Hyperliquid Review 2025 – Is This Crypto Exchange Safe or a Scam?

| Criteria | How We Rate |

| Stars | 4.5/5  |

| Security | 9/10 |

| Available Cryptocurrencies | 8.5/10 |

| Customer Service | 9/10 |

| User Experience | 8/10 |

| Is it Safe? | Yes |

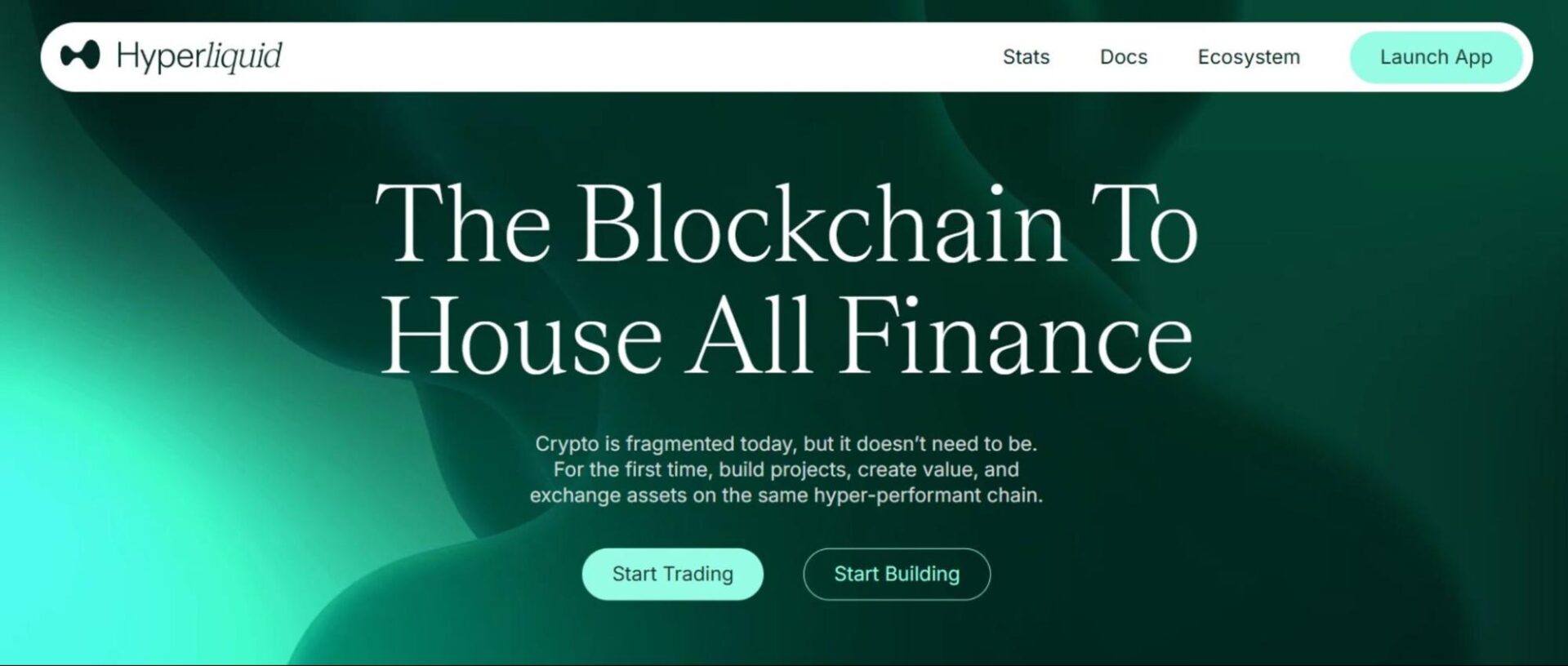

Hyperliquid Exchange is a decentralized exchange (DEX) running on its own high-performance Layer-1 blockchain, HyperEVM. The platform combines the best features of centralized exchanges (CEXs) with decentralization to offer a comprehensive interface for traders to participate in derivatives trading.

Hyperliquid is designed to offer traders low fees and speed processing about 200,000 transactions per second. This rapid transaction processing is made possible by Hyperliquid’s use of HyperBFT, a proprietary consensus algorithm optimized for both speed and security.

Aside from Hyperliquid’s custom consensus algorithm, other features that make Hyperliquid popular among traders include gas-free transactions, a fully on-chain order book, high leverage trading, liquidity vaults, cross-chain compatibility, and pro-level trading tools.

In this Hyperliquid review, we will highlight what Hyperliquid is to get a comprehensive look at the crypto platform. Additionally, we will break down Hyperliquid trading fees and provide a straightforward guide on how to create a new Hyperliquid account to buy crypto and HYPE token. Let’s get started!

What is Hyperliquid? A Comprehensive Look to The Crypto Platform

Hyperliquid is a decentralized exchange built on its own layer 1 blockchain. The crypto trading platform combines the best features of centralized and decentralized exchanges to offer users fast transactions, low trading fees, advanced trading features, and a smooth interface, all without an intermediary, as in centralized exchanges.

The Hyperliquid platform specializes in perpetual futures trading, allowing users to trade crypto derivatives without owning the underlying assets. For developers, Hyperliquid is an Ethereum-compatible smart contract platform (HyperEVM), which enables them to build DeFi applications within its ecosystem.

Additionally, the Hyperliquid protocol has a native cryptocurrency, HYPE. The HYPE token serves as the backbone of the Hyperliquid ecosystem. It plays a key role in governance, staking, and enabling advanced transactions within the HyperEVM.

