BNB Chain Announces $100 Million Permanent Liquidity Program for DeFi Ecosystem

Key Takeaways:

- $100 Million Permanent Liquidity Program (PLP) for BNB Chain Ecosystem is Live

- The initiative centres on enhancing liquidity depth, minimising slippage, and creating a sustainable financial ecosystem.

- The program partners with market makers to tighten price spreads and improve users’ trading experience.

- In doing so, this will further enhance the desirability of BNB Chain as a DeFi platform and attract new and upcoming DeFi projects to join forces.

BNB Chain Introduces $100 Million Liquidity Boost for DeFi

One of the biggest blockchain networks in the crypto space, BNB Chain has inaugurated its $100 million Permanent Liquidity Program (PLP). This program is designed to increase liquidity, optimize trade execution, and help boost the sustainable development of DeFi projects within its ecosystem.

Through this program, BNB Chain aims to make its DeFi ecosystem fiercer while making the process of acquiring liquidity and user adoption for new projects easier than ever.

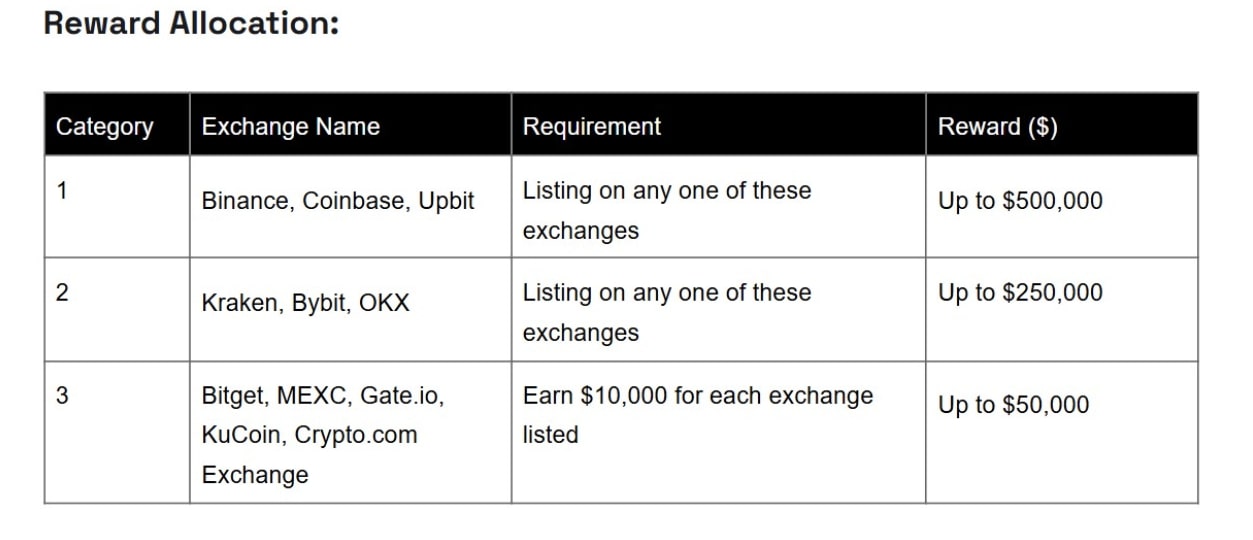

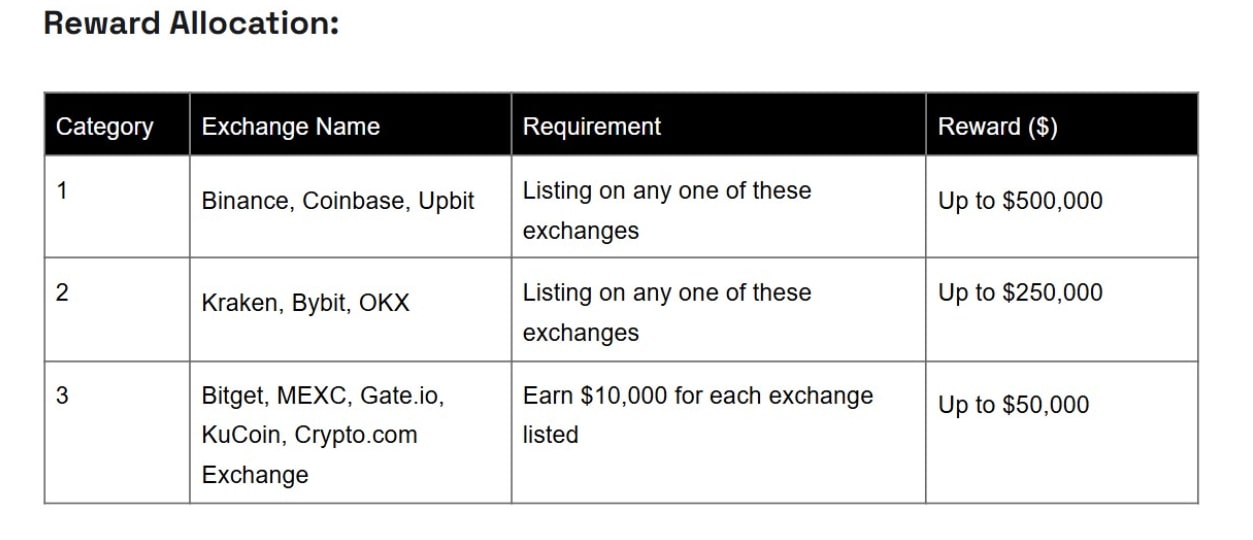

Rewards vary based on the prominence of the exchange listing. Source: BNB Chain

Why Liquidity Matters in DeFi

Lack of liquidity leads to high slippage, price volatility, and bad user experience, which deters traders and investors from participating. Strong liquidity is a critical factor for all DeFi protocols, especially DEXs, in order to run smoothly.

The PLP on BNB Chain sets out to overcome these prevalent challenges by providing:

- Deep liquidity pools enabling traders to place large trades with little effect on the assets prices.

- Reduced slippage, offering a better experience to those who require accurate price execution.

- A stronger DeFi ecosystem that draws developers, market providers, and capital.

How the Permanent Liquidity Program Works

