Crypto mining stocks plunge as Fed warns of ‘difficult tradeoffs’

US crypto mining stocks tumbled at the close of May 28 trading after minutes published by the Federal Reserve signaled its growing uncertainty about the country’s economic outlook.

The crypto market remained unscathed, despite the stock drops among crypto miners.

Uncertainty about the economic outlook looms

The minutes of the Federal Open Market Committee’s meeting on May 6 and 7, released on May 28, stated, “the Committee might face difficult tradeoffs if inflation proves to be more persistent while the outlooks for growth and employment weaken.”

The Fed had decided after its meetings in early May to keep interest rates steady at 4.25% to 4.50%, with the minutes revealing the reason was due to “a further increase in uncertainty about the economic outlook and a rise in the risks of both higher unemployment and higher inflation.”

Riot Platforms (RIOT) closed the May 28 trading day down 8.32%, CleanSpark (CLSK) tumbled 7.61%, and Mara Holdings closed down 9.61%, according to Google Finance data.

Meanwhile, crypto exchange Coinbase (COIN) also dropped 4.55%, Michael Saylor’s Bitcoin-buying firm MicroStrategy (MSTR) extended its five-day downtrend, falling another 2.14% following a class-action lawsuit being filed, accusing the company’s officials of having failed to represent the nature of Bitcoin (BTC) investments accurately.

The S&P 500 declined 0.56% over the trading day.

Tension between Trump and the Fed

It comes after recent tension between US President Donald Trump and the Federal Reserve, following Trump’s public criticism of the Fed Chair Jerome Powell for not cutting interest rates quickly enough. On April 17, Trump said, “Powell’s termination cannot come fast enough!”

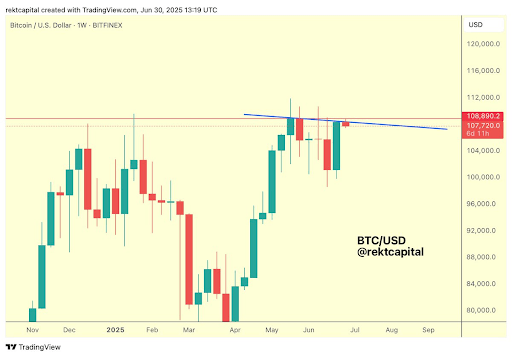

Related: Bitcoin sags below $108K as rate-cut bets evaporate before Fed minutes

The crypto market remained relatively stable over the same period. Bitcoin is down 0.90% over the past 24 hours, trading at $107,942 at the time of publication.

Market sentiment also improved, with the Crypto Fear & Greed Index climbing three points to 74, moving further into “Greed” territory.

The next Federal Reserve interest rate decision is set for June 18, with 97.8% of market participants expecting rates to remain unchanged, according to the CME FedWatch Tool.

Magazine: Move to Portugal to become a crypto digital nomad — Everybody else is

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.