The table below provides an overview of the Hyperliquid crypto exchange, including its features, founders, and additional details.

| Exchange | Hyperliquid |

| Founded | Originally started in 2020 and launched in 2023. |

| Headquarters | Singapore |

| Founders | Jeff Yan and Iliensinc |

| Best Features | On-chain order book, gas-free trading, high leverage trading, liquidity vaults, cross-chain compatibility, and pro-level trading tools. |

| Supported Cryptocurrencies | 100+ cryptocurrencies |

| Margin Trading | Yes |

| Futures Trading | Yes |

| Leveraged Trading | Yes |

| KYC Requirement | No KYC |

| Order Types | Limit orders, market orders, stop market, stop limit orders, Scale, and TWAP. |

| Gas Fee | Zero gas fees |

| Liquidity Vaults | User-owned vaults and protocol vaults |

| Token Supply | HYPE’s supply is capped at 1 billion tokens. |

| Daily Trading Volume | $13B+ |

About Hyperliquid Crypto Project and Team

Hyperliquid is a DEX designed to combine the speed and user experience of CEXs with the transparency and security of DeFi. The project was co-founded by Jeff Yan and Iliensinc, both Harvard alumni with strong backgrounds in finance and blockchain technology. Jeff Yan has expertise in quantitative trading, while Iliensinc, though pseudonymous, is highly respected for his skills in blockchain infrastructure.

The team also includes members from prestigious institutions, such as Caltech and MIT, as well as professionals from top firms like Citadel and Hudson River Trading. The project prioritizes community, which is reflected in their rejection of venture capital funding, allocating 70% of its tokens to users, and the redistribution of all revenue back to the community.

Start trading on Hyperliquid today and receive a $100 welcome reward to boost your trading capital.

Key Features of Hyperliquid Crypto Exchange

The key features of Hyperliquid crypto exchange are an on-chain order book, gas-free transactions, high leverage trading, liquidity vaults, cross-chain compatibility, and pro-level trading tools.

On-Chain Order Book

Most decentralized exchanges use off-chain order books or automated market makers due to the high throughput required by on-chain order books. However, the platform runs its order book on-chain, providing transparency, security, and speed-optimized transactions through its custom consensus mechanism, HyperBFT, which can confirm up to 200,000 transactions per second using Byzantine Fault Tolerance.

Gas-Free Transactions

Since Hyperliquid operates on its own Layer 1 chain, it controls the entire infrastructure and does not require users to pay gas fees for transactions, unlike Ethereum or other public blockchains. Instead, the platform covers the underlying transaction costs internally and charges users only minimal fees.

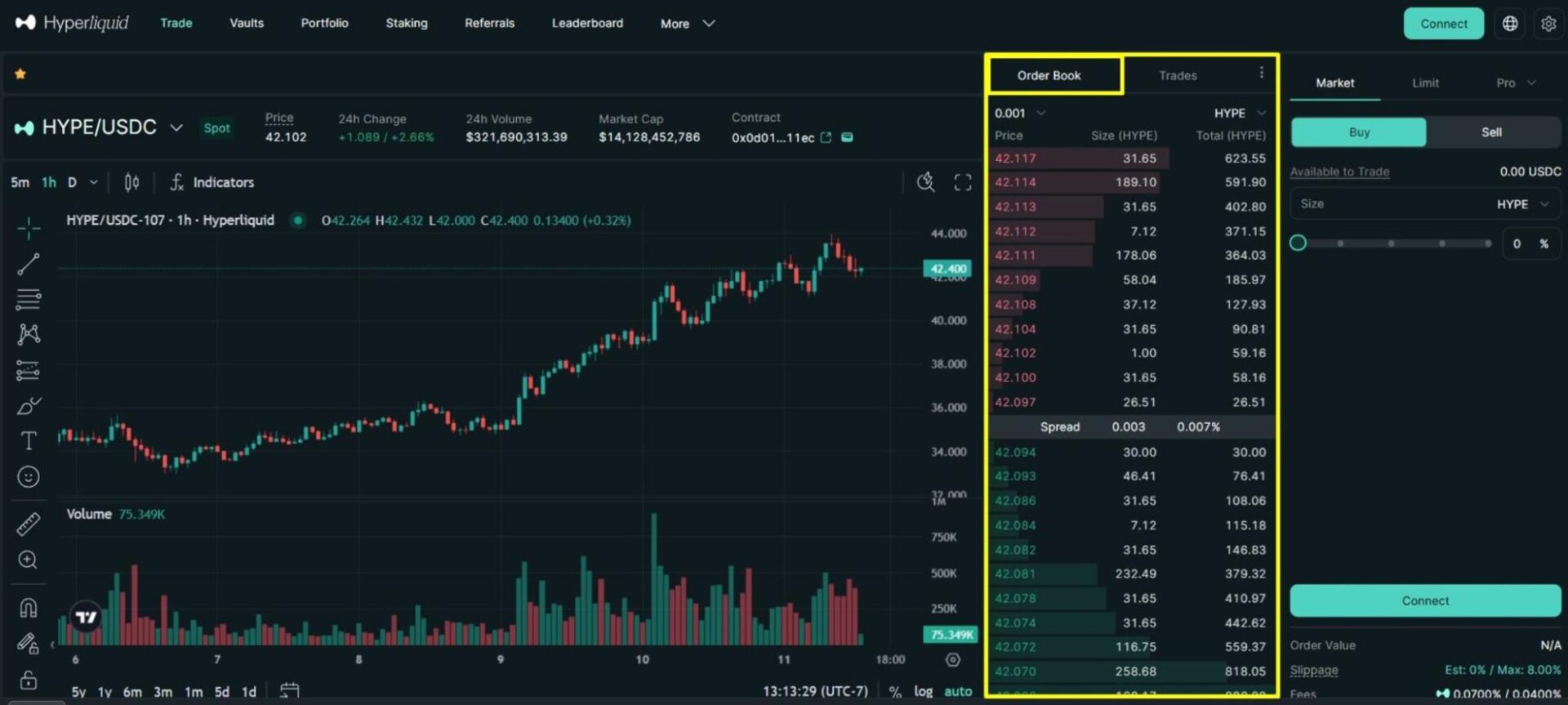

High Leverage Trading

Hyperliquid offers up to 40x leverage on perpetual futures contracts, allowing traders to amplify their positions beyond what their actual trading capital can carry. Due to the high risk associated with leverage trading, this feature is particularly tailored to experienced traders who are familiar with the strategy and want to increase their profit potential from rapid market movements.

