Trump Media To Launch Utility Token and $250M ETF Push

The post Trump Media To Launch Utility Token and $250M ETF Push appeared first on Coinpedia Fintech News

Trump Media and Technology Group, the parent company of Truth Social and Truth Plus, is planning to launch a new utility token as part of a broader expansion strategy. CEO Devin Nunes shared these updates in a letter marking the company’s first year as a public entity, detailing new features, investments, and upcoming crypto integrations.

The utility token will be introduced within a dedicated Truth digital wallet and will first be used to pay for Truth Plus subscriptions. Over time, it could also be used for other services across the Trump Media ecosystem, forming part of a larger rewards program.

A Strong Start, One Year In

Marking its first year as a public company, Nunes highlighted the company’s strong financial position, holding $777 million in cash with low operating costs. He believes this gives Trump Media a strong edge for growth, especially as it rolls out new premium features for Truth Plus, like longer videos, an edit button, and access to more conservative news channels and family-friendly content.

Big Investments in Finance

Meanwhile, under its financial services brand Truth.Fi, Trump Media is launching a series of ETFs and separately managed accounts with an “America-first” focus, in partnership with Yorkville America Equities and Index Technologies Group. Up to $250 million has been allocated to this venture.

However, the crypto ambitions have sparked concerns about potential conflicts of interest. Despite transferring his 59% stake to a trust, Trump remains linked to several crypto ventures, including World Liberty Financial, where he’s named “Chief Crypto Advocate” and profits from the company, which is mostly owned by the Trump family. His memecoin launch, Official Trump (TRUMP), just before returning to office, also drew criticism.

Nunes also expressed concern about stock manipulation, citing a hedge fund’s 6 million short positions and notifying the SEC. He added that the company is actively pursuing mergers and acquisitions to find “crown jewel” assets that align with its long-term vision.

Stock Pressure and M&A Plans

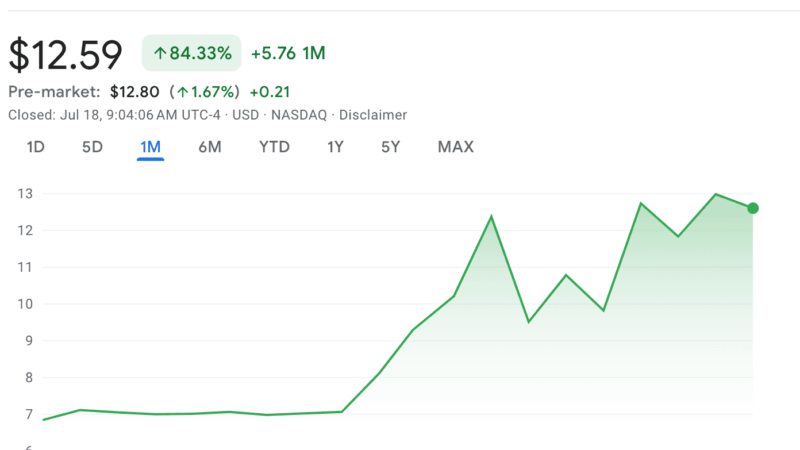

Despite the announcements, Trump Media’s stock (DJT) fell 3% on the day and is down 26% for the year, as investor interest appears to be cooling off amid broader market uncertainty. Nunes claims hedge fund manipulation is partly to blame and has alerted the SEC. He also says Trump Media is on the hunt for strategic acquisitions to support long-term growth.

NEW: In a letter to shareholders, CEO of Trump Media

NEW: In a letter to shareholders, CEO of Trump Media