Digital Asset Funds Record 10th Straight Week of Inflows Despite Israel-Iran Tensions

Digital asset funds extended their weekly inflow streak to ten weeks, drawing $1.24 billion and lifting 2025’s cumulative inflows to a new peak of $15.1 billion.

That said, trading activity cooled toward the week’s end, which, according to CoinShares, is likely influenced by the Juneteenth observance in the US and reports of escalating American involvement in tensions with Iran.

Despite a recent market correction, Bitcoin saw $1.1 billion in inflows for the second straight week, which indicates that investors remain confident and are buying the dip. Further highlighting this optimism, short-bitcoin investment products experienced small outflows of $1.4 million, according to the latest edition of CoinShares’ Digital Asset Fund Flows Weekly Report.

Ethereum also maintained momentum as it logged its ninth consecutive week of inflows, with $124 million added. The latest figure pushed the total for this stretch to $2.2 billion. This marks Ethereum’s longest inflow streak since mid-2021.

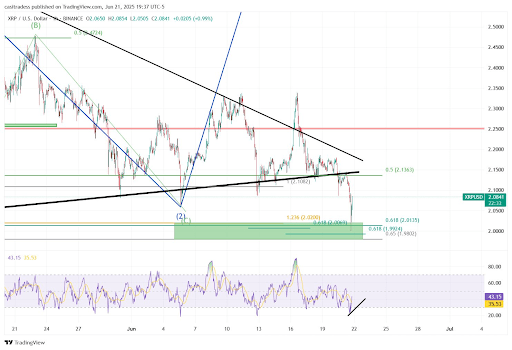

A similar trend was seen across Solana and XRP, which gained $2.8 million and $2.7 million in new capital, respectively, in the past week. Meanwhile, Chainlink, Cardano, and Litecoin followed suit while posting smaller inflows of $0.6 million, $0.3 million, and $0.2 million, respectively.

On the other hand, multi-asset products recorded outflows of $5.8 million. Sui also witnessed outflows of $0.5 million.

The US led regional inflows with $1.25 billion, followed by smaller contributions from Canada with $20.9 million, Australia with $16.6 million, and Germany with $10.9 million. Offsetting these gains were outflows from Hong Kong and Sweden, which recorded $32.6 million and $14.9 million, respectively.

Brazil and Switzerland also saw capital exit, posting outflows of $9 million and $7.7 million during the same period.

The post Digital Asset Funds Record 10th Straight Week of Inflows Despite Israel-Iran Tensions appeared first on CryptoPotato.