Ripple News Today: XRP Eyes $2.25 Amid Tokenisation Boom Forecast by Ripple and BCG

The post Ripple News Today: XRP Eyes $2.25 Amid Tokenisation Boom Forecast by Ripple and BCG appeared first on Coinpedia Fintech News

A report, developed by Ripple and Boston Consulting Group, forecasts that the tokenisation of real-world assets will see a massive growth in the coming years. The report, titled “Approaching the Tokenisation Tipple Point,” asserts that the market will grow to $18.9 trillion by 2033. Interestingly, the XRP market, probably fueled by the report, has crossed the crucial $2 mark. Will $2.25 be next? Let’s dive in for details!

Ripple and BCG Predict Explosive Tokenisation Growth

The Ripple-BCG report predicts that the tokenisation of real-world assets will grow from $0.6 trillion in 2025 to $18.9 trillion by 2033.

The report asserts that tokenisation will revamp the entire financial system of the world. It explains how it will work miracles in the areas of fractional ownership, instant transfer and regulatory compliance.

It even highlights how it will help XRP to emerge as a key player in the new system.

XRP Price Analysis: Technicals Hint at Bullish Breakout

XRP, the fourth largest cryptocurrency by market cap, has experienced a surge of 238.2% in the last one year.

At the start of this year, the XRP price was $2.08. On January 16, the XRP market touched an all-time high of $3.399. Between January 1 and 17 alone, the market grew by around 57.94%. Since January 18, the market has consistently plummeted by nearly 37.36%.

Since mid-January, the market has remained inside a descending trendline.

At the beginning of this month, XRP was around $2.0900. At one point on April 2, it reached as high as $2.2322, but by the end of that day, it slipped to a low of $2.0229.

Although between April 3 and 5, the market rebounded by 5.92%, it saw a severe correction of 16.16% between April 6 and 8.

Though the market experienced strong buying pressure on April 9, it was not adequate enough to help the market recover from the previous correction.

In the last 24 hours, the XRP price has recorded a rise of 1.7%. Currently, the price stands at $2.06 – slightly above the crucial $2 mark.

The RSI on the daily chart of XRP stands at 46.12. On April 8, it was as low as 32.12. The growth from 32.12 to 46.12 in this short period shows improving bullish momentum.

The 200-day EMA on the daily chart of XRP remains at $1.9506. The EMA level currently acts as a strong support.

Anyway, to confirm a long-term uptrend, the XRP market has to close strongly above the descending trendline resistance.

XRP Liquidation and Derivatives Data: What the Market is Telling US

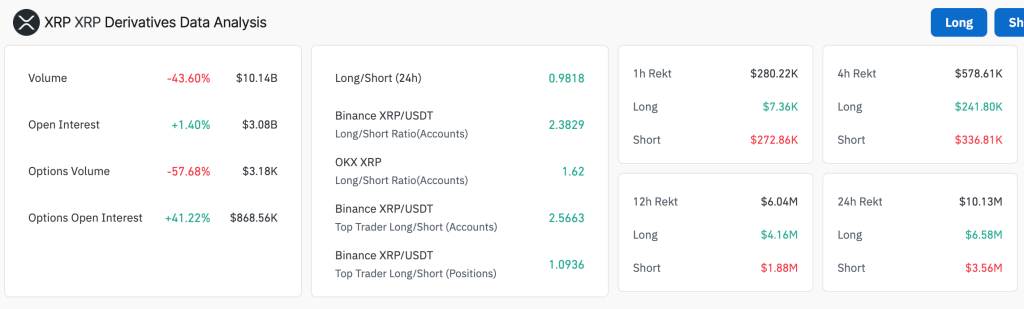

According to data, short liquidations ($336,810) are much higher than long liquidations ($241,800). This means that bearish positions are being squeezed.

Reports suggest that open interest in XRP derivatives has increased by 1.4% to $3.08 billion. This implies that more capital is entering the XRP market.

Geopolitical Risks: US-China Tariff War and XRP Impact

Since the inception of Donald Trump as the president of the United States, he has introduced several pro-crypto policies, including the appointment of a crypto task force to create a clear crypto regulatory framework and the establishment of a new law blocking the IRS from collecting certain crypto tax data.

The Trump administration has also appointed several pro-crypto leaders in key leadership positions, especially those directly or indirectly connected to the cryptocurrency industry. It has also created a permanent solution for the long-standing legal battle between the US Securities and Exchange Commission and Ripple.

Certainly, the political atmosphere in the country is currently favourable for the growth of the XRP market.

However, like other key asset markets, the crypto sector is also not immune to global macroeconomic uncertainties.

The US decision to impose aggressive tariffs against partner countries has created havoc in the global economy.

Almost all the asset markets, including the crypto market, have suffered the impact of Trump’s tariffs.

Recently, the Trump administration gave a 90-day pause for the implementation of the aggressive tariff policy.

Meanwhile, the US has provided no relief to China, and even imposed a tougher tariff against the country. Only time will tell the impact of the US-China tariff war.

Can XRP Overcome Key Resistance Levels?

In conclusion, XRP’s path to $2.25 hinges on overcoming the descending trendline resistance that has capped its recent rallies. A daily close above this level, coupled with rising RSI and strong support from the 200-day EMA, could signal the beginning of a sustained bullish trend. However, caution is warranted, as macroeconomic uncertainties and resistance near previous highs may limit upside in the short term.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.