Canadian watchdog greenlights spot Solana ETFs with staking rewards

Canada is poised to debut the world’s first spot Solana (SOL) exchange-traded funds (ETFs) on April 16 after the Ontario Securities Commission (OSC) approved listings from four major issuers: Purpose Investments, Evolve ETFs, CI Global Asset Management, and 3iQ.

Bloomberg senior ETF analyst Eric Balchunas shared the development in a social media post on April 14, highlighting that the funds will include staking.

Unlike futures-based products, these spot Solana ETFs will hold SOL tokens directly, offering investors real-time price exposure to the underlying asset. Each fund will track a different Solana-related index, providing diversified strategies while maintaining on-chain backing.

The approval cements Canada’s reputation as a global leader in crypto ETF innovation, having previously launched the first spot Bitcoin and Ethereum ETFs well ahead of other major markets.

Staking rewards

According to the document shared by Balchunas, the ETFs will participate in Solana staking to earn rewards, aiming to boost net returns for holders while helping to offset management fees and operational costs.

The staking model may also offer yields higher than those available from Ethereum staking products, reflecting Solana’s higher network reward rates. The ETFs aim to distribute these rewards back to shareholders, reducing the effective cost of holding the ETF over time.

Balchunas noted that the documentation references “via TD,” indicating that TD Bank distributed fund-related information. However, he clarified that TD is not facilitating the staking directly nor acting as a custodian for the staking process.

The mechanism of staking through an ETF is still novel, and while exact operational details haven’t been disclosed, the inclusion signals a growing willingness by Canadian regulators to embrace hybrid financial-crypto structures that blend DeFi features with traditional fund architecture.

US lagging

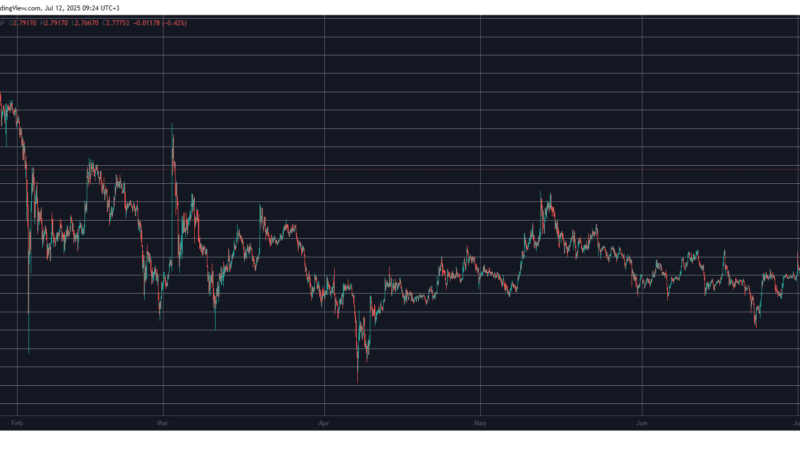

In contrast, the US has yet to approve any spot altcoin ETFs beyond Ethereum (ETH). The only Solana ETFs available to US investors are futures-based products, which Balchunas said have failed to generate meaningful traction.

He noted that the Solana ETFs have experienced lackluster growth and generated “very little in AUM.”

Balchunas added that the 2x leveraged XRP ETF, which launched more recently, has already outpaced the Solana futures ETFs in assets under management, highlighting a weak reception for SOL exposure in the US so far.

The Canadian launch provides the first regulated test case for spot altcoin ETFs with staking rewards. If the SOL ETFs see stronger adoption than their US futures counterparts, it could pressure regulators elsewhere to revisit their stance on spot altcoin ETF approvals, especially in jurisdictions like the US, where the debate over crypto regulation remains contentious.

With this launch, Solana joins Bitcoin and Ethereum in Canada’s regulated ETF ecosystem, giving investors an expanding suite of compliant crypto investment vehicles with direct blockchain exposure.

The post Canadian watchdog greenlights spot Solana ETFs with staking rewards appeared first on CryptoSlate.