SEC Roundtable Pumps DeFi Crypto Coins and AAVE Ahead of CPI News: What to Expect?

In a twist few expected, the SEC is warming up to DeFi crypto coins. There’s no PhD needed to make it in this market. Just stop being scared of clicking buttons and start learning decentralized finance.

At a June 9 roundtable titled “DeFi and the American Spirit,” Chairman Paul Atkins didn’t call for crackdowns or stricter oversight. Instead, he talked about liberty, innovation, and the core American idea of owning your own financial future.

The effect was immediate: Ethereum jumped, DeFi tokens rallied, and we might be looking at the first DeFi summer in five years.

A Call for Innovation Exemptions Among DeFi Crypto Coins

DeFi, put simply, is lateral distribution of surveillance. The financial cage in DeFi is digital and transparent, etched into the blockchain for computing eternity. Every node a watcher, every node a signal.

For the first time in years, a top U.S. regulator is talking about cutting DeFi builders some slack. Chairman Atkins proposed offering “conditional exemptive relief” to projects navigating the gray zones of crypto law.

“Many entrepreneurs are developing software applications that are designed to function without administration by any operator,” Atkins stated.

SEC Chair Paul Atkins announces that DeFi platforms will be exempt from regulatory restrictions.

He’s also stated that “The right to have self custody of one’s private property is a foundational American value that should not disappear when one logs on to the internet.” pic.twitter.com/dN7bSyRea2

— Adrian Dittmann (@AdrianDittmann) June 9, 2025

Atkins also argued against holding engineers accountable merely for writing code that others may use for regulated activities. Instead, he supported self-custody and blockchain’s ability to enable trustless, P2P (peer-to-peer) transactions.

“The right to self-custody one’s private property is a foundational American value,” he stressed.

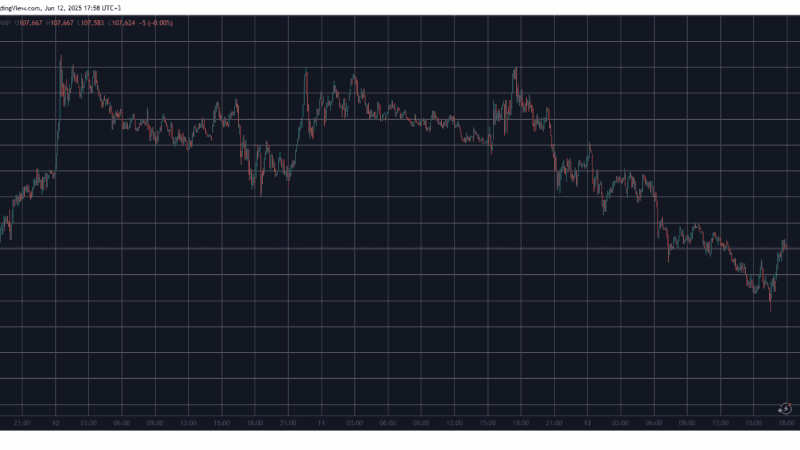

Market Responds to SEC’s Decentralized Focus

The policy shift spurred a wave of positivity across the crypto market. Ethereum, often regarded as the backbone of DeFi, jumped 8% to $2,750. Meanwhile, top DeFi tokens also rallied—with Uniswap (UNI), Aave (AAVE), and SKY soaring 25%, 15%, and 16%, respectively. Experts attribute much of Ethereum’s strong performance to the SEC’s remarks.

Paul Howard, Senior Director at Wincent, commented, “Positive sentiment from the SEC on DeFi has helped lift the market. Ethereum, in particular, has outperformed thanks to its pivotal role in this space.”

Broader market metrics echoed this enthusiasm. According to CoinGecko, the DeFi sector’s market capitalization grew by 10%, hitting $150 billion. Spot ETH ETFs saw net inflows of $53 million, while U.S. spot BTC ETFs attracted $386 million.

Implications for DeFi and Crypto Regulation

The SEC’s latest tone shift is a hard break from the previous regime’s crackdown-heavy posture.

“No one expected the SEC to lean in this far,” said ‘Crypto Is Macro Now’ author Noelle Acheson. “It’s a stark departure from the old guard.”

Still, not everyone’s buying the rebrand. Commissioner Hester Peirce warned that slapping “DeFi” on anything shouldn’t be a get-out-of-jail-free card. She highlighted the need to hold centralized entities accountable while continuing to protect innovators’ rights.

“The SEC must not infringe on First Amendment rights by regulating someone who merely publishes code,” Peirce emphasized.

By easing operational restrictions, the SEC is opening the door for the development of trustless, on-chain ecosystems. If Atkins’ proposed innovation exemptions gain traction, it could further solidify the U.S. as a hub for blockchain and DeFi innovation.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- In a twist few expected, the SEC is warming up to DeFi crypto coins.

- Chairman Atkins proposed offering “conditional exemptive relief” to projects navigating the gray zones of crypto law.

The post SEC Roundtable Pumps DeFi Crypto Coins and AAVE Ahead of CPI News: What to Expect? appeared first on 99Bitcoins.