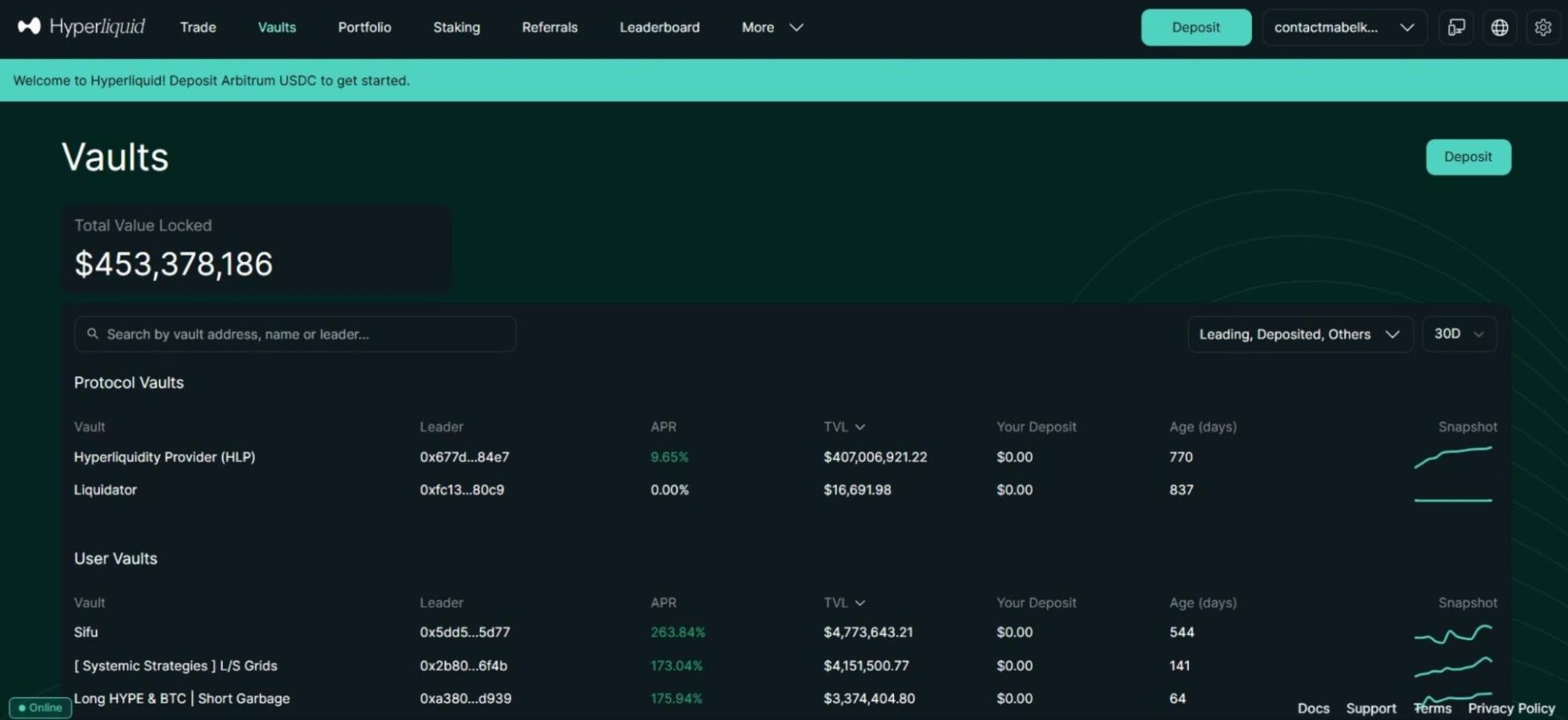

Liquidity Vaults

Liquidity vaults on Hyperliquid are created by individuals or entities who want to share their trading strategies with others. Users can deposit funds into these vaults and earn a share of the profits or losses based on the vault leader’s trading performance. Aside from user-owned vaults, the Hyperliquid platform features protocol vaults, such as the Hyperliquidity Provider (HLP) Vault, which acts as a market maker and liquidation mechanism, earning a portion of the trading fees.

Cross-Chain Compatibility

Previously, users had to bridge into Arbitrum before accessing Hyperliquid. With the recent Router Nitro Integration, Hyperliquid now supports single‑step deposits from over 30 blockchains, including major EVM chains (Ethereum, Arbitrum, Base, Polygon, etc.) and non‑EVM networks like Solana, Sui, Tron. This integration eliminates the previous process that required traders to bridge funds through Arbitrum before accessing Hyperliquid.

Pro-level Trading Tools

Another standout feature of Hyperliquid is the advanced trading tools available to traders, which are similar to those used by professional traders on traditional exchanges. This includes features such as the on-chain order book, real-time charts, customizable order types (including limit, market, and stop orders), in-depth market data, and responsive user interfaces, catering to both retail and institutional traders.

What Are the Pros and Cons of Hyperliquid?

The pros of Hyperliquid are listed below:

- Advanced Trading Features: Hyperliquid offers a wide range of trading options, including spot trading, perpetual trading, pre-launch futures contracts, margin trading, and up to 40x leverage. Additionally, it supports multiple order types, including market, limit, stop market, stop limit, scale, and TWAP orders, providing traders with advanced tools to execute various strategies.

- Community-Owned Liquidity Pools (Vaults): The Hyperliquid platform features an advanced vault system, where users can open their own vaults or contribute deposits to existing ones, sharing in the profits (about 10%).

- Fast Transactions on a Custom Layer 1 Blockchain: Hyperliquid operates on its own Layer 1 blockchain, utilizing a proprietary HyperBFT proof-of-stake consensus that enables up to 200,000 transactions per second, with near-instant finality and very low latency.

- Low Fees and No Gas Charges on Trades: Thanks to its PoS consensus and efficient design, Hyperliquid charges very low maker (0.045%) and taker (0.015%) fees and eliminates gas fees for trading transactions, significantly reducing trading costs compared to most other decentralized exchanges.

- Broad Asset Support and Cross-Chain Bridging: The platform supports over 100 assets, including major cryptocurrencies like BTC, ETH, AVAX, SOL, and SUI. It also offers multiple bridges (Arbitrum Bridge, Synapse, HyBridge) to facilitate cross-chain transfers, enhancing liquidity and user flexibility.

