MicroStrategy Buys 55,500 Bitcoins Worth ~$5.4 Billion!

The post MicroStrategy Buys 55,500 Bitcoins Worth ~$5.4 Billion! appeared first on Coinpedia Fintech News

Microstrategy witnessed an incredible 24.7% rise in its stock (NASDAQ: MSTR) price this week. The uptrend was buoyed by Bitcoin’s rally and the company’s planned financial moves. Widely known for its aggressive Bitcoin hodling and accumulation strategy, Microstrategy had cited a convertible debt, that offers a 0% interest rate grabbing the market’s attention.

The firm’s CEO Michael Saylor’s bold decision in 2020, to pivot the company’s balance sheet to Bitcoin, has yielded enormous rewards. Speaking at a press conference the previous day, Michael disclosed an astonishing $5.4 billion gain in Bitcoin holdings over the past two weeks. The numbers equal to a staggering $500 million per day.

Donald Trump’s recent win in the U.S Presidential Elections has opened doors to a crypto-friendly environment. With this, the speculation about Microstrategy’s next Bitcoin buying spree has been growing louder in the industry. The Bitcoin-focussed company has recently completed a $3 billion convertible bond sale, that is all set to potentially boost its massive Bitcoin reserves of 334,420 coins.

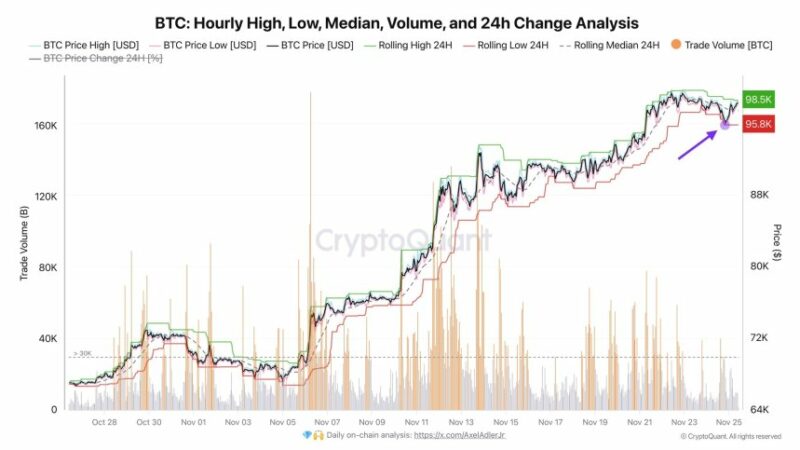

In a recent acquisition drive, Saylor-led Microstrategy has stacked 334,420 BTCs worth $5.4 Billion at an average price of ~$97,862 per Bitcoin. With this, the firm’s current Bitcoin reserve hits 334,420 coins. Successively, the intraday trading volumes of BTC are up 17.31% to $55.16B. Meanwhile, Bitcoin price saw a change of 0.12% in the past 24 hours taking the numbers to $97,496.00.

FAQs

MicroStrategy’s latest update confirms a holding of 334,420 Bitcoins, with more acquisitions anticipated.

The stock soared due to Bitcoin’s price appreciation, a $3 billion bond sale, and optimism around its Bitcoin-focused strategy.

The price of 1 BTC at the time of press is hovering around $97,496.00