Binance vs. Coinbase Comparison in 2025: Fees, Safety, and Security

Binance and Coinbase are two of the most widely used cryptocurrency exchanges globally, each serving millions of users and providing access to hundreds of digital assets. These platforms simplify cryptocurrency trading by providing users with tools they need to buy, sell, and trade digital assets securely.

Both Binance and Coinbase offer spot trading and provide opportunities for users to earn passive income. They are also popular for having high liquidity and a strong brand reputation in the crypto space. Although Coinbase and Binance share similar features, they have key differences that make them suitable for different traders.

Binance stands out for its advanced trading features, lower fees, and extensive support for a wide range of cryptocurrencies. It also offers features like futures trading, staking, and a robust DeFi ecosystem, making it a favourite among experienced investors and global traders. On the other hand, Coinbase is popular for its beginner-friendly interface and strong regulatory compliance.

If you’ve ever wondered which platform is best for you between Coinbase vs Binance, this detailed comparison covers the difference between Binance and Coinbase across transaction fees, best features, and their security and regulation levels.

What’s the Difference Between Coinbase and Binance?

The differences between Coinbase and Binance are trading tools, trading fees, staking options, regulatory compliance, supported cryptocurrencies, user experience, and additional features. Binance offers a broader range of trading tools and products than Coinbase.

For crypto trading, Binance users have access to spot, futures, margin, P2P, over-the-counter (OTC), and other trading options. The platform also provides them with a comprehensive interface with TradingView integration for easier management of their positions. Meanwhile, Coinbase only supports direct buy and sell orders, spot trading, and derivatives trading.

For additional features, Coinbase focuses on simple buying, selling, and holding, with features such as Coinbase Vault for secure long-term storage. On the other hand, Binance has many extra services such as crypto loans, a decentralized exchange (DEX), a launchpad for new tokens, and an NFT marketplace.

We will provide a more detailed comparison of Binance vs. Coinbase later in this article; however, the table below offers an overview of the two exchanges and their respective products and services.

| Exchange | Binance | Coinbase |

| Best For | Experienced traders who need advanced trading tools, low fees, and more crypto selection. | US residents and beginner traders who need a simple user interface for placing buy and sell orders. |

| Founded | 2017 | 2012 |

| Founder | Changpeng Zhao | Brian Armstrong |

| Headquarters | Malta | United States (remote-first company) |

| Supported Cryptocurrencies | 350+ | 280 |

| Trading Fees | 0.1% makers/takers for spot trading) and 0.5% for instant buy and sell. | 0.40% maker and 0.60% for takers. |

| Crypto Wallet | Binance Web3 Wallet | Coinbase Wallet |

| NFT Marketplace | Yes | Yes, via Coinbase Wallet |

| Leverage | 125x | 20x |

| Security | Insurance fund, Two-Factor Authentication, IP whitelisting, withdrawal address whitelisting, cold storage of crypto, multi-signature wallets, and a bug bounty program. | 2FA, cold storage, insurance for funds held in hot wallets, biometric access, and AES-256 encryption for digital wallets. |

| KYC Requirements | Mandatory | Mandatory |

| P2P Trading | Yes | No |

| Trading Markets | Futures, margin, options, and spot trading. | Spot and derivatives trading (perpetual futures contracts). |

| Order Types | Limit, market, stop-limit, trailing stop, post-only, and one-cancels-the-other orders. | Buy, sell, send, receive, and swap. |

| Accepted Payment Methods | Crypto, bank deposits, debit/credit card, Apple Pay, Google Pay, and third-party payment processors. | Crypto, bank transfers (ACH, SEPA, etc), and third-party payment processors. |

| Trading Volume (Subject to Market Changes) | $76 billion | $2.3 billion |

Do Binance and Coinbase Work in the USA?

Binance does not work in the USA, but Coinbase does. The Binance global platform is not available to traders in the United States. Instead, the exchange offers its services to US traders through Binance.US, which supports a more limited range of cryptocurrencies and provides fewer products and services, as well as limited options for trading cryptocurrencies.

Coinbase is a better fit for users in the USA because it is a regulated financial institution and complies with local laws. Additionally, Coinbase supports more cryptocurrencies than Binance.US and offers a broader range of payment options, as well as a more user friendly interface.

Register and Earn: Open a new account on Coinbase now and get $200 worth of BTC in welcome bonuses.

How do the Available Cryptocurrencies on Binance and Coinbase Compare?

When it comes to the number of available cryptocurrencies, Binance supports more crypto assets than Coinbase. Binance supports over 350 cryptocurrencies. Meanwhile, Coinbase only supports about 280 crypto coins.

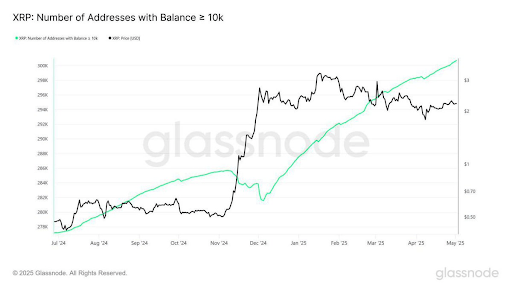

Both Binance and Coinbase support memecoins, stablecoins, and popular coins like BTC, ETH, SOL, and XRP. However, if you need more crypto support or are looking for a platform that will let you easily access lesser-known cryptocurrencies or new projects as soon as they hit the market, Binance is the ideal choice.

How Does the User-friendliness of Coinbase Compare to Binance?