- User-Friendly Experience with One-Click Trading: The Hyperliquid decentralized perpetual exchange simplifies trading with one-click order execution and wallet connection. This helps to avoid repeated confirmations and streamlines the trading experience, similar to centralized platforms.

- Governance and Community Focus: The native HYPE token enables governance participation and incentivizes trading activity. The platform is community-oriented, rejecting venture capital funding and reinvesting profits in users, which solidifies a more user-focused ecosystem.

The cons of Hyperliquid are listed below:

- Limited Withdrawal Options: Currently, USDC is the primary cryptocurrency supported for withdrawals. If you wish to withdraw another cryptocurrency or stablecoin from Hyperliquid, you will first need to convert it to USDC.

- Centralization: Although Hyperliquid claims to be fully decentralized, some have criticized Hyperliquid for its relatively centralized structure. Critics argue that the protocol is not truly decentralized in comparison to other Layer-1 blockchain networks like Ethereum.

- Systemic Risk and Operational Concerns: The platform has faced criticism over incidents such as the JELLY token controversy, where a large trader’s actions resulted in substantial losses for liquidity providers. Critics argue that mixed vaults expose users to systemic risk and that unrestricted position sizes allow potential manipulation.

What are Hyperliquid Supported and Restricted Countries?

Hyperliquid is accessible in major global markets, including the United Kingdom, Singapore, South Africa, Hong Kong, France, Nigeria, Australia, Vietnam, and many others, spanning over 180 countries. Users in these supported countries can trade over 100 crypto assets on the platform without requiring Know Your Customer (KYC) verification.

Aside from these supported countries, Hyperliquid explicitly restricts users in the following countries and regions from using Hyperliquid’s app:

- United States, including all US states and territories.

- Ontario, Canada

- Sanctioned Territories, including jurisdictions subject to economic sanctions or export control laws not named in the Terms, such as Russia, North Korea, Iran, Cuba, and Syria.

These restrictions apply regardless of citizenship or physical presence, meaning individuals or entities residing, incorporated, or operating in these regions are barred from accessing Hyperliquid’s platform interface.

What Are Hyperliquid Trading Fees?

Hyperliquid trading fees are based on your rolling 14-day cumulative trading volume and are assessed at the end of each day in UTC. All sub-account volume on Hyperliquid contributes to the master account’s total, and all accounts share the same fee tier. Vault volume is calculated separately. Referral discounts and rewards apply only to your first $25 million in trading volume.

Having said that, Hyperliquid trading fees include perps fee tiers, spot fee tiers, staking tiers, and maker rebates. Here’s a breakdown of these trading fees:

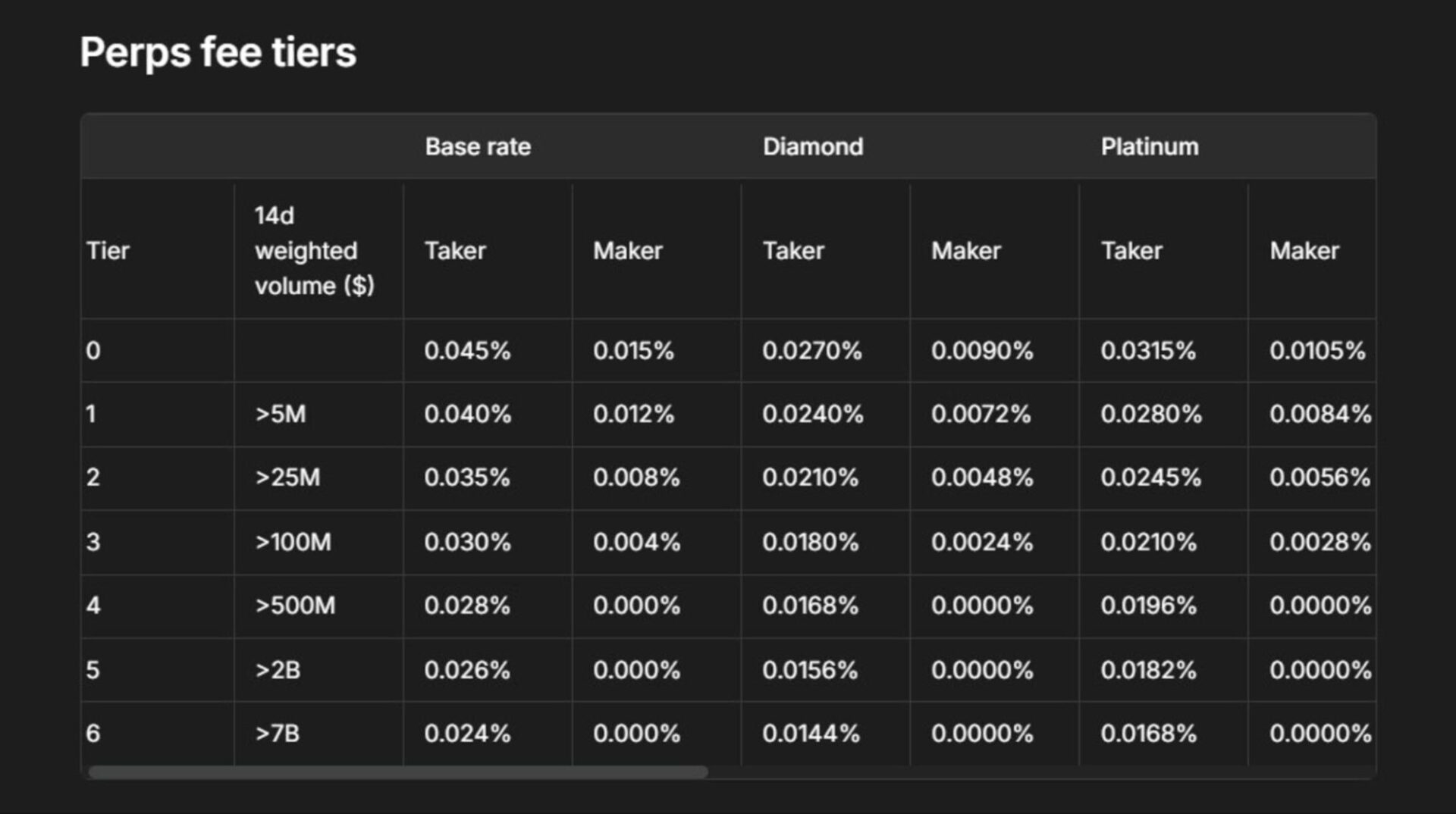

Perps Fee Tiers

Perps fee tiers are variable trading fees applied to perpetual futures contracts based on your 14-day trading volume. Depending on your category and total trading volume, you can expect your taker and maker fees to decrease. The categories include Base rate, Diamond, Platinum, Gold, Silver, Bronze, and Wood. Here is a breakdown of the costs you should expect to pay, depending on your tier;

