Metaplanet Strengthens Bitcoin Holdings with Additional 150 BTC Purchase, Reinforcing Long-Term Crypto Strategy

Key Takeaways:

- Metaplanet Inc. added 150 Bitcoin to their 3300 BTC portfolio.

- The purchase came to the total of 1.886 billion yen with an average price of 12,570,173 yen per BTC.

- In Q1 2025, BTC Yield for the company jumped to 68.3%, highlighting its rampant accumulation strategy.

- Like MicroStrategy in the U.S., Metaplanet also continues to position Bitcoin as a primary reserve asset.

- Japan’s corporate landscape and broader institutional adoption may eventually come to be influenced by the firm’s Bitcoin-focused treasury operations.

Metaplanet’s Strategy for Bitcoin Expansion

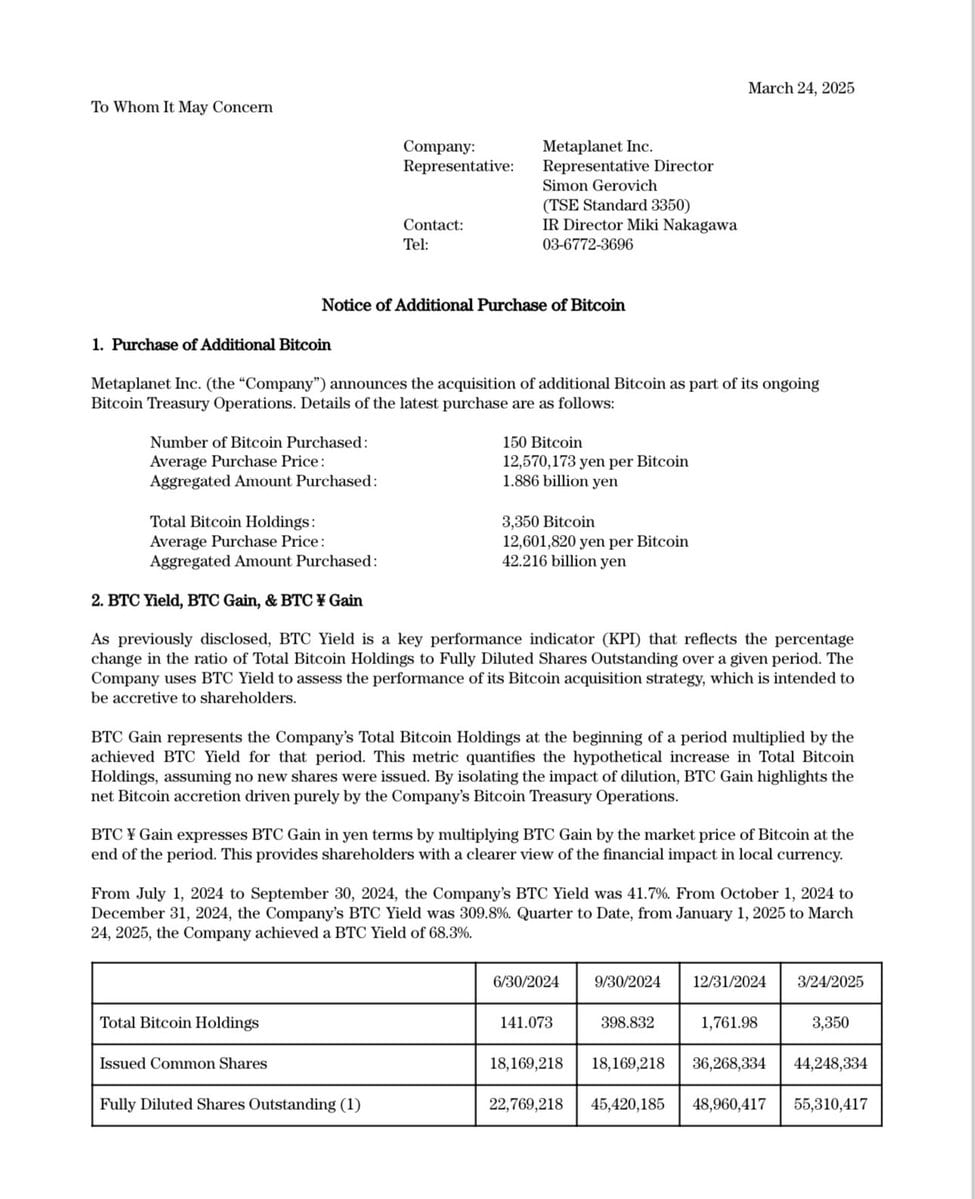

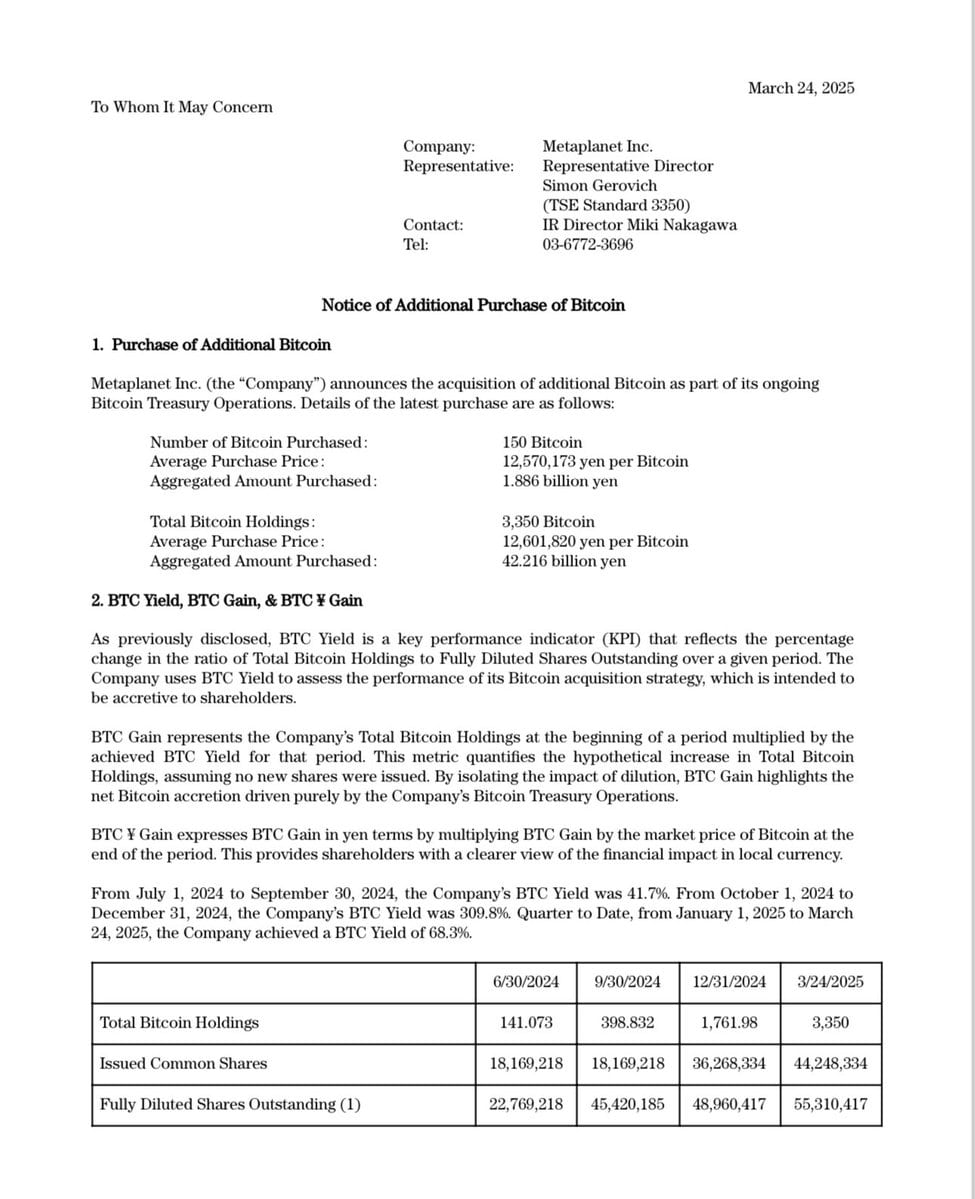

This prepares the ground for an eventual crypto treasury policy Metaplanet Inc., a public corporation in Japan, reported its newest Bitcoin buy in a significant step towards completing its Bitcoin-centric treasury strategy. It continues its accumulation, as it has added 150 BTC to its reserves, increasing its total to 3,350 BTC.