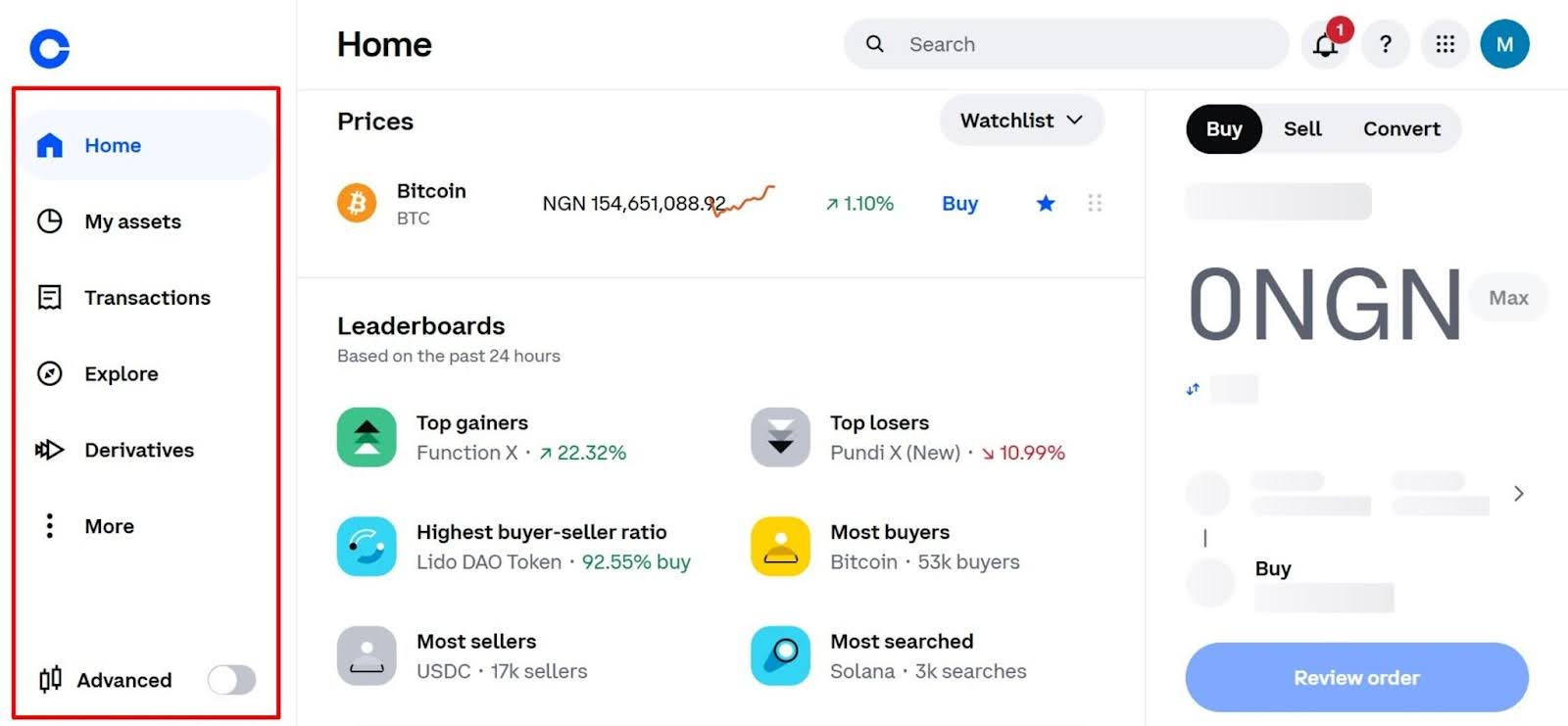

Coinbase is more user-friendly than Binance, making it a great choice for complete beginners. The exchange’s interface is clean, simple, and designed to make buying, selling, and managing cryptocurrencies straightforward.

In addition to a user friendly interface, Coinbase offers educational materials through various channels, including Learn & Earn. Coinbase’s Learn & Earn is a program that allows crypto traders to earn rewards for learning about cryptocurrencies and how to use the platform. To earn money by learning on Coinbase, users must watch video tutorials and complete quizzes to test their knowledge.

On the other hand, Binance is also a good starting point if you are looking for user-friendliness. Although its interface and service offerings are more complex than Coinbase’s and appeal more to experienced traders, beginners can also use the exchange to hold cryptocurrency and complete simple buy and sell orders on the spot market.

Binance offers a P2P marketplace and supports copy trading, allowing users to profit by mirroring the trading strategies of advanced investors. The company also offers comprehensive educational resources through their blog, FAQ section, and Learn & Earn program through Binance Academy. Additionally, Binance provides a “Lite” mode to simplify the interface for beginners.

What are Binance Fees Vs Coinbase?

The fees of Binance and Coinbase are trading fees, deposit and withdrawal fees, and staking fees. While Binance charges additional fees for NFT trading and options trading, we will only compare the fees that the two exchanges have in common.

Coinbase Vs Binance Trading Fees

Coinbase offers two primary trading platforms, each with distinct fees: the standard Coinbase platform and Coinbase Advanced Trade.

- Standard Coinbase Platform: Uses a spread-based fee model for buy and sell orders, which is around 0.5%, but the exact fee varies because they are calculated at the time you initiate your order. They can be influenced by factors such as payment method, order size, market conditions, location, assets, and other costs.

- Advanced Trade Platform: Maker fees start at 0.40% for 30-day trading volumes up to $10,000, while taker fees start at 0.60% for the same volume bracket.

Coinbase fees decrease with 30-day higher volumes. For example, users with volumes between $100,000 and $1 million have their maker fees dropped to 0.10%, and taker fees to 0.20%

Meanwhile, Binance also has a tiered fee structure that applies to spot, margin, and futures trading pairs.

- Spot and Margin Trading Fees: Standard Binance spot and margin fees are capped at 0.10% for both makers and takers. Users holding or using Binance Coin (BNB) to pay transaction fees can receive a 25% discount, reducing the fee to 0.075%. VIP traders receive an additional discount on fees, so the higher your 30-day trading volume, the lower your fees.

- Futures Trading Fees (USD-M and Coin-M Futures): For USD-M and COIN-M Futures, regular users pay 0.02% for maker fees and 0.05% for taker fees. Traders with higher trading volume enjoy lower costs, with VIP 9 paying 0% maker and 0.017% taker fees. Additionally, if you are a BNB holder, you can receive an extra 10% discount.

Start your trading journey on Binance today with $100 free trading credit and a 20% lifetime discount on fees.

Coinbase Vs Binance Deposit and Withdrawal Fees

Coinbase and Binance do not charge fees for crypto deposits. However, if you are depositing fiat currencies, you may incur a fee depending on the payment method you choose.

For withdrawals, Coinbase crypto withdrawal fees depend on network congestion and cryptocurrency, but they can be relatively high, sometimes reaching up to $60 or around 3%, depending on the asset.

Fiat withdrawal fees vary depending on the payment method, but they are generally higher than those on Binance. For fiat withdrawals, Coinbase imposes a $25 fee for wire transfers, while ACH transfers are free.

