Did China Sell Its Bitcoin Holdings? Peter Schiff Debunks BTC Arms Race Rumors

The post Did China Sell Its Bitcoin Holdings? Peter Schiff Debunks BTC Arms Race Rumors appeared first on Coinpedia Fintech News

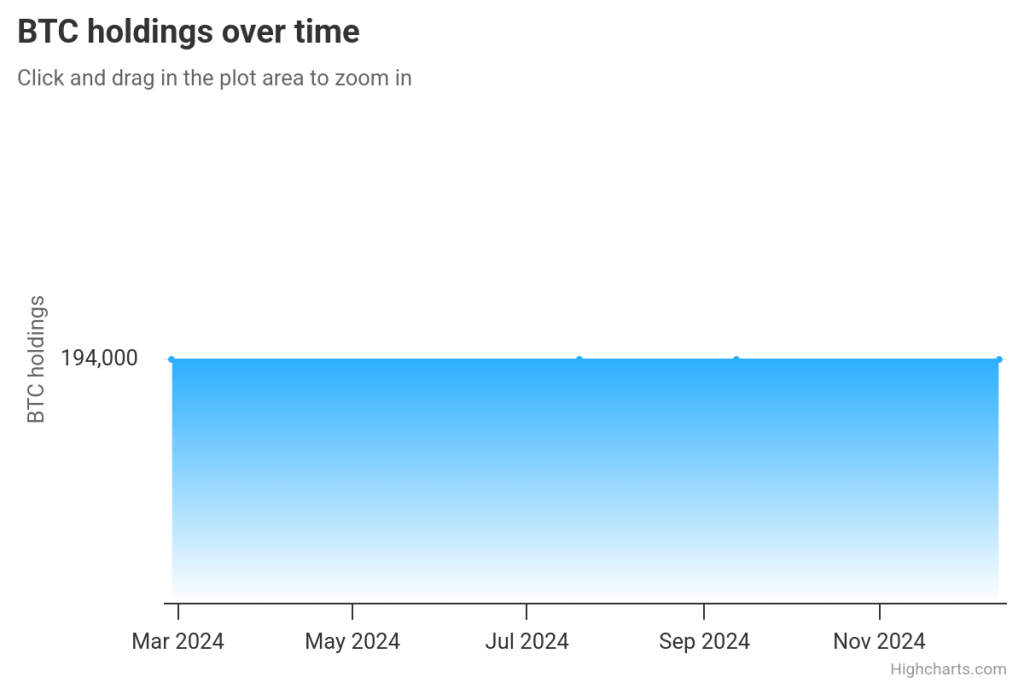

China is one of the top five Bitcoin holding governments, according to Bitcoin Treasuries. With 194,000 BTC tokens, it remains in the second position on the list, next to the US – which holds as many as 207,189 BTC tokens. There are rumours that a Bitcoin arms race could be triggered anytime soon. However, dismissing these rumours as baseless, renowned gold advocate Peter Schiff, known for his sharp criticisms of BTC, claims that the Asian superpower is not interested in any BTC arms race and that it dumped its BTC holdings at least two months ago. Shocking, isn’t it? Let’s dive in for more details!

Did China Sell Its Bitcoin Holdings

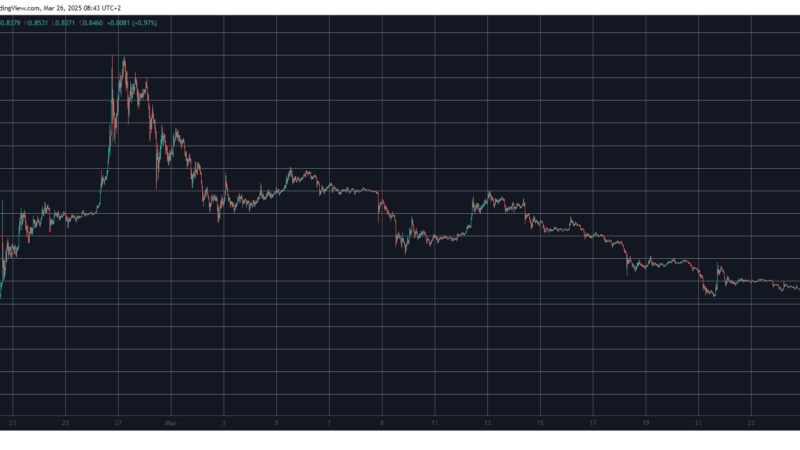

Schiff states that China dumped its Bitcoin holdings in January. This financial commentator is not the only person who has come up with such an argument. In January, crypto analyst Ki Young Ju claimed that China had sold all the tokens seized from the PlusToken scam.

Data from Bitcoin Treasuries indicates that China holds around 194,000 Bitcoin tokens.

However, Young Ju asserted that all these tokens had been dumped in January itself.

Peter Schiff’s Take: No Bitcoin Arms Race

Schiff’s statement comes in response to Senator Cynthia Lummis’ statement that a Bitcoin arms race between the US and China might be triggered soon. Denouncing Lummis’ statement indirectly, Schiff opines that China is less likely to enter a race to dominate the Bitcoin market. He even alleges that BTC enthusiasts are trying to push the Bitcoin market upwards using rumours related to the US and China BTC arms race. He also highlights that China prefers gold over Bitcoin.

Bitcoin Market: An Overview

In 2023, the Bitcoin market experienced a growth of 155.4%. In 2024, the annual price change index of BTC declined from 155.4% to 121.1%.

The BTC market follows a four-year cycle pattern. In the third year of every cycle, the market experiences massive bullish momentum. The latest cycle began in 2023. Since this year is the third year of the latest cycle, the market is expected to witness strong bullish momentum.

In January, 2025, the market recorded a growth of 9.54%. In February, the monthly returns index slipped from 9.54% to -17.5%. However, the Month-To-Date growth of BTC in March remains at +3.43%.

Since the US election, the political stance of the US government towards the crypto industry has shifted in favour of the sector. At the start of November 5, 2024 (the election day), the price of BTC was little above $67K. Since then, the Bitcoin market has grown by at least 28.43%.

Since the inauguration of pro-crypto leader Donald Trump, the US has introduced several pro-crypto policies, including the establishment of a strategic Bitcoin reserve.

US Bitcoin Reserve Strategy

The newly established crypto reserve is currently used by the US government to hold forfeited coins. It is unclear when the Trump administration will start purchasing tokens to add to its reserve.