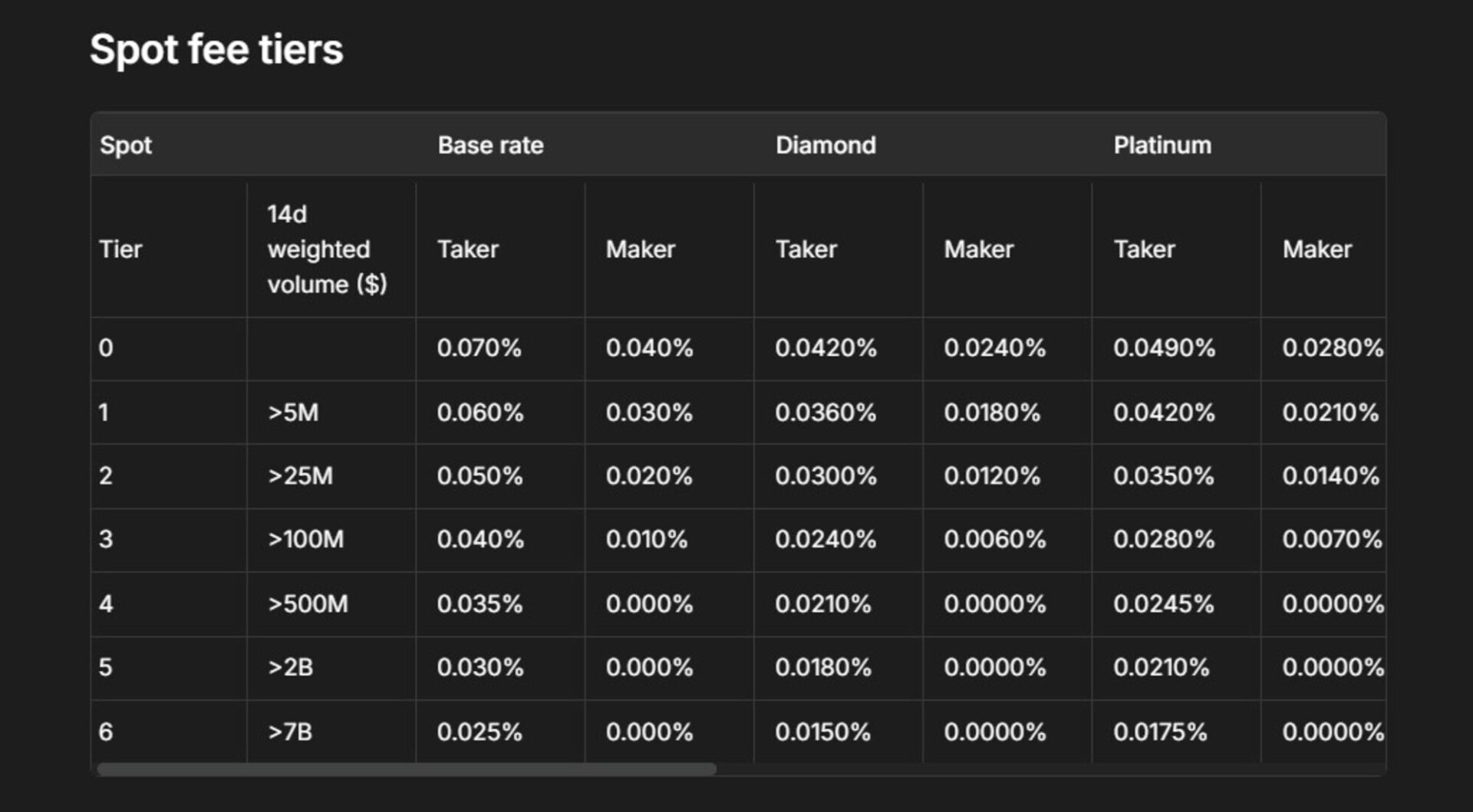

Spot Fee Tiers

Similar to perps, spot trading fees also follow a tiered structure based on your recent trading volume. Below is a breakdown of how these fees are charged based on the trader’s tier and category (Base rate, Diamond, Platinum, Gold, Silver, Bronze, and Wood).

Start trading with low fees on Hyperliquid. Get fee discounts and a 30% cashback on all your trading fees.

Staking Tiers

By staking Hyperliquid’s native token (HYPE), you qualify for trading fee discounts. The more you stake, the higher your discount tier, up to a maximum discount of 40%.

| Tier | HYPE Staked | Trading Fee Discount |

| Wood | >10 | 5% |

| Bronze | >100 | 10% |

| Silver | >1,000 | 15% |

| Gold | >100,00 | 20% |

| Platinum | >100,000 | 30% |

| Diamond | >500,000 | 40% |

Maker Rebates

Provide liquidity (i.e., place market maker orders) and contribute significantly to the platform’s trading volume. You can receive a rebate, a small payment instead of a fee, for those trades. Market maker rebates are paid out continuously on each trade directly to the trading wallet.

| Tier | 14d Weighted Maker Volume | Maker Fee |

| 1 | >0.5% | -0.001% |

| 2 | >1.5% | -0.002% |

| 3 | >3.0% | -0.003% |

Unlike many other protocols where fees primarily benefit the team or insiders, Hyperliquid directs all fees to the community through the HLP and the assistance fund. For security, the fund’s system address (0xfefefefefefefefefefefefefefefefefefefefe) holds only HYPE and operates entirely on-chain as part of the Hyperliquid L1 execution and requires a validator quorum for use in specific situations.