Binance, on the other hand, offers lower withdrawal fees that depend on the currency (crypto or fiat) and the transfer method. For crypto withdrawals, the costs also depend on the specific cryptocurrency and network conditions, but they are lower than those of Coinbase. You can find the standard fees for fiat and crypto withdrawals on Binance’s deposit/withdrawal fee page.

Coinbase Vs Binance Staking Fees

Coinbase does not charge fees for taking or unstaking crypto, they take commissions instead. Coinbase takes up to 35% of the rewards you earn. Meanwhile, Binance charges a lower commission on specific assets, for example, around 10% on users’ staking rewards, making its commission more competitive than Coinbase.

What are the Best Features of Binance Vs. Coinbase?

The best features of Binance include its web3 wallet, Binance Earn, NFT marketplace, and Binance Launchpad and Launchpool. Meanwhile, the best features of Coinbase are Advanced Trade, Coinbase Earn, Coinbase Commerce, and Coinbase Wallet.

The best features of Binance are explained below;

- Binance Wallet

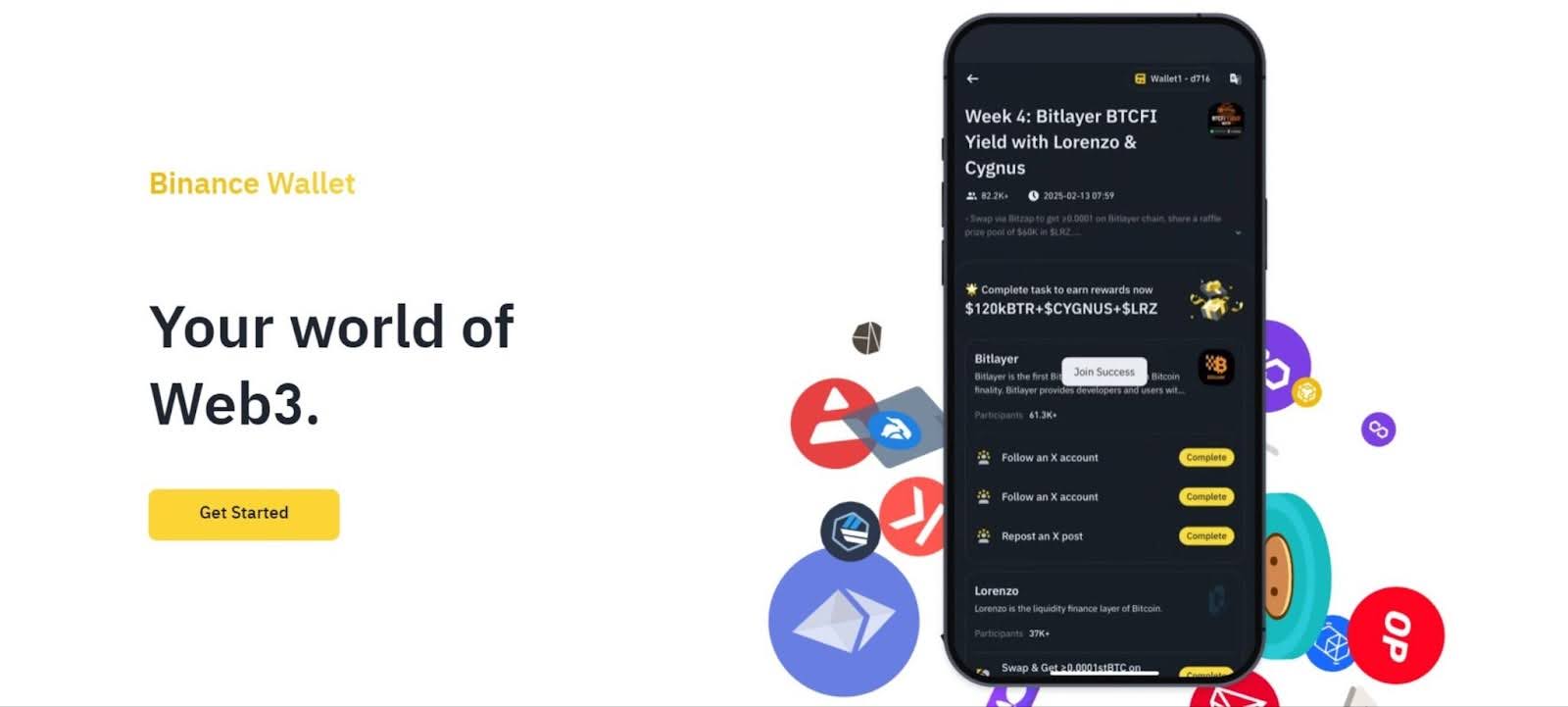

Binance Web3 Wallet integrates directly into the Binance platform, allowing users to easily interact with decentralized applications (dApps) across multiple blockchains. Unlike traditional custodial wallets, where the platform holds the private keys, Binance’s Web3 Wallet offers users self-custody and the ability to manage assets independently.

It supports DeFi protocols, NFT platforms, and token swaps across Ethereum, BNB Chain, and other networks. The web3 wallet also allows Binance users to participate in exclusive airdrop campaigns, execute cross-chain token swaps, and interact with various blockchain platforms.

