Binance Targets High-Net-Worth Individuals: Launches Crypto Wealth Management Platform

Deemed to be a breakthrough crypto exchange solution for wealth managers, Binance has launched “Binance Wealth.” It is a service aimed to bridge traditional wealth management with digital assets for a broader access.

Binance Wealth is built to bring together worlds of traditional finance and crypto. This will enable financial advisors to bring crypto assets into a secure, structured environment for client portfolios. Outlined in Binance’s 30 October 2024 press release, the company’s newest service “Binance Wealth,” marks a significant shift for high-net-worth clients and wealth managers.

“Today marks a new dawn for wealth management,” Binance said in a recent tweet.

This move can be seen as the platform’s role in pioneering crypto access within a structured wealth management solution.

Today marks a new dawn for wealth management.

Introducing #Binance Wealth, the world's first technological solution purpose-built for wealth managers to bring crypto to their clients directly on a digital asset exchange.

Learn more

https://t.co/0KXmIvlraH pic.twitter.com/CqnWHWseyW

— Binance VIP & Institutional (@BinanceVIP) October 29, 2024

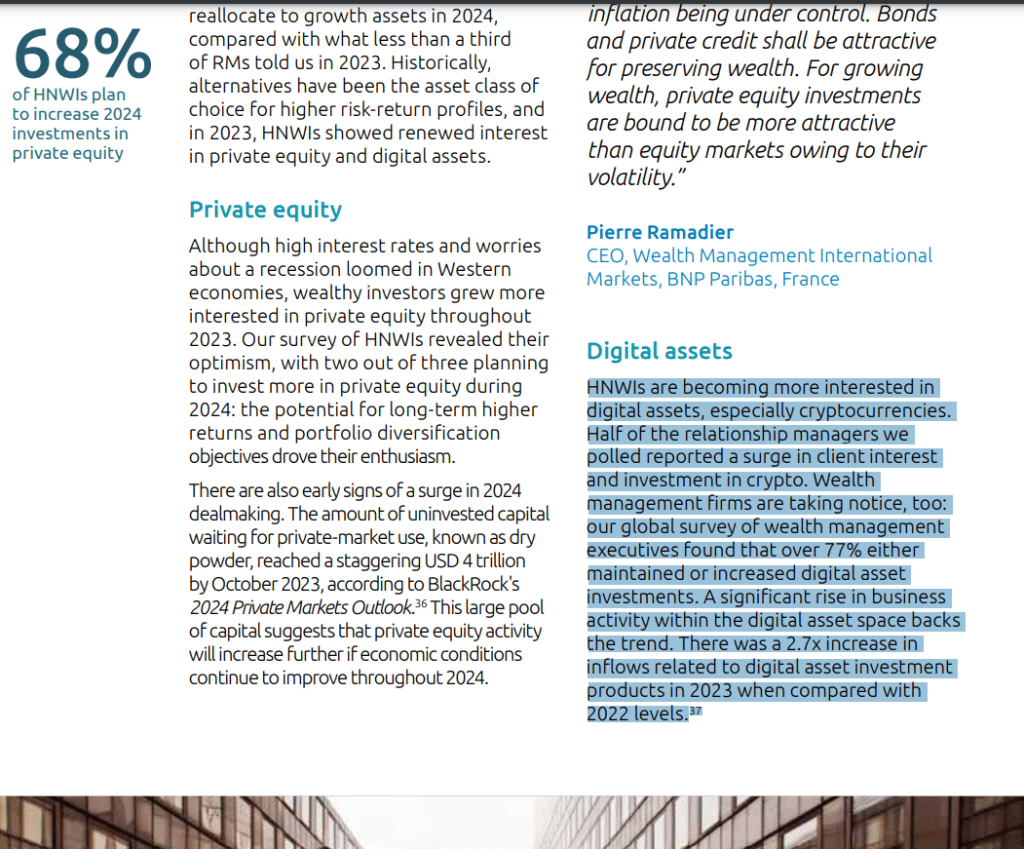

Capgemini Say Over 77% HNI’s Increased Investment In Digital Assets

A growing interest in digital assets among high-net-worth individuals indicates a broader shift in wealth management. Many affluent clients now view crypto as a valuable part of a diversified portfolio.

A recent Capgemini study notes that over found that over 77% of individuals either retained or increased their digital asset investments.

As a result, financial advisors and wealth managers are under increasing pressure to incorporate cryptocurrencies in their portfolio, making platforms like Binance Wealth, a key necessity.

Will Binance Succeed In Empowering Wealth Managers To Embrace Crypto?

With the new platform, Binance addresses long-standing barriers in wealth management for crypto. It provides infrastructure, asset recommendations, and onboarding guidance tailored to the private wealth sector.

Binance Wealth offers a tool kit specifically designed for wealth managers. It includes portfolio management, staking, trading, and advanced account oversight.

According to Catherine Chen, Binance is “equipping wealth managers with the tools they need to bring digital assets into their clients’ portfolios confidently.”

Chen added that Binance Wealth also provides educational resources and portfolio-building tools in line with what wealth managers are accustomed to. This can give them a foundation to guide clients into unfamiliar but promising crypto markets.

Companies like Stripe have also adopted crypto, partnering with Circle’s USDC to “bridge stablecoins with traditional payments.” Binance’s launch of this wealth management platform responds to this market momentum, equipping wealth managers to meet the rising interest in digital assets among high-net-worth clients.

Explore: Asia’s Private Wealth Managers enter Crypto, Expect Bitcoin To Hit $100K By Year-End

Driving Crypto Into Mainstream Financial Landscape

Binance Wealth’s launch signifies a pivotal moment for crypto adoption among high-net-worth clients.

“Our aim is to make digital assets approachable for wealth managers hesitant due to unfamiliarity or lack of tools,” Chen noted, highlighting Binance’s goal of bridging the crypto knowledge gap.

Binance is also looking to address challenges around regulatory alignment. This has often been a barrier for traditional wealth managers.

Global giants PwC iterated that, for industry players worldwide, 2024 is about more than just resilience; it’s about establishing a robust ecosystem where clear regulatory frameworks lay the groundwork for renewed stability and long-term growth

For more on the importance of regulation in this area, check PwC’s latest Global Crypto Regulatory Report and its impact on wealth management.

Explore: Binance, Coinbase–Not Individuals–Are Taking Full Advantage of Ethereum Layer-2 Benefits, Here’s Why

The post Binance Targets High-Net-Worth Individuals: Launches Crypto Wealth Management Platform appeared first on .