EigenLayer Drops 36%, But RSI Signals Breakout Rally Ahead!

The post EigenLayer Drops 36%, But RSI Signals Breakout Rally Ahead! appeared first on Coinpedia Fintech News

Amid the broader market pullback, Eigenlayer faces a pullback as the bullish exhaustion surfaces. However, the underlying demand and critical support at $3.17 tease a comeback for the newly listed token.

Will the Eigenlayer listing on multiple top exchanges rally turn under $3 as Bitcoin clings to $61k? Learn more in Coinpedia’s EIGEN price analysis below.

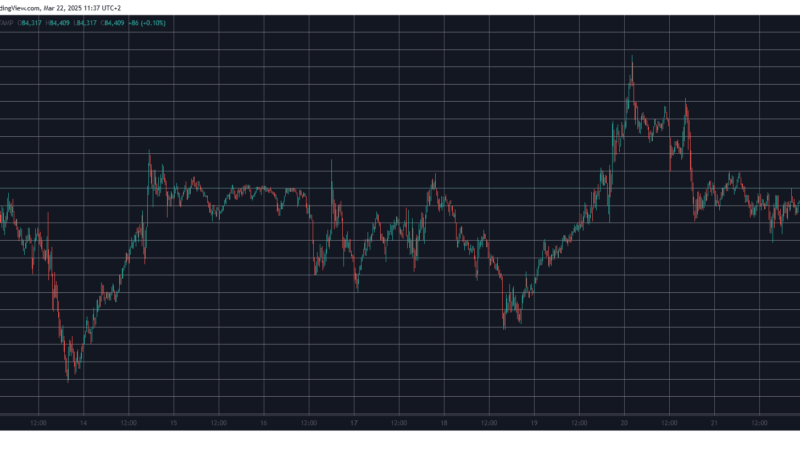

Pullback Phase Begins

In the four-hour chart, the Eigen layer token shows a pullback phase leading to lower-high and lower-low formation. This leads to two parallel trend lines forming a falling channel pattern.

With the listing gain stopping at $5.28, the gradual bullish exhaustion and the broader market correction led to a pullback in Eigenlayer. The Eigen token is currently trading at $3.34, which is at a discount of 36.64% from its $5.20 high.

Furthermore, the Eigen token is taking a bearish reversal from the overhead resistance trend line and is likely to challenge the bottom support. However, the recent lower price rejections from the $3.17 reflect a critical buying area.

Based on the Fibonacci levels retraced over the all-time high and the $3.17 support, the bearish reversal ignited from the 23.60% level.

Technical Indicators:

RSI: Despite the ongoing correction, the daily RSI line reflects the possibility of a bullish divergence. With a bullish divergence, a potential double-bottom reversal is anticipated from the $3.17 base.

DMI Indicator: Supporting the bullish trend continuation possibility, the DMI line reflects the DI lines in a positive alignment with the ADX above 30, reflecting a high trend momentum.

Will EIGEN Price Bounce Back?

Based on the Fibonacci levels, a double-bottom formation will have a neckline at 23.60% Fibonacci level. Further, a bullish breakout of $3.57 neckline will likely reach the pinnacle of the falling channel pattern near the 61.80% Fibonacci level at $4.34.

This will increase the possibility of a rounding bottom reversal or a potential head and shoulder pattern following a minor pullback at 38.20% Fibonacci level at $3.855.

Optimistically, a bullish breakout could lead to 1.272 or 1.618 Fibonacci levels at $1.06 and $7.23, respectively. On the flip side, the crucial supports are present at $3.17, a psychological mark of $3.00 and $2.50.

Worried about Bitcoin price sustaining above $60K? Read our Bitcoin (BTC) Price Prediction.