SEC Drops Case Against Binance: Crypto Rebounds as BNB Eyes Massive Triple-Digit Rally

Key Takeaways:

- The SEC throws out a high-profile lawsuit against Binance with prejudice, which shows a big change in how the current administration handles regulation.

- Binance celebrates the legal victory, calling it a “huge win for crypto” and crediting Chairman Paul Atkins and Trump-era allies for policy reversal.

- BNB is predicted to rise quickly as analysts foresee a rally toward a new all-time high. There is also growing speculation that it could break $1,000 if the momentum stays strong.

The U.S. Securities and Exchange Commission (SEC) has officially abandoned its case against Binance. This is a big win for the global crypto industry in both legal and symbolic terms. This choice has already led to talk of a market-wide comeback and a revived positive mood for Binance’s native coin, BNB.

SEC’s Sudden Dismissal Signals Policy Reversal

The SEC has dropped its civil complaint against Binance “with prejudice,” which means that the issue is over and done with. It had been a big deal in the crypto sector since mid-2023. This legal language is very important because it makes sure the case can’t be reopened later.

The U.S. government is revising how it controls digital assets right now, so this news is timely. Paul Atkins, who is well-known for being pro-crypto, is now a high-ranking official at the SEC. This shows that the agency is shifting away from what detractors called “regulation by enforcement.”

People think that Atkins’ support for the Trump administration’s crypto-friendly policy is quite important. The SEC is moving away from the harsh crackdowns that were common during the Gary Gensler period under this new direction. Instead, the present government seems more interested in helping U.S. blockchain innovation, which it now sees as strategically crucial for keeping the U.S. competitive in finance.

Binance publicly acknowledged this reversal in tone, posting on X:

Huge win for crypto today. The SEC’s case against us is dismissed.

Thank you to Chairman Atkins & the Trump team for pushing back against regulation by enforcement. U.S. innovation is back on track – and it’s just the beginning.— Binance (@binance) May 29, 2025

Read More: SEC Pushes Back Decision on Grayscale’s Avalanche and Cardano ETFs

A Look Back: Binance’s Legal Saga with the SEC

Allegations That Shook the Industry

The original lawsuit, filed in June 2023, accused Binance of several serious violations:

- Artificial inflation of trading volumes

- Misrepresentation to investors

- Improper handling of client funds

- Sale of unregistered securities

The complaint named Changpeng Zhao, or “CZ,” who is the person who started Binance. The SEC filed this action at a time when tensions were growing between U.S. regulators and the crypto industry. It was one of the SEC’s most well-known actions to enforce the law.

Binance is relieved that these allegations were dropped, and it also means that future litigation like these may have to overcome more obstacles. Critics of the SEC’s previous strategies say the agency blurred the line between fraud and innovation, stifling legitimate blockchain projects.

With this lawsuit now closed permanently, Binance is positioned to rebuild its reputation—and possibly expand more aggressively in the U.S. market, which it had partially retreated from during the height of the legal pressure.

Read More: SEC Uncovers $110M Crypto Scandal: Unicoin’s ‘Asset-Backed’ Claims Fall Apart

BNB Price Outlook: All Eyes on $1,000

There has been a general cooling off of the cryptocurrency market in recent days. After reaching a recent high of $111,814, Bitcoin’s value dropped to around $105,000. This has tempered immediate gains for BNB, despite the positive legal news. Analysts, on the other hand, are still positive about the token’s medium-term future.

By August 12, BNB is expected to rise to $857.04, which would be a new all-time high. This goal has sparked new rumors that BNB could finally break beyond the $1,000 mark, a psychological barrier that would put it in the top tier of mega-cap cryptocurrencies.

Several factors could drive this rally:

- Legal clarity: With the SEC lawsuit now resolved, investor confidence is likely to return.

- Reduced regulatory risk: The new U.S. regulatory tone may benefit Binance and other large crypto players.

- BNB’s utility: The token is still very important to Binance’s ecosystem. It is utilized for trading fee discounts, launching new tokens, and DeFi features.

Michaël van de Poppe, a crypto analyst, said, “BNB has been fundamentally undervalued compared to its dominance in trading volume and infrastructure.”. With the lawsuit no longer an overhang, the token could finally reflect that value.”

How the Binance Ruling Could Reshape Crypto in the U.S

If this shift continues, it might signal a new direction in U.S. cryptocurrency regulation. With the current leadership, the SEC might take a more helpful, guidance-based approach and prefer working together over suing.

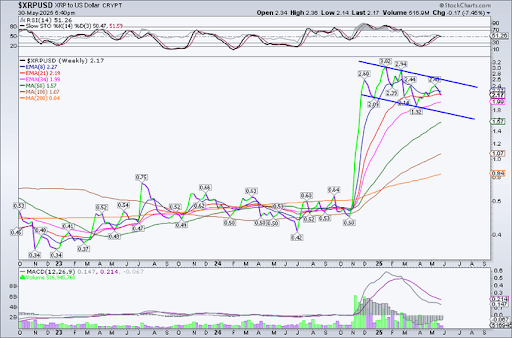

This is a big change from the years 2021 to 2023, when Ripple (XRP), Coinbase, and Uniswap Labs all had to deal with legal threats. For instance, the Ripple case took years to settle and was only partially settled in 2023.

The SEC’s decision to drop the Binance case is not only a sign of peace, but it might also be the start of new laws or executive acts that could finally make things clearer for regulators.

The post SEC Drops Case Against Binance: Crypto Rebounds as BNB Eyes Massive Triple-Digit Rally appeared first on CryptoNinjas.