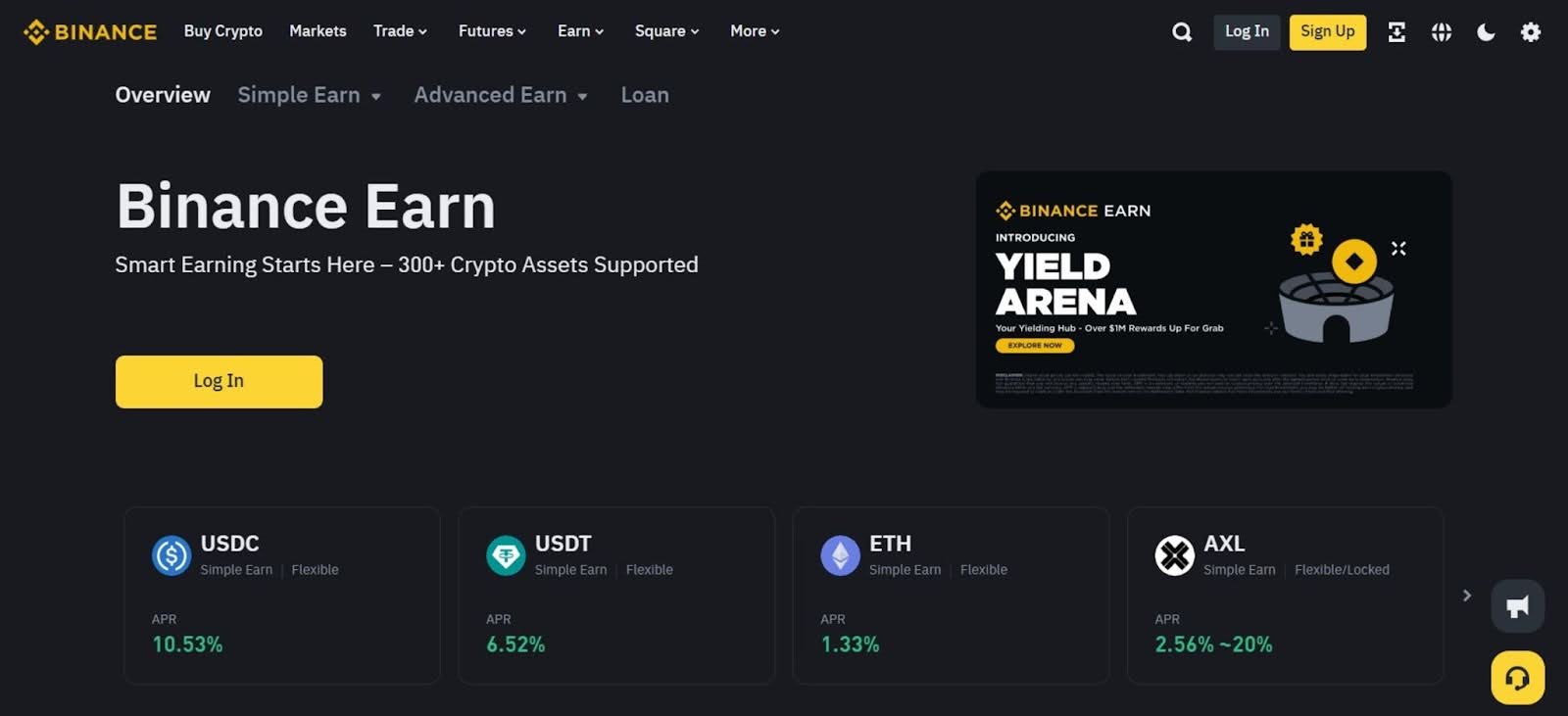

- Binance Earn

Binance Earn is a comprehensive suite of financial products designed to help users grow their crypto holdings passively. Whether you are a long-term holder or a new investor, Binance Earn offers flexible and locked savings accounts, as well as ETH and SOL staking options through Simple Earn, liquidity farming, dual investment strategies, and more.

For example, with locked staking, users can commit a certain amount of tokens for a set period and earn competitive returns. In contrast, flexible savings allow for instant withdrawals and lower yields, providing liquidity when needed. Binance supports deposits of approximately 300 cryptocurrencies, and users can earn an Annual Percentage Rate (APR) of up to 52.9%.

