentiment over the past week. On Sep. 10, the probability of maintaining the higher rate was at 66%, but it has since flipped, with the market now largely expecting a hold at the lower level. This shift reflects growing concerns about economic growth and the labor market’s health, outweighing inflation worries.

A decision to lower or maintain rates at this point signals the Fed’s balancing act between controlling inflation and fostering employment. The market has been pricing in a reduction, considering the rate is at a two-decade high. Investors are closely watching Powell’s remarks for indications of future policy direction.

A dovish tone could spur optimism, leading to increased market activity, while a hawkish stance might signal prolonged caution.

The post Fed’s rate decision looms with 63% odds favoring a cut appeared first on CryptoSlate.