Whales Selling, Retail Buying: Is Bitcoin Price at $109k on Crossroads?

The post Whales Selling, Retail Buying: Is Bitcoin Price at $109k on Crossroads? appeared first on Coinpedia Fintech News

Bitcoin has made it to the center stage of the crypto market again, not just for its price hovering around the all-time high, but also for the strategic moves happening behind the scenes. Strategy recently purchased 4,020 BTC at an estimated cost of $427 million, fueling speculation about a potential leg up. However, the market seems divided by views. While price holds above $109k, investors are now eyeing the on-chain trends, liquidation data, and whale moves for clues on the next move.

Smart Money vs. Retail Money?

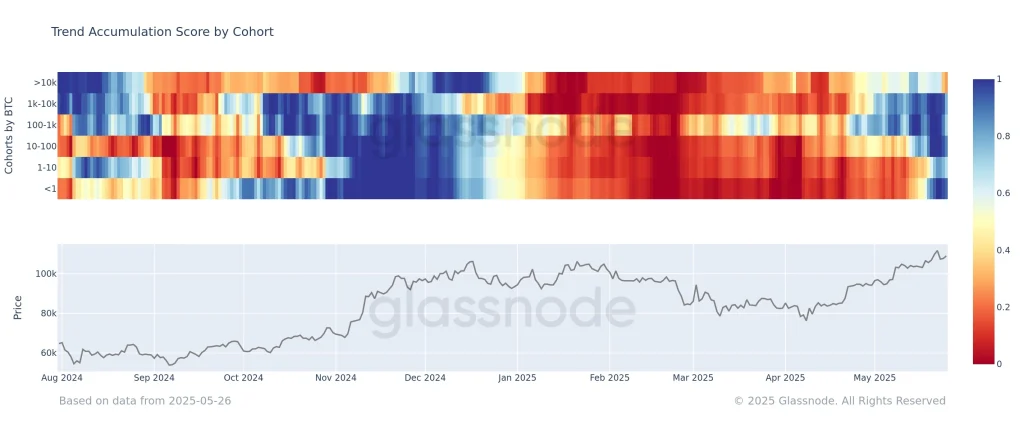

Recent insights from Glassnode reveal a crucial shift, where the greater than 10k BTC cohort (the market’s largest players) have moved into a net distribution zone with a score around 0.3. This is an obvious reversal from earlier in the year, when whales were leading accumulation during price rallies.

Other cohorts like the 1k to 10k holders and the 100 to 1k BTC holders are also slowing down. While wallets with 10 to 100 BTC and sub-1 BTC continue their shopping spree. Further suggesting that leadership is moving downward on the wallet-size curve. This implies that the retail is buying the dip, while whales may be booking profits or analysing an incoming volatility.

What Does the Liquidation Heat Map Say?

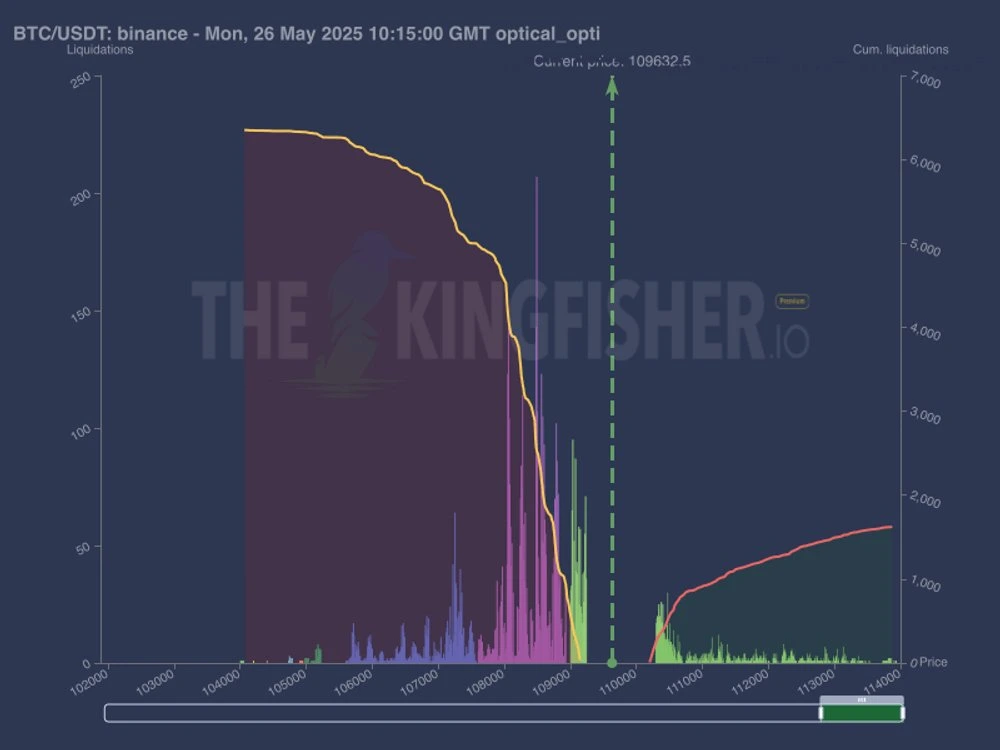

The liquidation map by Kingfisher gives another layer of insight. With Bitcoin currently priced around $109k, there’s a significant buildup of long liquidation just below the $109k, $108.5k, and $107k mark. This indicates a potential liquidity grab to the downside that could be in the works, which could be driven by leveraged long positions at a risk of being wiped out.

It is to note that, above the present BTC price, short liquidation levels seem to be weak, indicating less momentum for an upward squeeze. Correlating this with the distribution by large holders paints a picture where short-term downside volatility is not just possible, but is statistically favored. However, it is worth citing that such moves often reset leverage and provide stronger bases for continuation.

Bitcoin (BTC) Price Analysis:

Bitcoin price today is down 0.40% at $109,222.37, but still holding a 3.37% gain over the past week. The market cap sits at $2.17 trillion, slightly lower day-over-day, while 24-hour trading volume surged to $50.45 billion. The price ranged between $107,609.56 and $110,376.88, showing short-term volatility. We can expect a pullback before the next ATH, which could be around $113k.

If you are a hodler, you need to read our Bitcoin (BTC) price prediction 2025, 2026-2030 NOW!

FAQs

The Bitcoin price today is down a negligible 0.40% to $109,222.37, however, the trading volume is up 5.77% with an inflow of $50.45 billion.

The key levels to watch are $107k–$109k, if BTC dips here, strong reactions could occur from liquidation-driven volatility.