Cardano (ADA) Price Prediction for March 20

The post Cardano (ADA) Price Prediction for March 20 appeared first on Coinpedia Fintech News

Cardano (ADA) price remained stable throughout the week. However, given the current market sentiment and investors’ outlook, this stability may soon change, potentially leading to a massive upside rally.

Indicator Reveal ADA Bullish Sentiment Reach 4-Month High

Today, March 20, 2025, on-chain analytics firm Santiment posted on X (formerly Twitter) that specific altcoins like ADA are experiencing the highest positive sentiment on social media. This is seen as a bullish sign and could attract more investors and traders.

However, the post on X also noted that this positive sentiment follows the United States Securities and Exchange Commission (SEC) classifying ADA’s use case as “smart contracts for government services.” As a result, bullish sentiment for ADA has reached a four-month high.

Cardano (ADA) Price Action and Upcoming Levels

According to expert technical analysis, ADA has been consolidating within a narrow range between $0.69 and $0.75 for the past few weeks and is now on the verge of a breakout.

Based on recent price action and historical patterns, if the asset breaks out of this consolidation and closes a daily candle above the $0.76 level, there is a strong possibility it could initially surge by 12%, reaching $0.85 in the coming days.

Traders and investors should note that $0.75 is a key level, as it aligns with the 200 Exponential Moving Average (EMA) on the daily timeframe, acting as a significant resistance for the asset.

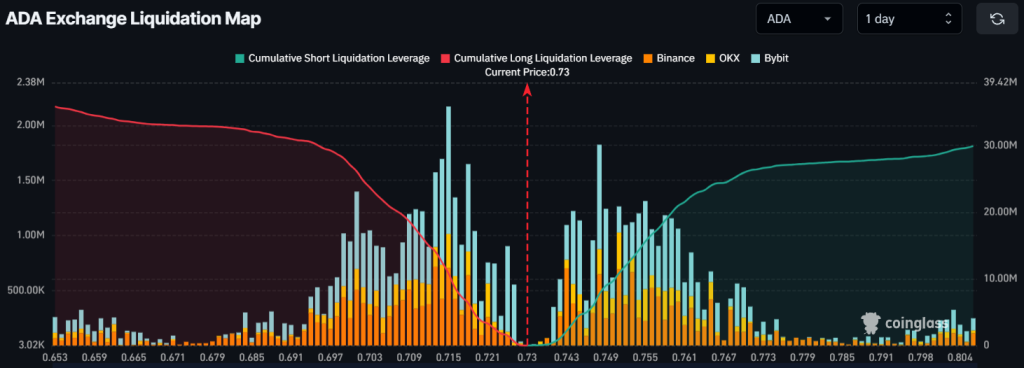

ADAs’ Over-Leveraged Levels

Despite the mixed price action, traders appear bullish as they are betting on the long side, according to on-chain analytics firm Coinglass.

Data reveals that traders are currently over-leveraged at $0.715 on the lower side, holding $11 million worth of long positions. Meanwhile, $0.75 is another over-leveraged level where traders betting on the short side hold $7.70 million worth of short positions.

These over-leveraged levels and the millions worth of short and long positions hint that bulls are currently dominating, which could support the asset in rallying in the coming days.

Specific altcoins like Cardano are seeing high positive sentiment on social media. Aided by the fact that the SEC classified

Specific altcoins like Cardano are seeing high positive sentiment on social media. Aided by the fact that the SEC classified