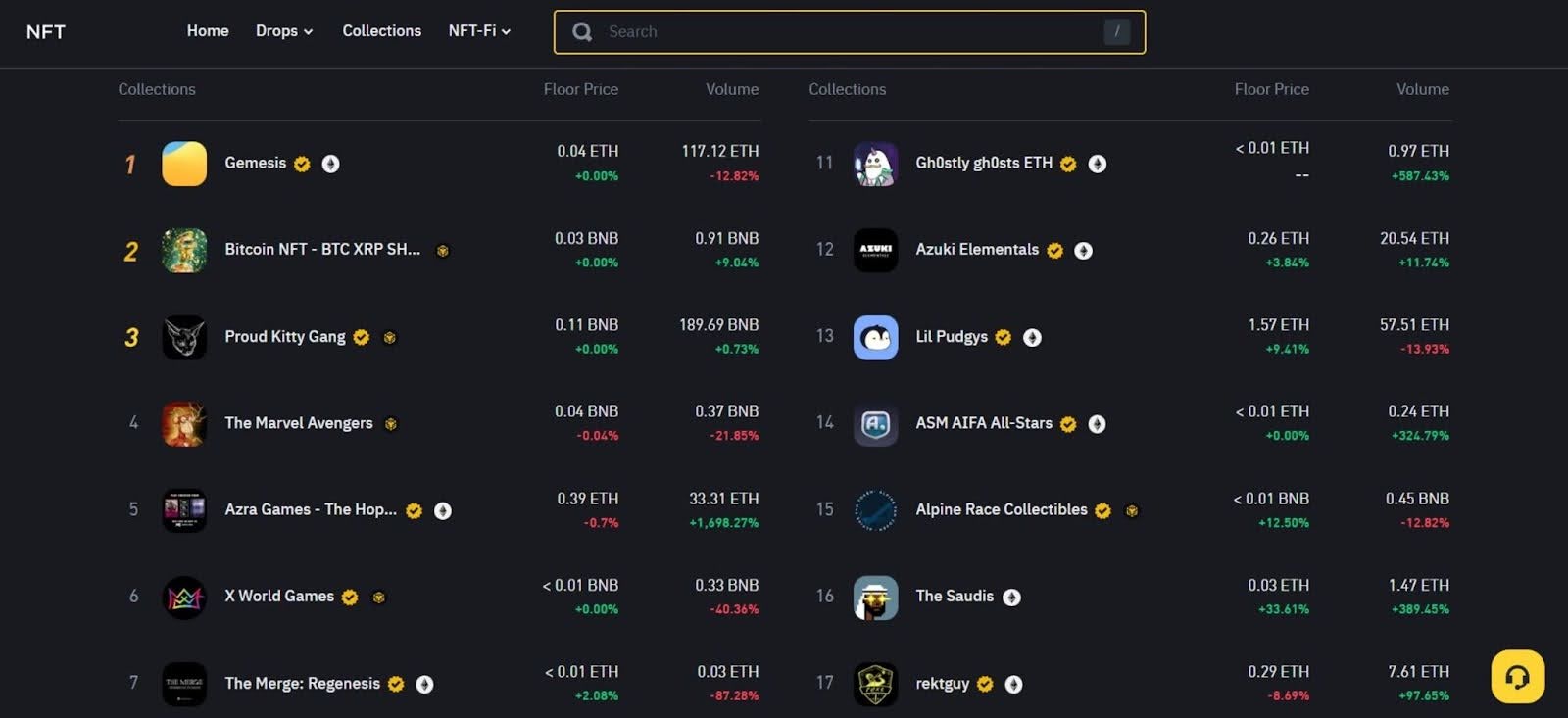

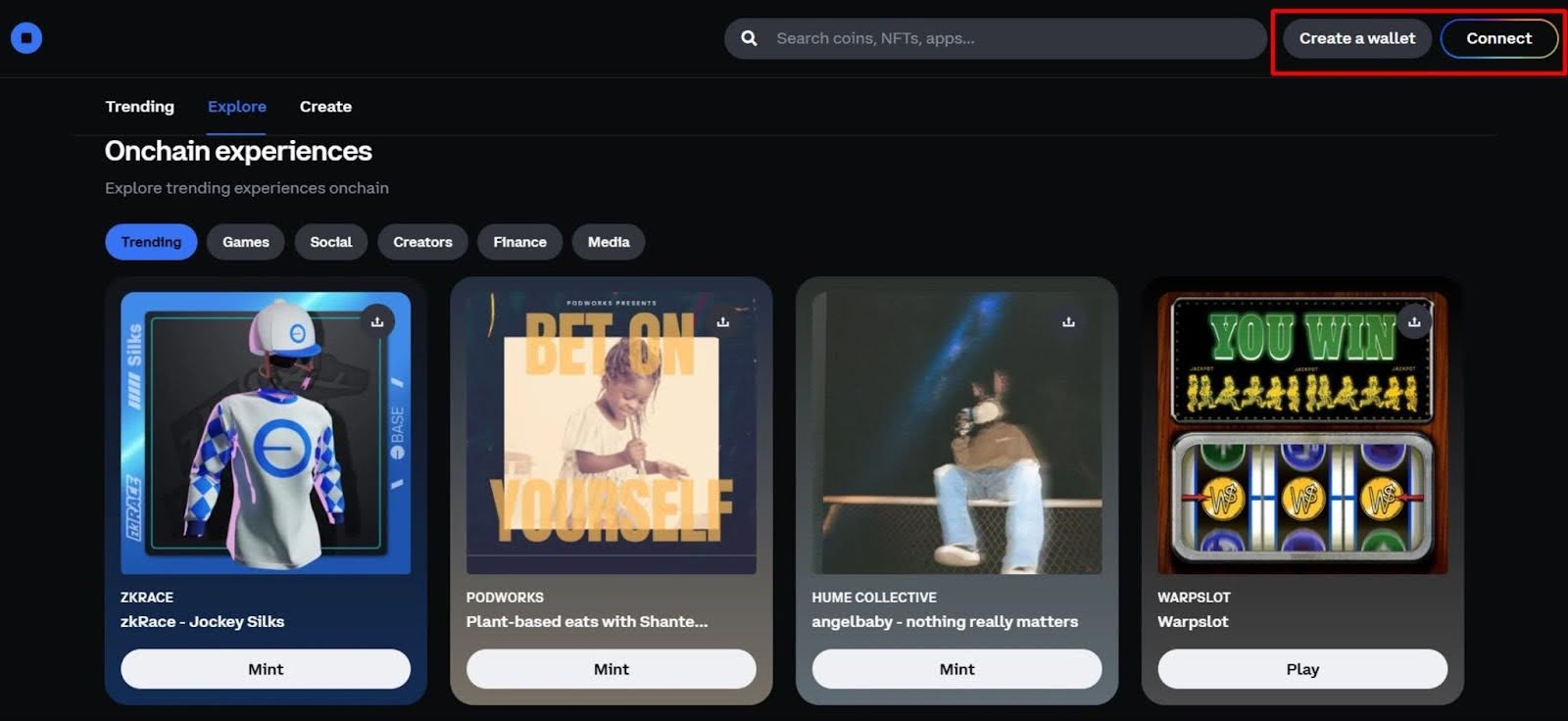

- NFT Marketplace

Binance also provides access to an NFT Marketplace, which connects creators, collectors, and traders in a digital art and collectibles environment. The marketplace supports the minting, buying, and selling of NFTs across a wide range of categories, including gaming, art, and music.

What sets Binance’s NFT platform apart is its integration with the broader Binance ecosystem, offering better liquidity, lower fees, and easier onboarding for both creators and buyers. Plus, the NFT marketplace offers occasional exclusive drops and events with celebrities or major brands as an incentive.

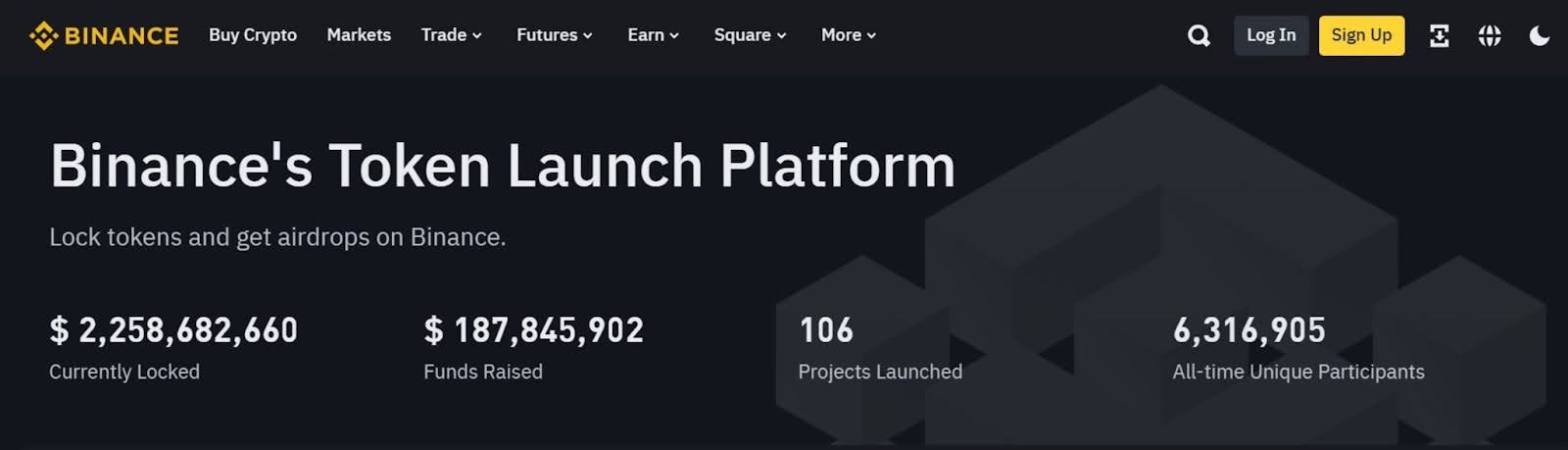

- Binance Launchpad and Binance Launchpool

Binance Launchpad and Launchpool allow users to participate in new project launches and earn rewards early. Binance Launchpad offers access to token sales (also known as Initial Exchange Offerings or IEOs), where users can buy promising new tokens before they hit the market.

