Top Companies Buying Bitcoin in 2025 – MicroStrategy No Longer Alone

The post Top Companies Buying Bitcoin in 2025 – MicroStrategy No Longer Alone appeared first on Coinpedia Fintech News

A new report from ‘MicroStrategist|BitcoinPower.Law’ uncovers an accelerating global trend: corporations are aggressively accumulating Bitcoin for their treasuries. While MicroStrategy holds a significant lead, smaller, agile firms are rapidly increasing their Bitcoin holdings, signaling a dynamic shift in the corporate crypto landscape.

MicroStrategy’s Dominance: A Double-Edged Sword

MicroStrategy remains the undisputed leader in corporate Bitcoin holdings, boasting a massive 582,000 BTC tokens. This translates to an impressive 2.771% of Bitcoin’s total supply, dwarfing the second-largest holder, Marathon Digital Holdings, which possesses 49,179 BTC (0.234% of total supply).

However, MicroStrategy’s substantial lead comes with heightened expectations. The report suggests that the company’s ability to further expand its Bitcoin reserves hinges on continued access to bond funding.

Bitcoin’s Market Trajectory: What the Numbers Say

Bitcoin is currently trading above its long-term power law trendline, indicating strong upward momentum. Based on the power law model, projected median Bitcoin prices are:

- $336,000 by 2030

- $998,000 by 2035

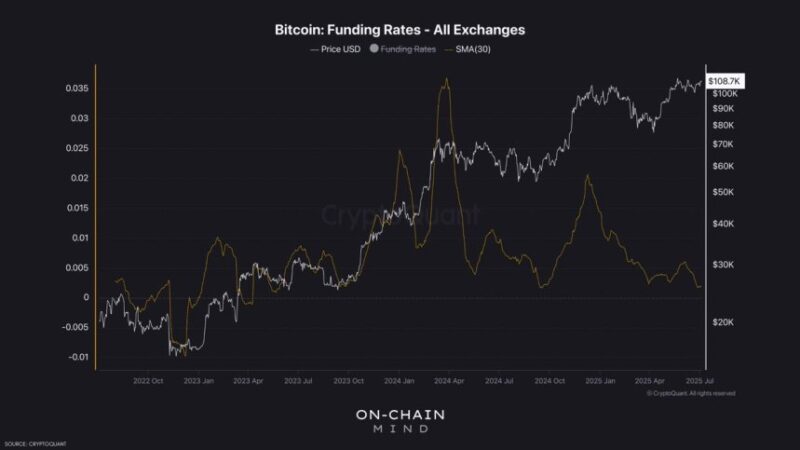

In the past year, Bitcoin’s price has surged by over 61.3%, and in the last 30 days, it has climbed 3.4% to reach $107,036. Despite a pause in the global M2 money supply, the report highlights that Bitcoin typically lags liquidity by 12 weeks, suggesting potential for further growth in the coming months.

The Rise of Agile Accumulators: Smaller Firms Making Big Moves

The report emphasizes that smaller companies are exhibiting the fastest Bitcoin accumulation per share, often seeing their share prices rise in tandem with their increasing “stacking speed.”

Here’s a look at some notable smaller players:

- Semler Scientific: Holds 3,808 BTC tokens and has acquired over 1,424 BTC in 2025 alone. The company’s valuation could see a boost if ongoing legal issues related to its QuantaFlo device (which led to a $29.75 million settlement in principle) are fully resolved.

- ALTBG: Possesses approximately 620 BTC, valued at $66,098,274. The company appears to be fairly valued and is reportedly preparing for substantial Bitcoin acquisitions.

- MetaPlanet: Owns 8,888 BTC, with a value of around $947,550,746. Investors are advised to exercise caution as its price appears overvalued.

- Smarter Web (SWC): Holds around 10.6 BTC, valued at $1,130,067. SWC stands out with a high daily BTC yield of 9.6%, though the report cautions about potential reversals if momentum fades.

Navigating the Risks: High Valuations and Hype Cycles

The analysis warns that companies with high market Net Asset Value (mNAV) and high days to close (DTC) may be overhyped. A slowdown in Bitcoin stacking by these firms could lead to sharp declines in their share prices.

Identifying Smart Bitcoin Stacking Opportunities

The report advises investors to look for companies that balance rapid Bitcoin accumulation with sustainable growth. Key tools for guiding investment decisions include mNAV, DTC, and fair value charts. Crucially, investors are cautioned to avoid companies at their price peaks during hype cycles.