They acquired 1.886 billion yen worth of bitcoin at an average price of 12,570,173 yen per BTC. It’s the latest step in Metaplanet’s ongoing Bitcoin Treasury Operations, which underlines the importance of Bitcoin as a strategic financial asset.

Purchase of additional Bitcoin by Metaplanet

High Growth in Bitcoin Holdings

Metaplanet has substantially increased its Bitcoin holdings in the past year through aggressive purchases. The company’s timeline of strategic events is as follows:

| Date | Total BTC holdings |

| June 30, 2024 | 141.073 BTC |

| September 30, 2024 | 398.832 BTC |

| December 31, 2024 | 1,761.98 BTC |

| March 24, 2025 | 3,350 BTC |

It shows that the firm’s BTC stockpiles have jumped by over 2,200 BTC in just a half of the year, which proves it’s aggressive accumulation.

This means that for people who are sure that they want to hold Bitcoin in the long run, they will not mind holding through sell-off while the macroenvironment for fiat currencies remains inflationist.

BTC Yield and Financial Performance

To track Metaplanet’s financial approach, we are using BTC Yield — a key performance indicator (KPI) that indicates the percentage of growth in the ratio between Total Bitcoin Holdings and the Fully Diluted Shares Outstanding.

In the last 3 quarters the company reported the following BTC yield numbers:

From July 1, 2024 – September 30, 2024: 41.7%

309.8% for October 1, 2024 – December 31, 2024

68.3% from January 1, 2025 – March 24, 2025.

This metric shows Metaplanet’s ability to expand its Bitcoin holdings without excessive dilution of shares, presenting a healthier financials prospect to its investors.

Implications and Strategic Recommendations for Japan’s Corporate Sector

Metaplanet’s acquisition comes amid the wider trend of corporate Bitcoin adoption that identifies Bitcoin as a way for companies to diversify their balance sheets, particularly in the wake of recent inflation of the U.S. dollar. Rather, they are this pioneer on what appears to be Japan’s corporate Bitcoin adoption with its Metaplanet initiative, following in the footsteps of the U.S. companies, MicroStrategy and Tesla, who paved the way.

Potential Market Influence

Metaplanet’s strategic Bitcoin acquisitions could set a precedent for other Japanese companies to explore Bitcoin as a treasury asset. As corporate Bitcoin adoption gains traction, Japan’s financial regulators may intensify their scrutiny, potentially leading to the introduction of new crypto regulations.

Bitcoin in Treasury Management

Companies may look for stores of value other than the yen as concern over devaluation mounts.

The hedging against inflation that Bitcoin offers is beneficial for businesses that operate internationally.

Impact on Investor Sentiment

This is a way of investing in Bitcoin without directly doing so! MicorStrategy stocks have been rising together with BTC, making people think if they could do it again for other companies with strong BTC reserves.

Metaplanet’s shares may attract more interest from institutional investors focused on crypto.

Road Ahead: Upcoming for Metaplanet

Metaplanet’s Bitcoin purchase is probably not the last. Considering its past performance, it might act in a similar manner and accumulate BTC in the next few months. Here are the key factors to look at:

- More BTC purchases: Will Metaplanet keep buying BTC for its reserves in Q2 and beyond?

- Stock market reaction: What will institutional investors make of Metaplanet’s rising Bitcoin exposure?

- Regulatory landscape: Japanese authorities to bring clarity to crypto accounting rules for public companies?

More News: Metaplanet’s 4,000% Stock Surge: A Japanese Company’s Bitcoin Strategy Pays Off

The post Metaplanet Strengthens Bitcoin Holdings with Additional 150 BTC Purchase, Reinforcing Long-Term Crypto Strategy appeared first on CryptoNinjas.