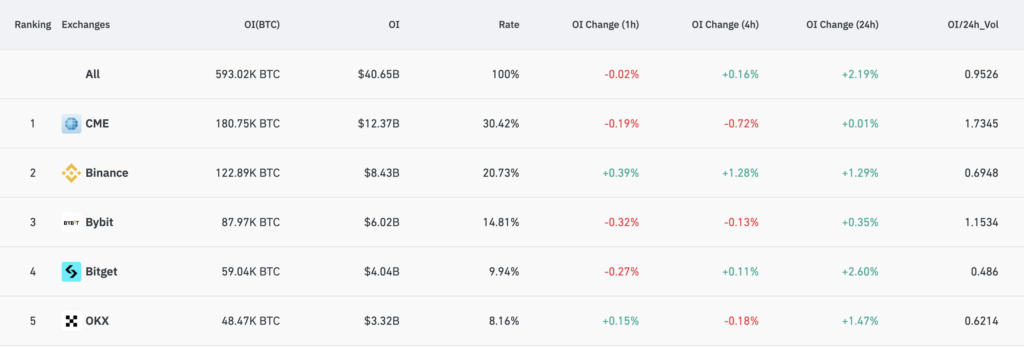

Bitcoin option interest reaches all-time high of $40 billion across all exchanges

Bitcoin’s open interest has surpassed $40 billion for the first time, according to data from Coinglass. Total open interest reached 593,020 BTC, equivalent to $40.65 billion, marking a new high in the crypto derivatives market.

The Chicago Mercantile Exchange (CME) leads with an open interest of 180,750 BTC, valued at $12.37 billion and accounting for 30.42% of the total. Binance follows with 122,890 BTC in open interest, worth $8.43 billion and representing 20.73% of the total. Other exchanges with notable open interest include Bybit at $6.02 billion, Bitget at $4.04 billion, and OKX at $3.32 billion.

Over the past 24 hours, total open interest increased by 2.19%, with Bitget experiencing a 2.60% rise and OKX a 1.47% increase. The overall rate change remained relatively stable, indicating consistent investor engagement in Bitcoin futures.

The increased open interest reflects ongoing interest in Bitcoin derivatives as investors navigate post-halving market conditions, with Bitcoin price just 7% below its all-time high.

The post Bitcoin option interest reaches all-time high of $40 billion across all exchanges appeared first on CryptoSlate.