62.8% Of XRP Realized Cap Held By New Investors: Sign Of Fragility?

On-chain data shows a large portion of the XRP Realized Cap is in the hands of investors who got in during the last six months. Here’s what this could mean for the asset.

XRP Investors Younger Than Six Months Have Significantly Increased Realized Cap Share

In a new post on X, the on-chain analytics firm Glassnode has discussed how the Realized Cap of XRP has changed recently. The “Realized Cap” here refers to an indicator that, in short, keeps track of the total amount of capital that the holders of the asset as a whole have invested into it.

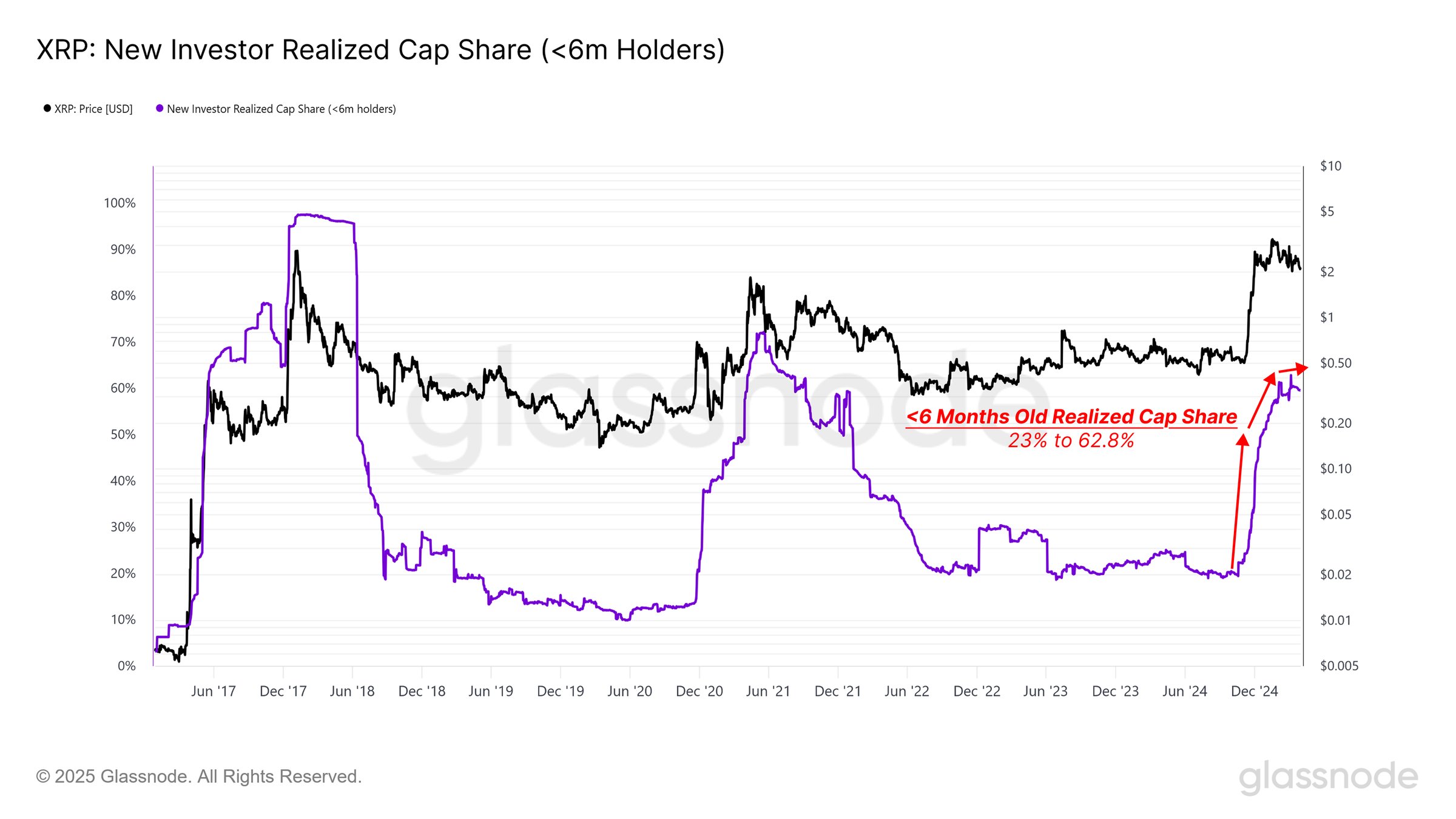

Changes in this metric, therefore, correspond to inflows and outflows that the cryptocurrency is observing. Below is the chart shared by the analytics firm that shows the trend in the Realized Cap for XRP over the last few years.

As displayed in the above graph, the XRP Realized Cap has shot up during the past few months, implying that a large amount of capital has flown into the cryptocurrency. More specifically, the asset has seen the metric double from around $30.1 billion to $64.2 billion.

In the same chart, Glassnode has also attached the data of the indicator for the young investor age groups. It would appear that the capital held by cohorts like 1-month to 3 months and 3 months to 6 months has spiked recently, which makes sense considering the growth in the aggregated Realized Cap has come during these windows.

According to the analytics firm, this short-term capital spike is a sign of retail-led momentum. The momentum appears to have cooled off, however, as the metric has no longer been growing as sharply recently.

A consequence of all the fresh capital inflows is that XRP has seen a shakeup in investor dominance. As another chart shared by Glassnode shows, the new investors, comprising all the age bands under 6 months, have witnessed their Realized Cap share blow up.

Prior to the new inflows, this cohort controlled just 23% of the cryptocurrency’s Realized Cap, but today that value has grown to 62.8%. This means that 62.8% of the entire capital invested into the coin has come at price levels of the last six months.

Given that XRP is currently trading under the prices that it has been at for most of this window, a lot of these holders would be underwater. “This rapid concentration in new holders reflects strong retail involvement – but also raises the risk of fragility, as many hold elevated cost bases,” notes the analytics firm.

From the chart, it’s apparent that these are the same conditions that led to a top during the last two bull markets. With inflows slowing down as the price declines, it’s possible that the same pattern may once again be forming for XRP.

XRP Price

With a plunge of more than 8% in the last 24 hours, XRP has retraced its latest recovery as its price has returned to $1.78.