Big SEI Token Investment by Trump-Backed World Liberty Financial

Key Takeaways:

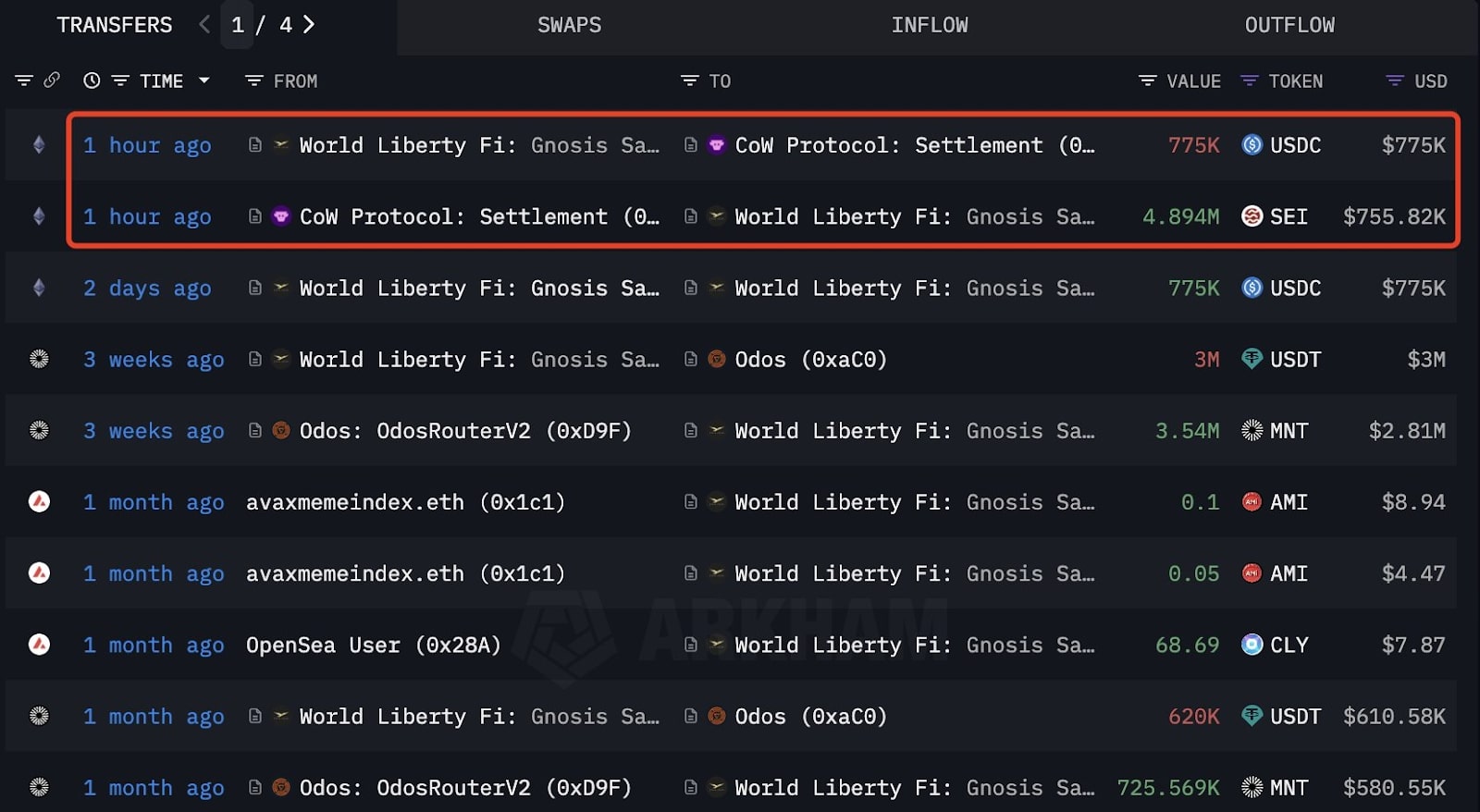

- The purchase was made by World Liberty Financial, a group linked to Trump, which acquired 4.89 million SEI tokens for $775,000.

- The SEI token surged 7.8% shortly after the purchase.

- Despite previous losses, the move hints that it may seek aggressive positioning in crypto again.

An enormous cryptocurrency acquisition from World Liberty Financial (WLFI) is drawing intense interest in both political and financial circles. According to April 12 reports from blockchain monitoring tools, WLFI purchased 4.89 million SEI tokens in exchange for 775,000 USDC — an average price of $0.158 per token.

Since then, the Trump-linked crypto wallet now has a balance of 5.98 million SEI tokens, based on public on-chain data.

WLFI, which has previously dealt with the ups and downs of the volatile crypto market, is making a bold bet with the investment, marking a prominent return to the spotlight.

World Liberty Financial: A Deep-Pocketed but Risky Player in Crypto

World Liberty Financial has emerged as one of the more high-profile political entries into the crypto space. WLFI has gained attention for its aggressive investment strategy, driven by individuals reportedly connected to Donald Trump.

To date, WLFI has lavished a jaw-dropping $346.8 million on 11 individual tokens. But all of those investments are in the red now, with an unrealized loss of $145.8 million and counting. So the recent SEI purchase is not just another crypto buy — it shows that WLFI is continuing to double down, despite significant setbacks.

Even with the losses, WLFI’s holdings still total approximately $101 million in value, having seen a 1.18% increase in just the past 24 hours — possibly buoyed by the recent SEI activity.

More News: World Liberty Financial Invests $4M in AVAX and MNT Despite Portfolio Losses

Why SEI? Examining the Potential of the Cryptocurrency

Sei is a Layer 1 blockchain designed for speed, especially in DeFi and real-time trading applications, and its native coin is called SEI.

SEI has had an up and down performance. The price of the token fell by 75.9% over the past year. In the last month, it dropped 12%, and another 14.4% in just the last two weeks. On April 7, it hit bottom at $0.1293, from $0.1720 at the start of the month.

But on April 6, SEI price gained 10.5% in a day due to buy activity. On April 10, we saw a small 4.11% correction, but the bounce clearly indicated that interest and momentum remained. WLFI’s latest purchase may represent a strategic bet on a potential rebound.

Political Influence and Market Psychology

When financial maneuvers are tied to a political figure as polarizing and powerful as Donald Trump, market reactions can often be more emotional than rational. The story seems to be what SEI price did immediately after the WLFI transaction — 7.8% in 24 hours, and 3.4% in one hour — which would indicate a market view that the purchase was a vote of confidence.

Crypto communities often track big wallets and politically connected buyers, interpreting their moves as signals. Even with criticism over WLFI’s past performance, visibility like this around a token like SEI can have immediate effects.

The Trump brand — controversial, powerful and unpredictable — has brought an element of human drama to what is otherwise an abstract world of blockchain transactions.

More News: World Liberty Financial of Trump to Introduce USD1 Stablecoin Backed by U.S. Treasuries

The post Big SEI Token Investment by Trump-Backed World Liberty Financial appeared first on CryptoNinjas.