Binance vets these projects for quality and potential. Meanwhile, Launchpool lets users stake BNB or other assets to farm new tokens for free over a set period, incentivizing long-term engagement and helping new projects gain traction quickly.

The best features of Coinbase are explained below:

- Coinbase Advanced Trade

Advanced Trade gives users a more advanced trading experience within the main Coinbase app. Advanced Trade offers charting tools powered by TradingView, deep liquidity, access to limit and stop orders, and lower fees for spot and derivative trading compared to the basic buy/sell interface.

The Coinbase Advanced Trade interface features are designed for users who want more control over their trades without needing to leave the Coinbase ecosystem. For seasoned traders, it brings in many of the capabilities found on more technical exchanges, but with Coinbase’s focus on security and ease of use.

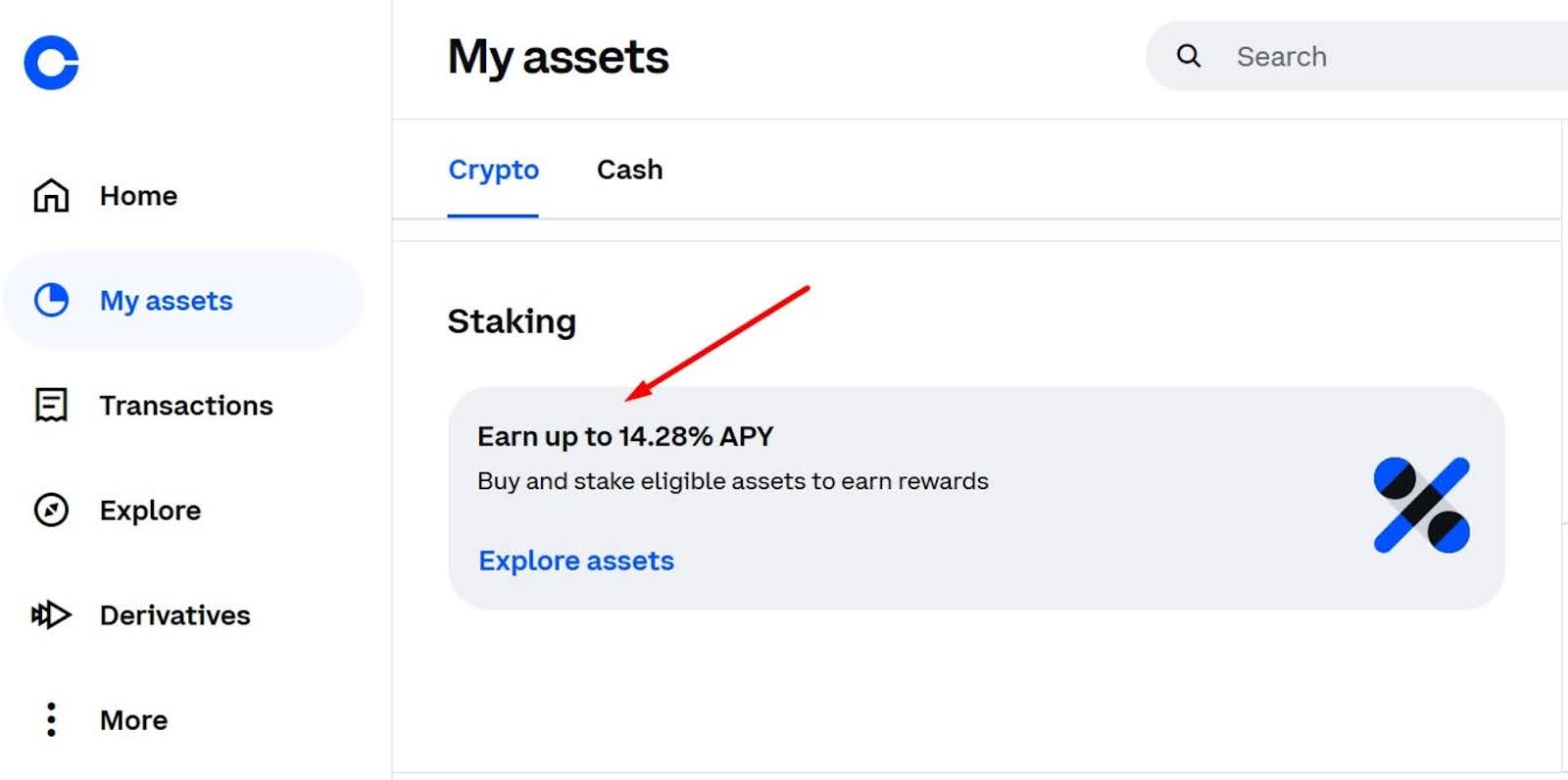

- Coinbase Earn

Coinbase Earn is another standout feature, particularly for users seeking to earn passive income by staking their crypto holdings. Traders can earn up to 14% APY on crypto assets and up to 10% on fiat currencies. In addition to staking, Coinbase offers a Learn and Earn program that helps new users earn monetary rewards by watching educational videos and completing a short quiz or task.

