Arthur Hayes Buys $4M Worth of Aethir (ATH) After PENDLE Selloff

The post Arthur Hayes Buys $4M Worth of Aethir (ATH) After PENDLE Selloff appeared first on Coinpedia Fintech News

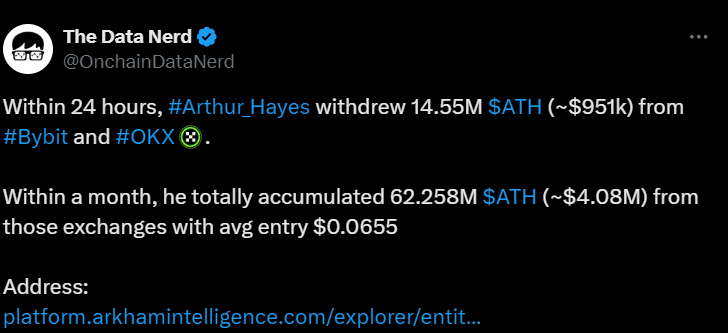

After selling millions of dollars worth of PENDLE tokens, Arthur Hayes, the ex-CEO and co-founder of BitMEX, purchased a significant amount of Aethir (ATH) tokens from centralized exchanges (CEXs). On September 23, 2024, the on-chain analytics firm TheDataNerd made a post on X (formerly Twitter) that Hayes had bought 14.55 million ATH tokens, worth $951K, from ByBit and OKX.

Arthur Hayes’s Big Bet on Aethir (ATH)

Additionally, the analytics firm also stated that over the past month, hayes has accumulated a significant 62.258 million ATH tokens, worth $4.08 million at an average price of $0.0655. Aethir is developing a scalable decentralized cloud infrastructure (DCI) for gaming and AI.

Noticing Arthur Hayes’ interest in ATH tokens, Aethir posted on X, “Glad to see Hayes sharing positive sentiments about what we’re building at Aethir.”

Aethir (ATH) Current Price Momentum

Following this massive purchase, ATH is currently trading near $0.0642 and has experienced a price surge of over 2.5% in the past 24 hours. During the same period, its trading volume dropped by 8%, indicating lower participation, likely due to its low market cap. According to coinmarketcap data, ATH’s current market cap is $260 million, with a total supply of 42 billion ATH tokens.

Technical Analysis and Upcoming Levels

According to expert technical analysis, ATH appears bullish and is currently retesting its breakout level of $0.0617, which occurred on September 22, 2024. If ATH successfully holds this breakout level, there is a strong possibility it could surge by 38% to reach the $0.089 level in the coming days.

However, this token is not available on Binance, Coinbase, or Kraken. Despite its absence from these major exchanges, community sentiment around ATH remains extremely high. According to recent data, 90% of community members are bullish on ATH, while only 10% are bearish.