The fund, worth $100 million, will be used to tap liquidity across various sectors of the BNB Chain ecosystem, including, but not limited to:

- Decentralized exchanges (DEXs) – For increasing trading depth and lowering slippage.

- Lending and borrowing protocols for providing liquid markets for DeFi lending.

- Yield farming platforms — To motivate liquidity providers in a holistic way.

PLP’s core concept is to focus on long-term liquidity provision instead of short term incentives. This sets it apart from traditional liquidity mining programs, which frequently experience a flight of capital once rewards expire. The PLP, on the other hand, is looking to create a sustainable infrastructure for liquidity across BNB Chain’s DeFi ecosystem.

Driving Growth for The New DeFi Projects

Many new DeFi projects face liquidity shortages which make it challenging to attract users and investors. The BNB Chain PLP serves as a valuable support system by:

- Less volatile market means that traders can jump in and out of positions more safely.

- Improve liquidity conditions for new DeFi protocols to encourage their adoption.

- Carving out a niche for institutional market makers on the BNB Chain ecosystem.

By enhancing liquidity, this enables smaller projects to grow much more quickly, creating more potential for decentralization and innovation in BNB Chain’s DeFi ecosystem.

Establishing BNB Chain as the DeFi Blockchain of Choice

With a focus on liquidity and making DeFi more approachable, BNB Chain reinforces its position as a go-to ecosystem for both developers and investors. The decision is consistent with its vision of creating a scalable, efficient, and user-friendly blockchain ecosystem.

More News: BNB Chain Completes Upgrade and Launches Pascal Hard Fork: A New Era of EVM Compatibility and Speed

The post BNB Chain Announces $100 Million Permanent Liquidity Program for DeFi Ecosystem appeared first on CryptoNinjas.