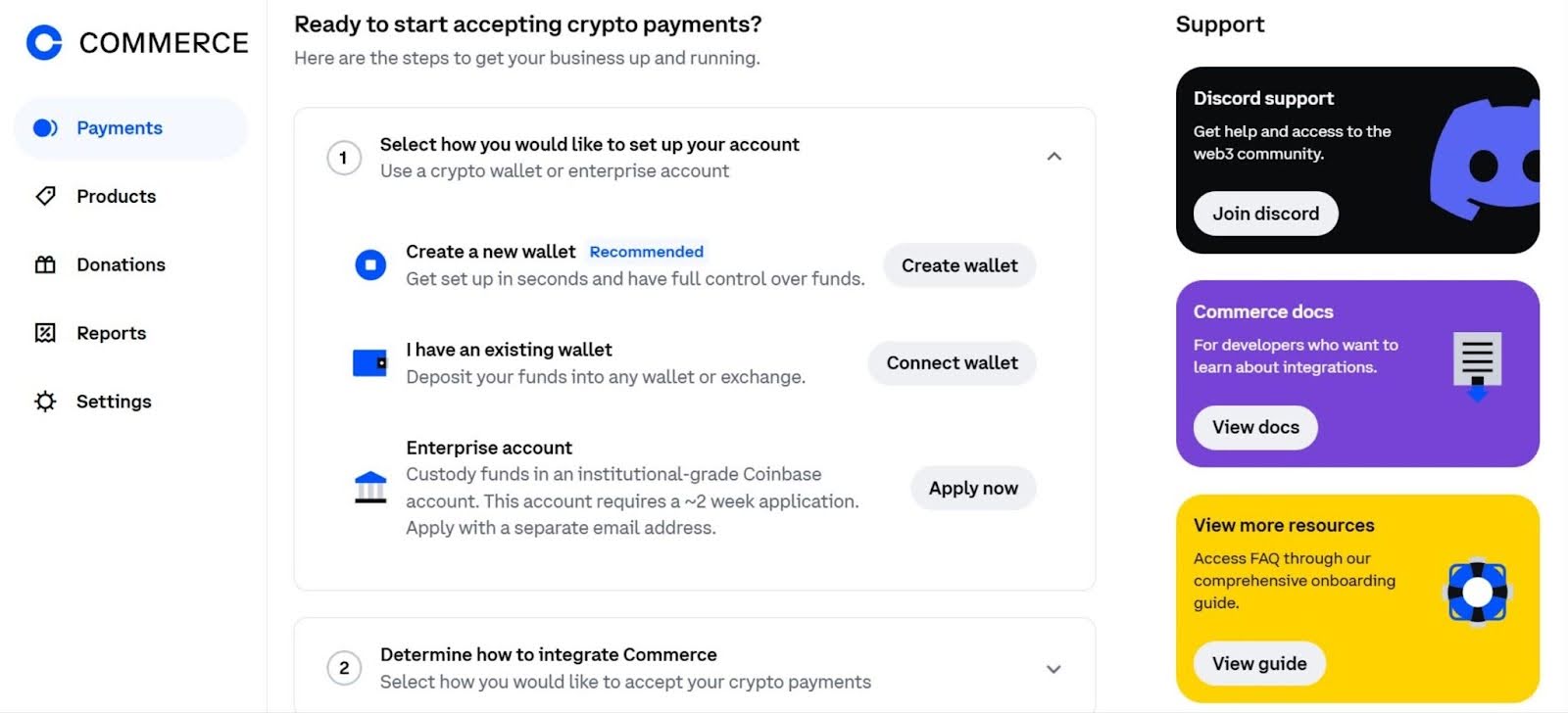

- Coinbase Commerce

Coinbase Commerce enables merchants and businesses to accept payments from anywhere in the world using the supported cryptocurrency of their choice. For easier payments, Coinbase Commerce integrates with popular e-commerce platforms, such as Shopify and WooCommerce. Your checkout workflow can be added as a payment option on these shopping portals.

- Coinbase Wallet

Coinbase Wallet is a self-custody crypto wallet that gives you complete control over your private keys and cryptocurrencies, storing them directly on your device. Unlike Binance Wallet, it is a standalone digital wallet that supports thousands of tokens across major blockchains, including Bitcoin, Ethereum, Solana, and numerous Ethereum-compatible networks, as well as NFTS on Ethereum and Polygon.

What are the Security and Regulation Levels of Binance vs. Coinbase?

The security and regulation level of Binance vs. Coinbase are different due to the measures they implement and the countries they operate in. For regulation, Coinbase is highly regulated, especially in the United States, where it is publicly listed and complies with the SEC, FinCEN, and KYC/AML, as well as other local financial laws.

On the other hand, Binance is not as regulated as Coinbase; in fact, the exchange has faced regulatory challenges that led to the establishment of Binance.US, a more US law-compliant version. Aside from the US, it operates in many countries but has also faced regulatory scrutiny in several jurisdictions, including the UK and the EU.

Moving on, here is a breakdown of the security features Binance and Coinbase use to keep user assets and data safe. Binance uses:

- Multi-Layered Security: Binance employs a comprehensive, multi-layered security framework that includes cold storage for the majority of customer funds, real-time monitoring of account activities, advanced data encryption, and organizational protocols like multi-signature and threshold signature schemes.

- User Account Protections: The platform also encourages users to activate robust authentication options, such as two-factor authentication (2FA) and hardware keys, as well as IP whitelisting and withdrawal address whitelisting, to add additional protection on their end.

- SAFU Funds: Binance maintains a Secure Asset Fund for Users (SAFU) to compensate users in the event of a breach. According to records, following a major hack in 2019, Binance compensated affected users and has since enhanced its security posture, ensuring that no major breaches have been reported since.

Open a new Binance account today to receive lower fees and a $100 trading fee credit.

Meanwhile, Coinbase uses:

- Security Infrastructure: Coinbase is recognized for its robust security measures, including cold storage for the majority of customer funds, insurance coverage for digital assets held online, and regular security audits. The platform also offers a Vault for long-term holders who can lock their funds in a vault that requires multi-email approval for withdrawals.

- User Account Protections: Like Binance, Coinbase also offers its users two-factor authentication, biometric logins, withdrawal whitelists, and encrypted data storage.

- Regular Audits by Regulators: As a regulated US financial institution, Coinbase’s security protocols are subject to regular scrutiny by regulators, which enforces a high baseline for operational security.

Sign up on Coinbase to earn the $200 BTC new user incentive and access additional unique prizes for finishing straightforward activities.

What is the Customer Support of Binance vs. Coinbase?

When it comes to the customer support of Binance vs Coinbase, both exchanges provide various options for users to find help and answers to their queries. However, when comparing Binance and Coinbase customer support, we found that the experiences and customer reviews were mixed, indicating that both platforms face challenges in meeting user expectations.

Binance provides customer support through multiple channels, including 24/7 live chat, email, and social media platforms. One advantage of Binance’s support system is its multilingual capabilities, offering assistance in languages such as English, Chinese, Korean, and Japanese.

Despite these advantages, some Binance customers complain of slow response times, with some users reporting waiting periods that extend to weeks before receiving meaningful help.