How to Create a New Hyperliquid Account to Buy Crypto?

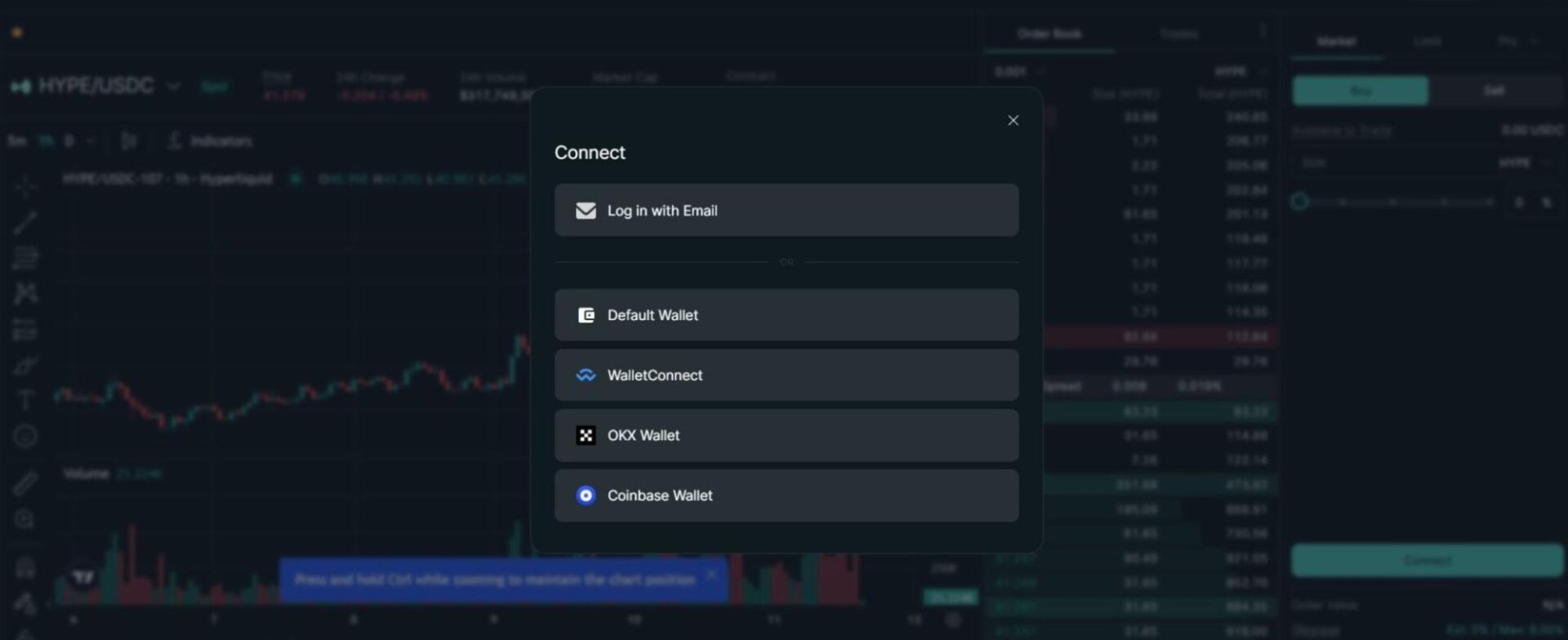

To create a new Hyperliquid account to buy crypto, visit Hyperliquid’s official website, then connect your wallet. You can choose to either use an email wallet or import an already existing EVM-compatible wallet. Below is a step-by-step guide for both methods.

Start trading on Hyperliquid today and receive a $100 welcome reward to boost your trading capital.

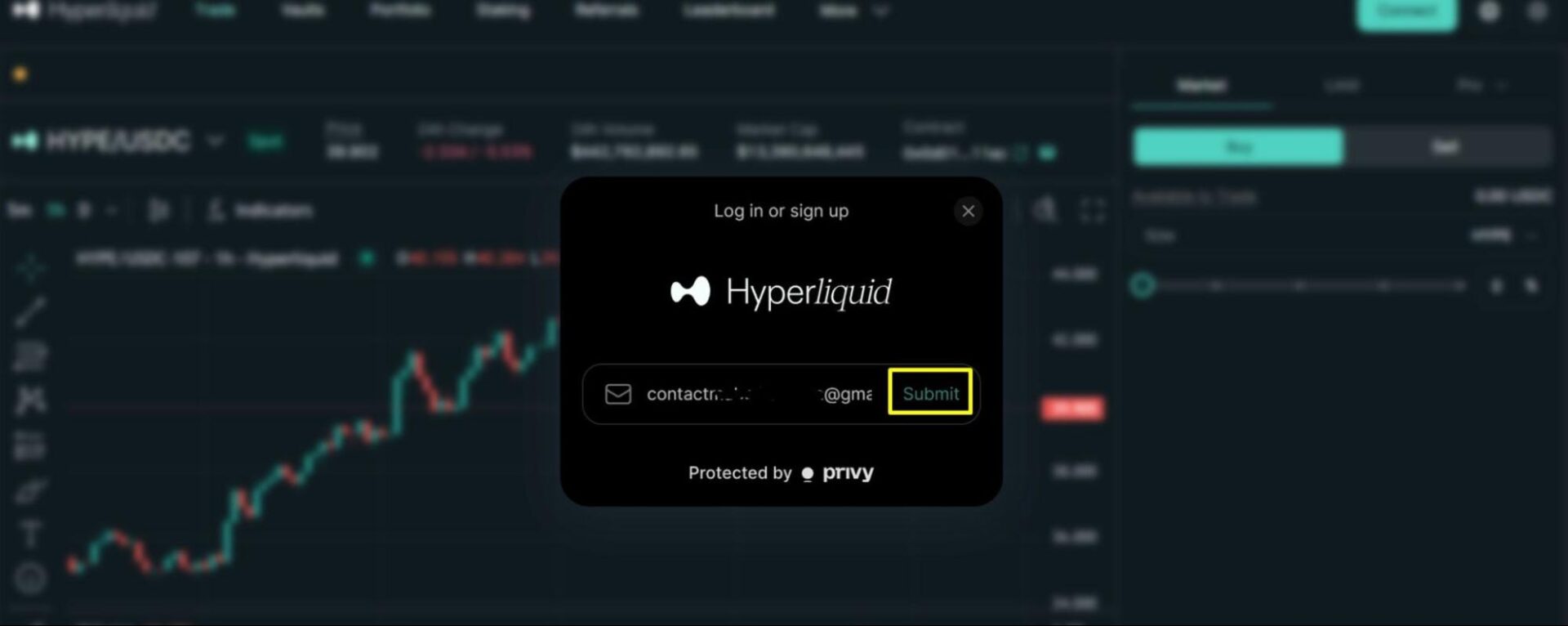

Follow these steps if you choose to log in with your email.

