Blockchain Group wins approval for $11B raise to execute aggressive Bitcoin acquisitions

The Blockchain Group on June 10 won shareholder approval to raise more than €10 billion ($11 billion) for additional Bitcoin (BTC) purchases effective immediately, formalizing a proposal first aired one day earlier.

During an ordinary and extraordinary general meeting, investors holding 39% of voting rights backed every resolution with support exceeding 95%, according to a statement posted on X.

The delegation grants directors authority to issue equity or other securities and to tap public or private markets without preferential subscription rights when necessary.

CEO Jean-Philippe Casadepax-Soulet said the mandate will “accelerate our Bitcoin Treasury Company strategy” by increasing the number of BTC per share on a fully diluted basis over time.

Furthermore, shareholders also elected Alexandre Laizet to the board and appointed him deputy chief executive, with responsibility for Bitcoin strategy. His six-year term runs through December 2030.

The authorization raises the ceiling far beyond the €300 million at-the-market (ATM) facility the Paris-listed firm announced on June 9 in partnership with asset manager TOBAM.

That structure allows The Blockchain Group to sell new shares in discreet tranches at prevailing market prices, with TOBAM acting as the sole subscriber. If fully executed, TOBAM could acquire up to 39% of the company’s equity.

Shareholder calculus and market context

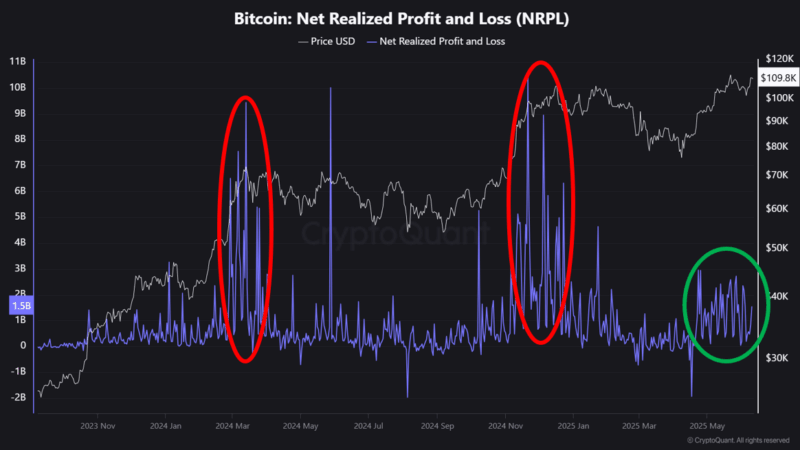

The vote follows a period of subdued volatility for Bitcoin, which trades at $108,937.66 as of press time, close to its all-time high of nearly $112,000.

Corporate appetite for hard asset reserves has outpaced price action. European firms largely avoided large-scale crypto balance sheet moves until this year’s adoption of the Markets in Crypto-Assets (MiCA) regulation, which delineates custody and disclosure standards for digital assets.

Board members told investors the authorization provides flexibility to respond quickly when market conditions present compelling entry points.

The approved instruments include ordinary shares, preferred shares, warrants, and convertible bonds, enabling the treasury team to align funding costs with market demand.

Balance sheet already holds 1,471 BTC

The corporate treasury program commenced in early June, when The Blockchain Group acquired 624 BTC, valued at approximately $69 million, increasing its holdings to 1,471 BTC. The total amount is worth roughly $160 million as of press time.

Management plans to channel proceeds from the expanded authorization into similar acquisitions, positioning the firm as Europe’s most aggressive public buyer of Bitcoin.

Unlike North American peers such as Strategy, The Blockchain Group operates diversified subsidiaries in data intelligence, artificial intelligence consulting, and decentralized technology development.

Executives frame the treasury allocation as an ancillary use of excess capital rather than a full pivot to a single-asset business model.

The post Blockchain Group wins approval for $11B raise to execute aggressive Bitcoin acquisitions appeared first on CryptoSlate.