Coinbase, on the other hand, offers customer support through phone, email, and live chat channels, with 24/7 phone support primarily available to customers in the United States. This phone support is a significant benefit for users who prefer direct verbal communication, especially in urgent situations.

Coinbase also features a comprehensive FAQ and support centre, designed to help both new and existing users troubleshoot common issues independently. However, despite these resources, Coinbase’s customer support has also faced criticism. Users often report that replies are too generic or unhelpful, and there have been complaints about account freezes and difficulties in resolving disputes.

Binance or Coinbase: Which One is Suitable for You?

To decide which exchange is suitable for you between Binance and Coinbase, you must first know your trading goals. Both are popular crypto exchanges, but they serve different needs. For instance, if you are looking for advanced features, Coinbase won’t be suitable for you. So, here is a quick guide to help you decide which one suits you best.

Binance is best for traders looking for:

- Advanced Trading Tools: Binance offers a comprehensive suite of trading options, including peer-to-peer (P2P) trading, spot trading, margin trading, and derivatives trading with up to 125x leverage. It also integrates TradingView and provides a wide range of order types.

- Lower Fees: Binance fees are significantly lower (as low as 0.10%), which can make a big difference for active traders. High-volume traders and those who pay their fees with BNB can also get up to a 25% discount on fees. This competitive fee structure makes Binance one of the best exchanges for zero-fee Bitcoin trading.

- Extensive Coin Selection: Binance lists over 350 cryptocurrencies, surpassing the number supported by Coinbase. Binance’s crypto selection includes popular coins, stablecoins, and numerous new coins, making it an attractive option for those interested in altcoins and early-stage projects.

- Staking and Earning: Binance offers higher staking rewards and supports a wider range of staking options than Coinbase. The platform also offers more opportunities for traders to earn passive income, including Simple Earn (ETH and SOL staking), crypto loans, and Advanced Earn (dual investment and on-chain yields).

- Global Reach: Binance is accessible in over 150 countries outside the US and offers multilingual support in 40 languages, making it a strong choice for global users.

So, if you don’t mind the complex interface and advanced features on Binance, then it will be the ideal exchange for you, as it offers higher liquidity than Coinbase, which is beneficial for crypto traders.

You can also customize your trade to match your goals, and these are only some of the products available on the Binance crypto exchange. Read this comprehensive Binance review to learn more about the other products and services available to Binance users.

Coinbase is best for traders who value:

- User Experience: Coinbase offers a user-friendly platform and guided onboarding process, making it ideal for newcomers to crypto. The platform is designed to be simple and easy to navigate, reducing the learning curve for first-time users.

- Regulatory Compliance: As a publicly traded US company, Coinbase adheres to strict crypto laws, providing users with peace of mind regarding legal protections and transparency. This strong compliance also makes it the best option for US traders, although it may not be suitable for users outside the country due to certain regulatory restrictions.

- Strong Security Features: Coinbase holds 98% of customer funds in cold storage and uses robust security measures, including multi-party computation (MPC) and insurance for digital assets.

- Customer Support: Offers phone, email, and chat support, with the option to request a call in emergencies. Coinbase also offers comprehensive educational materials that teach users crypto concepts and guide them on how to use the platform.

While Coinbase supports fewer cryptocurrencies and generally charges higher fees than Binance, this won’t be a significant issue for users who want to trade popular crypto assets or for small-volume traders.

If you are a US resident, a small volume trader, or you don’t mind paying high fees for user-friendliness and security, you can learn more about Coinbase’s features and pros and cons in this Coinbase review. To compensate for the high Coinbase fees, you can use this Coinbase referral code to open an account and get $200 worth of BTC in sign-up rewards.

Register on Coinbase to receive the $200 BTC new user reward and get other exclusive bonuses for completing simple tasks.

Is Binance Safe?

Yes, Binance is safe. Binance uses strong security measures, including advanced encryption and cold wallet storage, to protect users’ funds and data. The platform encourages users to activate Two Factor Authentication and withdrawal address whitelisting to add double protection and ensure that withdrawals are restricted to only pre-approved addresses.

As discussed earlier, Binance offers a comprehensive user interface for both crypto traders, NFT traders, and those who are looking to explore the Web3 ecosystem. Since the Web3 interface differs from the exchange, Binance utilizes MPC (Multi-Party Computation) technology to secure users’ wallets.

Is Binance Better Than Coinbase?

Binance may be better suited for experienced traders who require comprehensive tools to manage their trading portfolios. This is because the exchange offers more advanced trading features, including margin and futures trading, with up to 125x leverage.

Binance offers higher staking returns and more staking options, an NFT marketplace, and support for over 350 crypto assets. In addition to these features, Binance is also an excellent option for frequent users and crypto day traders due to lower fees (around 0.1% spot fees vs. up to 0.6% on Coinbase).

On the other hand, Coinbase will be a better fit if you are a beginner who needs a platform that is easy to use, supports a wide range of cryptocurrencies, and offers basic and advanced trading features. Additionally, if you are in the US, Coinbase is a more suitable option due to its strong regulatory compliance and nationwide availability across all US states.

Do Coinbase and Binance Charge Fees?

Yes, Coinbase and Binance charge fees. Both trading platforms charge users for spot and futures trading using a tiered fee structure where traders with higher 30-day trading volume pay lower fees. Cryptocurrency deposits on the two exchanges are usually free, but fiat deposits and withdrawals incur fees depending on the method you use.

Transaction fees on crypto exchanges could pile up and take a significant portion of your profits if you were a frequent trader. Therefore, Binance offers users who register with a Binance referral code a 20% discount on fees in addition to the existing tier structure.

Open a new account on Binance now to enjoy discounted fees and get a $100 trading fee credit.

Who Has More Volume, Binance or Coinbase?

Binance has more volume than Coinbase. It is popularly known as the largest crypto exchange by trading volume, with an average of $76 billion at the time of writing. On the flip side, Coinbase’s volume at the time of writing was about $2.3 billion.

Can US Citizens Use Binance?

No, US citizens cannot use the Binance global platform. They can only use Binance.US, a version of the platform that is compliant with US regulations. Binance US customers can buy, sell, and hold any of the 100+ supported cryptocurrencies through this platform.

The post Binance vs. Coinbase Comparison in 2025: Fees, Safety, and Security appeared first on CryptoNinjas.