Step 1: Click the “Connect” button on the platform’s homepage and select “Login with email,” then enter your email address. After that, click “Submit” and within a few seconds, Hyperliquid will send a 6-digit confirmation code to your email. Type in the 6-digit code to proceed.

To qualify for the welcome rewards, visit Hyperliquid’s referral page and add the current Hyperliquid referral code. Once you enter the code “HYPERLIQUIDREVIEW” in the field provided, click “Claim rewards” for your bonuses and discounts to apply.

Follow these steps if you choose to create a new account with a DeFi wallet:

Before we proceed, you need an Ethereum virtual machine (EVM) wallet (e.g, MetaMask, OKX Wallet, Coinbase Wallet, and WalletConnect) and collateral (USDC, BTC, ETH, SOL, or FARTCOIN).

Choose the EVM Wallet You Want to Connect

Once you have an EVM wallet and collateral, go to the Hyperliquid official website and click the “Connect” button, and choose a wallet to connect. A pop-up will appear in your wallet extension asking you to connect to Hyperliquid. Press “Connect.”

Step 2: Connect Your External Wallet

Click the “Enable Trading” button. A pop-up will appear in your wallet extension asking you to sign a gasless transaction. Press “Sign” and your wallet will be connected automatically.

Step 3: Deposit Crypto

To trade, you will need to deposit USDC or any of the other crypto we mentioned above as collateral.

- For USDC: Enter the amount you want to deposit and click “Deposit.” Confirm the transaction in your EVM wallet and wait a few minutes for the transaction to be confirmed and completed.

- For BTC, ETH, SOL, and FARTCOIN: Send the asset to the destination address shown. Note that only USDC is used as trading collateral on Hyperliquid. Therefore, if you deposit these assets, you must sell them for USDC to facilitate spot or perpetual trading.

Once your deposit is confirmed, you can start trading on the Hyperliquid crypto exchange.

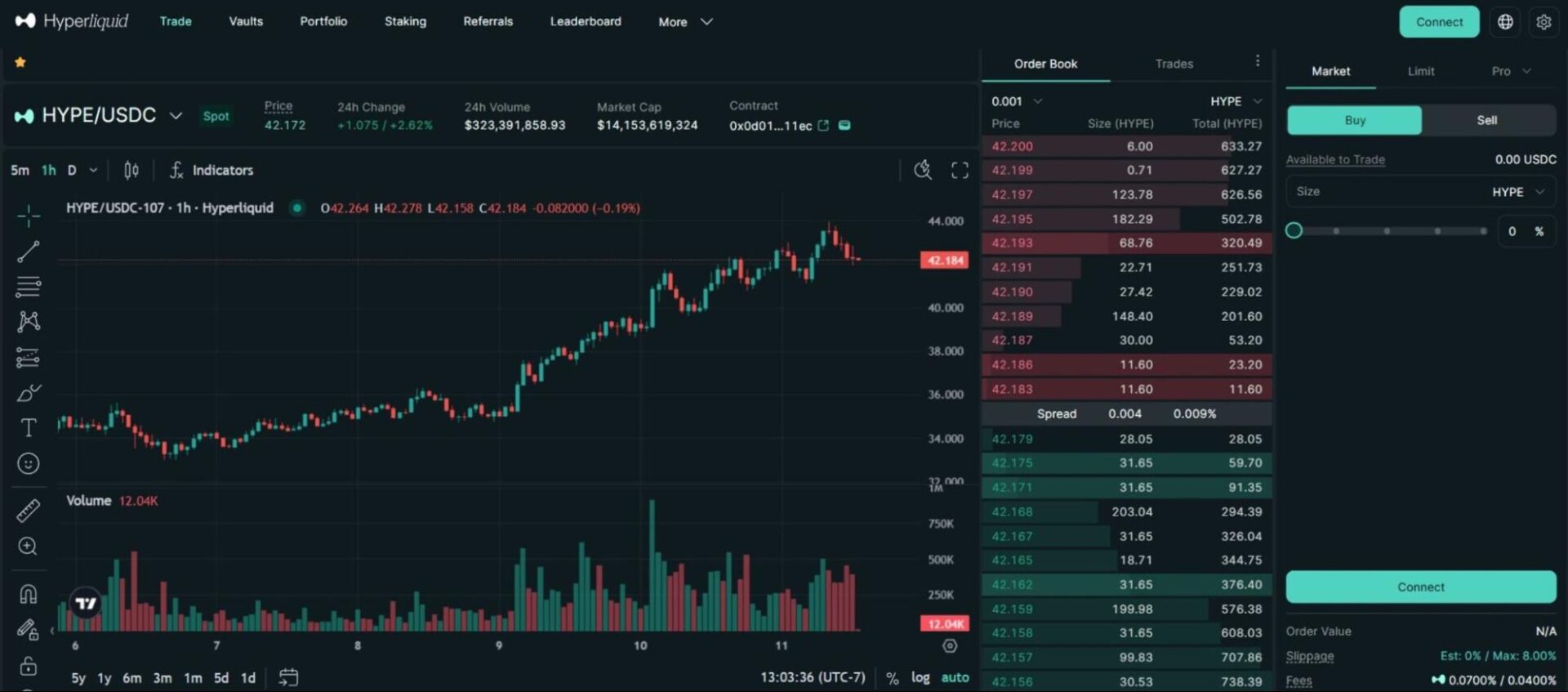

Step 4: Start Trading

Trading perpetual contracts on Hyperliquid is slightly different from the standard spot market buy and sell. Here, you use USDC as collateral to long or short the token instead of purchasing the token itself. Here’s how to achieve this:

- Visit the “Trade” interface and use the token selector to choose a token that you want to open a position in.

