Crypto Market’s “Shallow Sell-Off” Indicative Of Strong Bid For Risk Assets: Trading Firm

Crypto trading firm QCP Capital says the “shallow sell-off” in crypto markets following Iran’s recent attack on Israel indicates healthy market demand for risk-on assets.

Crypto Market Remains Well Bid For Risk Assets

Despite Iran launching over 180 missiles toward Israel yesterday, the sell-off in traditional financial (TradFi) assets was relatively muted. The S&P 500 closed 1% lower, while U.S. benchmark West Texas Intermediate (WTI) oil prices rose 2%.

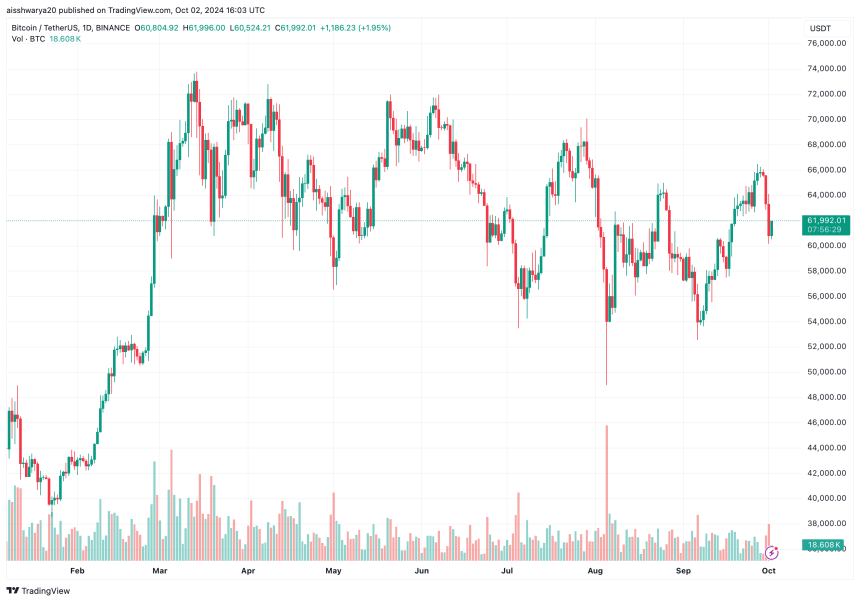

In contrast, the digital assets market was hit relatively harder, with Bitcoin (BTC) sliding more than 5% following Iran’s attack. The total crypto market cap eroded over 6% in value while liquidations surpassed $550 million in the past 24 hours, data from CoinGlass indicates.

In the report, QCP Capital says that the premier cryptocurrency seems to have found strong support at the $60k level. However, the firm cautions that further escalation in the Middle East might force BTC to drop to $55k.

Regarding the market sell-off witnessed yesterday, the trading firm stated:

Middle East geopolitics will steal the limelight for now, but the shallow sell-off suggests that the market remains well bid for risk assets. This minor setback shouldn’t distract from the bigger picture.

The report also remarked that China’s recent economic policy actions are similar to those of Japan in the 1990s. Notably, the Bank of Japan (BoJ) tackled deflation by reducing interest rates, introducing negative interest rates, and starting the quantitative easing program. The report added:

The flush of liquidity from the PBoC and potential fiscal support will likely support asset prices in China, with bullish sentiment potentially spilling over globally to support risk assets, including crypto.

Additionally, the report pointed to the US Federal Reserve (Fed) Chair Jerome Powell’s recent dovish remarks at the National Association for Business Economics, signaling further interest rate cuts in 2024.

For context, the Fed cut rates for the first time in 4 years on September 18. Subsequently, financial markets worldwide experienced a surge in the price of risk-on assets, such as stocks and cryptocurrencies.

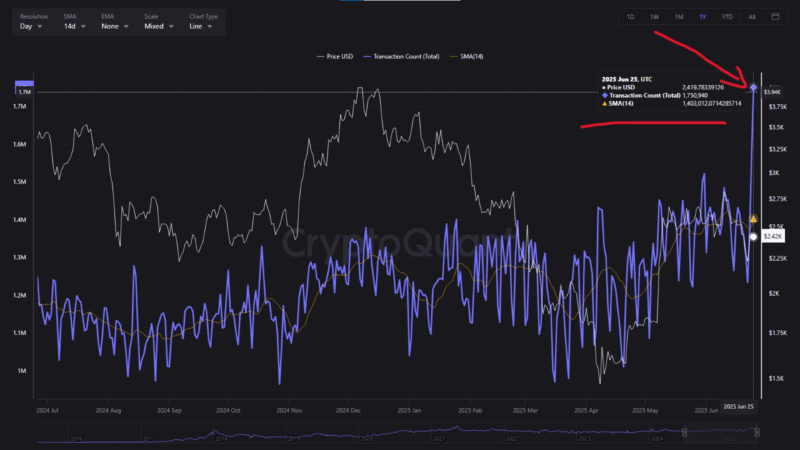

The report concluded that “asset prices are expected to remain supported heading into 2025”, buoyed by aggressive interest rate cuts by both the largest (Fed) and third largest (People’s Bank of China) central banks in the world.

What To Expect From Bitcoin In Q4 2024?

Although the Iran-Israel conflict directly impacted BTC’s price, crypto analysts remain optimistic about a potentially strong Q4 2024. One analyst suggested that the recent dip could represent BTC’s “quarterly low.”

Another crypto analyst Eric Crown opined that BTC could reach new all-time-high (ATH) value in Q4 2024, basing his analysis on the cryptocurrency’s historical performance in the months following September. Bitcoin trades at $61,992 at press time, down 1.2% over the last 24 hours.