Yield Optimization Goes Viral: Sperax Crypto Explodes But What is Sperax?

Sperax crypto is rallying, up nearly 200% in two days after the idea of a yield optimizer was floated. Will SPA price 10X from now?

Bitcoin, Ethereum, and meme coins have been hogging all the crypto limelight. The crypto community expects Bitcoin to break $100,000 and Ethereum to reclaim $4,000.

While their eyes are trained on these coins, Sperax (SPA)

, an altcoin trading on multiple exchanges, including Coinbase, has been defying gravity.

$spa volume exceed marketcap

Do you know what is the mean of that pic.twitter.com/sLCprhBTGy— mahmoud Yousef (@mahmoudjo94) November 28, 2024

SPA Price Analysis: Sperax Crypto Mounts Incredible +200% Climb in 48 Hours

SPA has surged nearly 200% in two days, emerging as one of the top performers in the past 48 hours, according to Coingecko data.

(SPAUSDT)

At this pace, SPA is up 233% from November lows and breaking out from a multi-week trading range.

From the daily chart, SPA is within a bullish breakout formation. If bulls defend $0.011103, the coin would easily spike above 2024 highs.

Further tailwinds for this rally will be if Bitcoin continues printing higher highs, closing above $100,000 in the coming few days.

One analyst predicts SPA to hit $0.21605, a near 10X from spot rates, assuming the momentum is sustained.

(Source)

The question now is: What is Sperax crypto, and why is it rallying so hard?

EXPLORE: 15 Best Anonymous Bitcoin Wallets with no KYC in 2024

What is Sperax? Why is Sperax Rallying So Hard?

While meme coins are dominant, it is not to say there is no activity in other sub-sectors.

DeFi projects are drawing billions, pushing the valuation of Uniswap, Aave, PancakeSwap, and others higher.

Amid this, Sperax, another DeFi protocol, is looking to differentiate itself from the crowd.

With headquarters in New York, Sperax launched in 2020 with initial plans of a layer-1 blockchain.

However, the team later pivoted and focused on releasing an algorithmic stablecoin, Sperax USD (USDs).

The stablecoin, like DAI, is yield-bearing and lives on Arbitrum, not the Ethereum mainnet.

Holders received yield without staking or claiming. The yield is from collateral deployed on other DeFi protocols, mostly Curve Finance.

Over the coming years, the project plans to build a full-stake ecosystem in which USDs will be at the core.

EXPLORE: Best New Cryptocurrencies to Invest in 2024

Why is SPA Up Nearly 200%?

Although SPA has had a massive year, with gains, especially in the first half of 2024, the resumption of the uptrend follows the announcement of a yield optimizer.

The product, set for launch on Arbitrum, allows users to invest their stablecoins, USDC or USDT, and earn a yield.

The yield optimizer automatically allocates funds across various pre-determined strategies to maximize gains and reduce risks.

Once a user redeems their shares, they receive the whole allocation and a yield.

Once the idea has been worked on, the optimizer will drive adoption, allowing newbies to earn extra yield in a low-fee environment.

Since the team said it will be simple and boasts a user-friendly interface, Sperax’s total value locked (TVL) could rise.

(Source)

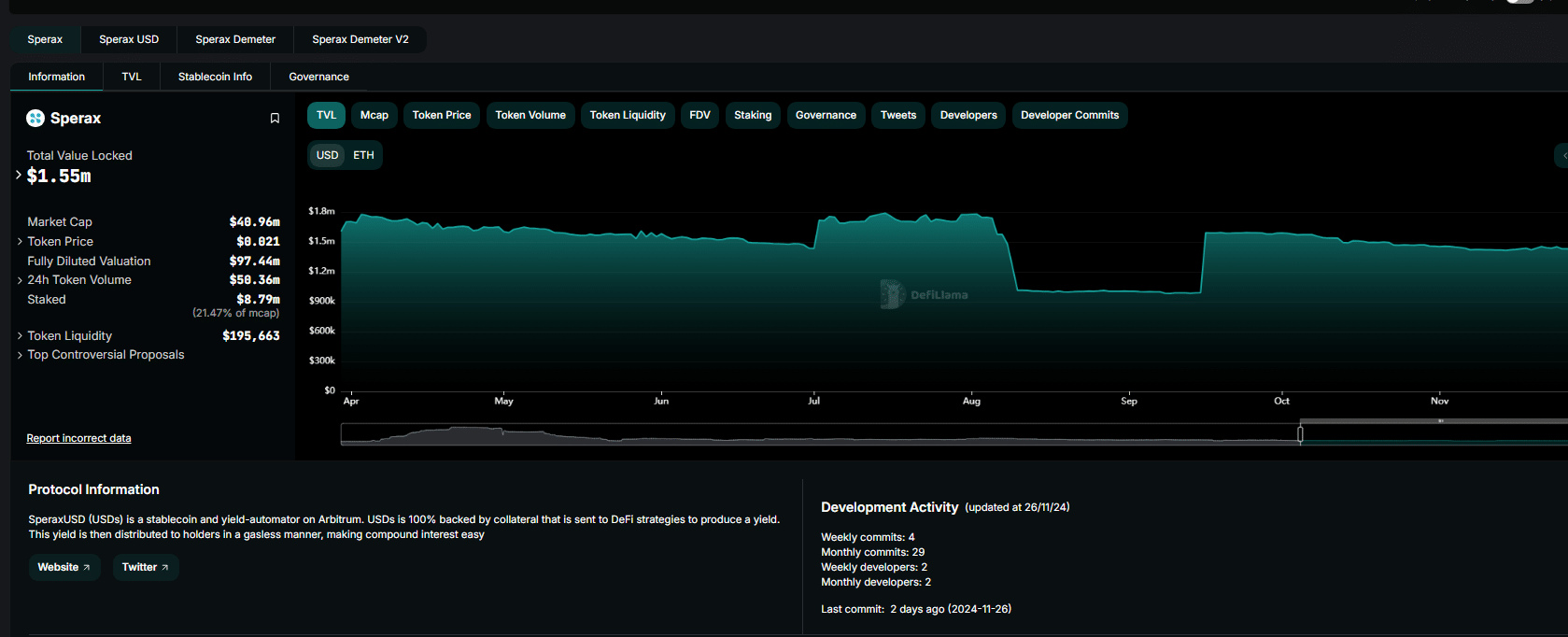

According to DeFiLlama, Sperax has a current TVL of $1.55 million.

EXPLORE: FET Price Faces Unlock: Will AI Crypto Token Unlocks Dent AI Coin Prices?

Join The 99Bitcoins News Discord Here For The Latest Market Update

The post Yield Optimization Goes Viral: Sperax Crypto Explodes But What is Sperax? appeared first on .