- Decide if you want to long or short that token. If you expect the token price to go up, you want to go long. If you expect the token price to go down, you want to short. Use the slider to choose leverage or type in the size of your position.

- Then, click “Place Order”. Revise your order details and click “Confirm” in the modal that appears.

Your position is open, and you can monitor, modify, and close your orders at will.

Where to Buy Hyperliquid Crypto?

To buy Hyperliquid crypto (HYPE) on the Hyperliquid exchange, follow these steps.

1. Set Up a Crypto Wallet: Download, install, and fund a secure wallet like MetaMask, Coinbase Wallet, OKX Wallet, or Rabby Wallet. Follow the steps above to connect your wallet to your new account.

2. Deposit Funds: Transfer USDT or USDC from your external wallet to your Hyperliquid account through the Arbitrum network. You can also transfer ETH, BTC, SOL, or FARTCOIN from Ethereum or other networks. Still, you must swap these assets for USDC because it is the only crypto used as trading collateral on the Hyperliquid crypto exchange.

3. Buy HYPE Token on Hyperliquid Spot: Using the Hyperliquid app or website, navigate to the Trade page and select the HYPE/USDC pair to purchase HYPE tokens.

4. Set Parameters and Confirm Your Purchase

Set the price you want to buy HYPE at; you can choose to buy at the current market price or a future price. Also, select the order type and add other relevant details. Then, approve the transaction in your wallet, and your HYPE tokens will appear in your wallet.

Besides buying HYPE directly from Hyperliquid, you can use some centralized exchanges to buy HYPE and then transfer it to the crypto wallet connected to your account. These exchanges offer a quick and easy way to purchase Hyperliquid directly with your local currency, while giving new users numerous rewards to support their crypto trading journey.

If you are considering using CEXs to purchase HYPE, ensure you use a valid invite code to qualify for the bonuses your chosen platform offers. You can find current referral codes for top crypto exchanges like Bybit and KuCoin, and learn how to get free Bitcoin in this crypto sign-up bonus article.

FAQs

1. Is Hyperliquid Exchange a Scam?

No, Hyperliquid Exchange is not a scam. However, recent activity on the exchange has raised concerns in the crypto community due to suspicious, high-leverage trades that may be linked to illicit behaviour. For instance, Blockchain analytics firm Spotonchain flagged unusual trading patterns involving millions of dollars in leveraged positions.

Spotonchain noted that over two days, an individual successfully closed two ETH long positions with a 100% win rate, profiting approximately $2.2 million—a pattern that has fueled speculation about potential market manipulation or money laundering. While this doesn’t make the platform a scam, it highlights concerns about how fraudsters could exploit Hyperliquid’s infrastructure.

2. Who Should Use Hyperliquid?

Hyperliquid is best suited for the following investors;

- Crypto traders and investors interested in decentralized perpetual futures trading. For these traders, Hyperliquid offers trading with low fees (0.02%, which is lower than that of many crypto exchanges in the industry. Perp futures investors will also benefit from the platform’s deep liquidity and high-performance Layer-1 blockchain optimized for derivatives.

- DeFi Enthusiasts and Builders: In addition to supporting decentralized trading through the exchange, Hyperliquid is also designed for high-performance financial applications. The platform is built around HyperCore and HyperEVM. HyperCore powers native trading features like perpetuals trading and spot markets, while HyperEVM allows developers to build and deploy applications using familiar Ethereum tools. With this setup, smart contracts on the HyperEVM can directly interact with the trading infrastructure on HyperCore. This is helpful for DeFi builders because it removes the need to work around the usual limitations of separate execution layers or bridges. Developers can create apps that rely on high-speed trading or liquidity access while still using standard smart contract frameworks.

- Traders Seeking Decentralized Alternatives to CEXs: Hyperliquid stands out for providing many of the core features traders expect from centralized exchanges, including low latency, deep liquidity, and a fully on-chain order book for both perpetual and spot trading. This gives traders more control over pricing and execution, similar to what they’d find on platforms like Binance or Bybit.

Traders can also use up to 40x leverage on some assets, which is unusually high for a DEX. All trades, positions, and liquidations are transparent and verifiable on-chain, adding an extra layer of auditability that many CEXs lack. Together, these features make Hyperliquid a decentralized option that doesn’t compromise on speed or advanced trading functionality.

- Traders Looking for No KYC Exchange: Hyperliquid allows users to trade without going through any KYC verification process. There’s no need to submit personal documents, undergo identity checks, or create an account tied to an email address, so traders can connect their wallet and start trading immediately.

Additionally, all crypto trading activity, including deposits, withdrawals, and position management, is handled through smart contracts on-chain, and user balances are linked directly to their wallet address, not a custodial account. This is particularly suitable for users who prioritize privacy or operate in regions where centralized exchanges impose barriers to access.

Read Next: Discover the benefits of trading on non-KYC exchanges in this Best no KYC crypto exchanges article.

3. Does Hyperliquid Require KYC?

No, Hyperliquid does not require KYC. Although the decentralized perpetuals exchange shares some features with centralized exchanges, it remains a decentralized platform that allows users to connect their wallets and start trading quickly without requiring identity verification.

Open a trading account on Hyperliquid without KYC and receive a $100 bonus and 30% cashback on fees.

4. What Countries are Restricted by Hyperliquid?

Hyperliquid restricts users from certain jurisdictions, primarily due to sanctions and legal considerations. Restricted countries include, but are not limited to, the US, Ontario, Canada, Cuba, Iran, Myanmar, North Korea, Syria, and certain Russian-occupied regions of Ukraine.

The post Hyperliquid Review 2025 – Is This Crypto Exchange Safe or a Scam? appeared first on CryptoNinjas.