Bitcoin Price Analysis: May Rally and Lark Davis’s Take on Market Top Signals

The post Bitcoin Price Analysis: May Rally and Lark Davis’s Take on Market Top Signals appeared first on Coinpedia Fintech News

Bitcoin continues to capture investor attention as it navigates a critical phase in its price cycle. Entrepreneur and well-known Crypto Analyst Lark Davis recently shared his perspective on whether the market is nearing its peak or still has room to run.

Bitcoin’s May Performance and Current Price Overview

Starting May at approximately $94,146, Bitcoin’s price surged impressively throughout the month. By May 22, the cryptocurrency reached a new high near $111,970, marking an 18.66% increase within just three weeks. Although the market experienced a slight correction of about 3.9% on May 23, bullish momentum quickly resumed, pushing the price back up by over 1.5% the following day.

As of now, Bitcoin’s price stands at around $108,789—roughly 2.8% below its all-time high. This steady price action reflects ongoing investor interest and a cautiously optimistic market sentiment.

Insights from Lark Davis on Market Top Signals

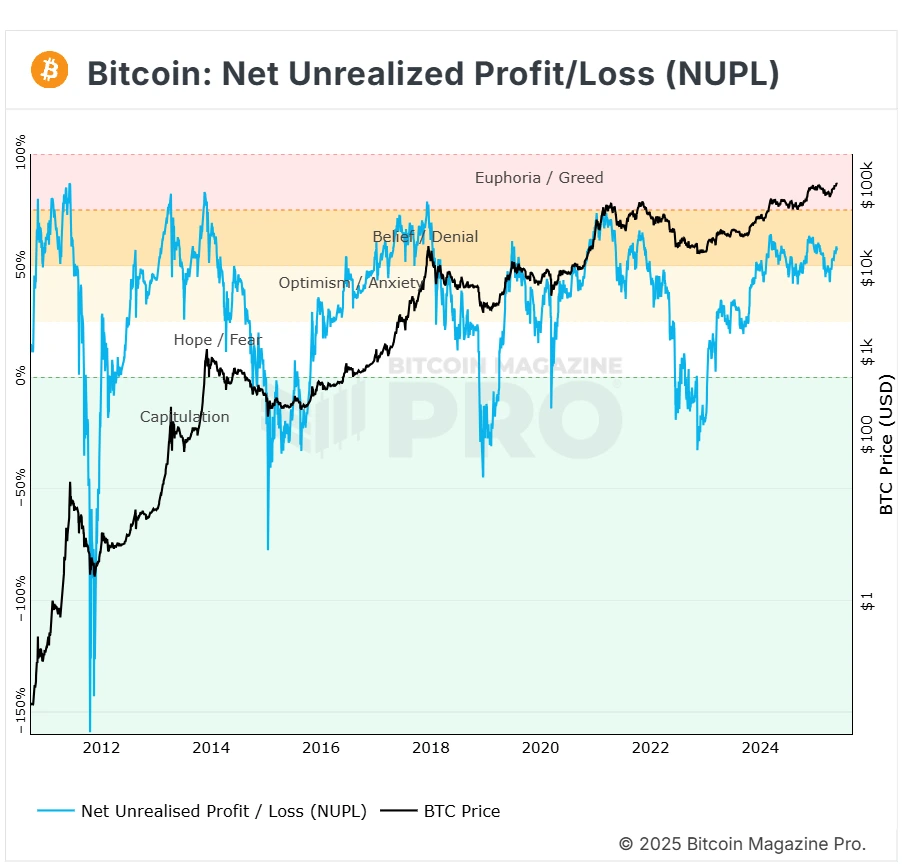

In a recent post on X (formerly Twitter), Lark Davis challenged the common narrative that Bitcoin’s rally is at its end. He referenced the Net Realised Profit and Loss (NPL) indicator to support his view that the market still holds significant upside potential.

The NPL indicator tracks the average paper profit across Bitcoin holders. When the value is strongly positive, it often signals that many investors have realized profits, sometimes preceding market corrections. However, Davis noted that this indicator is not currently at peak levels, suggesting that widespread profit-taking has yet to occur.

This analysis implies that while Bitcoin has rallied significantly, many holders are still in profit but have not rushed to sell, a condition that can support further price appreciation.

Understanding the Net Unrealised Profit/Loss Indicator

To clarify, the Net Unrealised Profit/Loss (NUPL) metric measures how much profit or loss investors hold on paper without having sold. A positive reading indicates collective profitability among holders, while a negative value points to unrealized losses.

On May 5, the NUPL was at 52.78%. When Bitcoin reached its peak price recently, the indicator rose to approximately 58.7%. These values, though elevated, have not yet reached extreme levels historically associated with market tops. This aligns with Davis’s view that the rally may still have room to grow before a potential correction.

Balanced Perspective and Market Caution

While Lark Davis provides an optimistic take, it is important for investors to maintain a balanced perspective. Cryptocurrency markets remain volatile and subject to rapid changes based on external factors such as regulatory developments, macroeconomic conditions, and broader market sentiment.

Monitoring key technical indicators like the NPL and NUPL, alongside fundamental factors, can offer valuable insights for making informed investment decisions.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The NPL indicator tracks overall profit realized by Bitcoin holders; high positive values often signal potential market corrections.

NUPL indicates collective paper profits/losses. Bitcoin’s NUPL is elevated but not at historical extreme levels for a market top.

Bitcoin is highly volatile. While current sentiment is cautiously optimistic, invest only what you can afford to lose and consider long-term goals.

Bitcoin could reach $200,000 by year-end 2025, driven by ETF inflows and supply tightening, though predictions vary. Sources