DOGE Price Prediction: Will Bulls Eye the $0.1785 Target?

The post DOGE Price Prediction: Will Bulls Eye the $0.1785 Target? appeared first on Coinpedia Fintech News

The crypto market today has been trading sideways, lacking a clear trend direction as major assets struggle to build momentum. Dogecoin, too, has mirrored this consolidation phase. Despite a modest 0.19% dip in the last 24 hours and a 3.95% drop over the week, DOGE has shown signs of resilience.

After rebounding from a low of $0.1427, the coin surged to $0.1677 before settling near $0.1645. With $24.64 billion in market cap and over $882.9 million in daily volume, Dogecoin is currently in a key accumulation phase. The question now is whether a breakout is brewing. Join me as I derive the potential price targets for the near term.

Dogecoin Welcomes Spike in Addresses & Social Sentiment

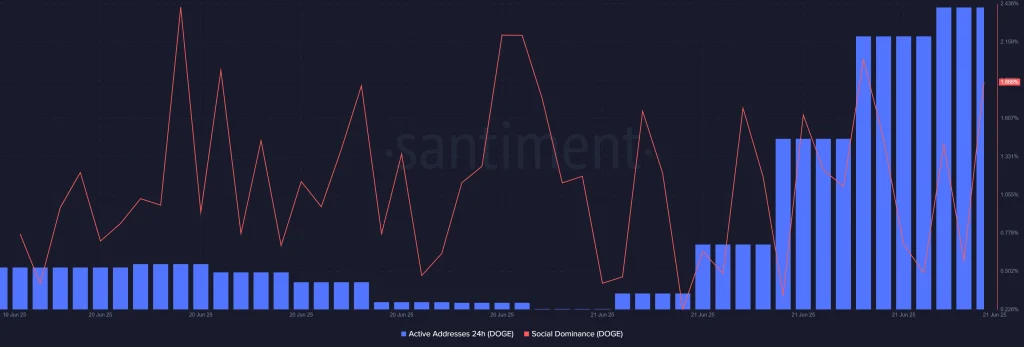

Recent on-chain data from Santiment paints a bullish outlook for Dogecoin. The number of active addresses has significantly increased over the past few days, with the blue bars in the chart showing a sharp rise from June 21 onwards. This uptick suggests the re-entry of user activity and transactional behavior on the DOGE network.

More notably, social dominance, which is represented by the red line, has also seen fluctuating but overall upward momentum, peaking alongside address activity. This trend indicates renewed attention on DOGE in online crypto discussions and communities. Which is often a precursor to increased speculative interest.

Together, this surge in active wallet participation and social buzz implies that Dogecoin is far from being dormant. When combined with current market consolidation, such behavioral signals often come before a notable price move.

DOGE Price Analysis:

On the 4-hour chart, DOGE is showing classic signs of price compression. Bollinger Bands have started to tighten, indicating reduced volatility and a potential buildup for an explosive move. DOGE at press time is trading around $0.1645, hugging the middle band, with key resistance at $0.1716 and support at $0.1617. Successively, a close above $0.1716 could take the price to $0.1785.

The RSI sits at 57.07, a neutral zone that still offers upside room before entering overbought territory. Notably, despite the bearish lean in the order book of 61% sellers, bulls are managing to hold the current range. This consolidation follows a strong bounce from the $0.1427 support, forming a higher low structure, which is often the base for a bullish continuation. That being said, intraday traders should consider a stop loss at $0.1595.

Also read our Dogecoin Price Prediction 2025, 2026-2030!

FAQs

Dogecoin is in a consolidation phase after rebounding from a local low, with price compression on lower timeframes.

On-chain data shows rising active addresses and increasing social dominance, hinting at growing user engagement and potential price action.

While the order book leans bearish, technical patterns like compression and rising RSI hint at a breakout.