Ripple SEC News: XRP Nears Banking License And Faces Critical Support Test

The evolution of Web3 banking is starting. XRP is applying to become a bank in the latest Ripple SEC news. So should I sell my house to buy more XRP? Short answer: NO, but the price is in a crucial position.

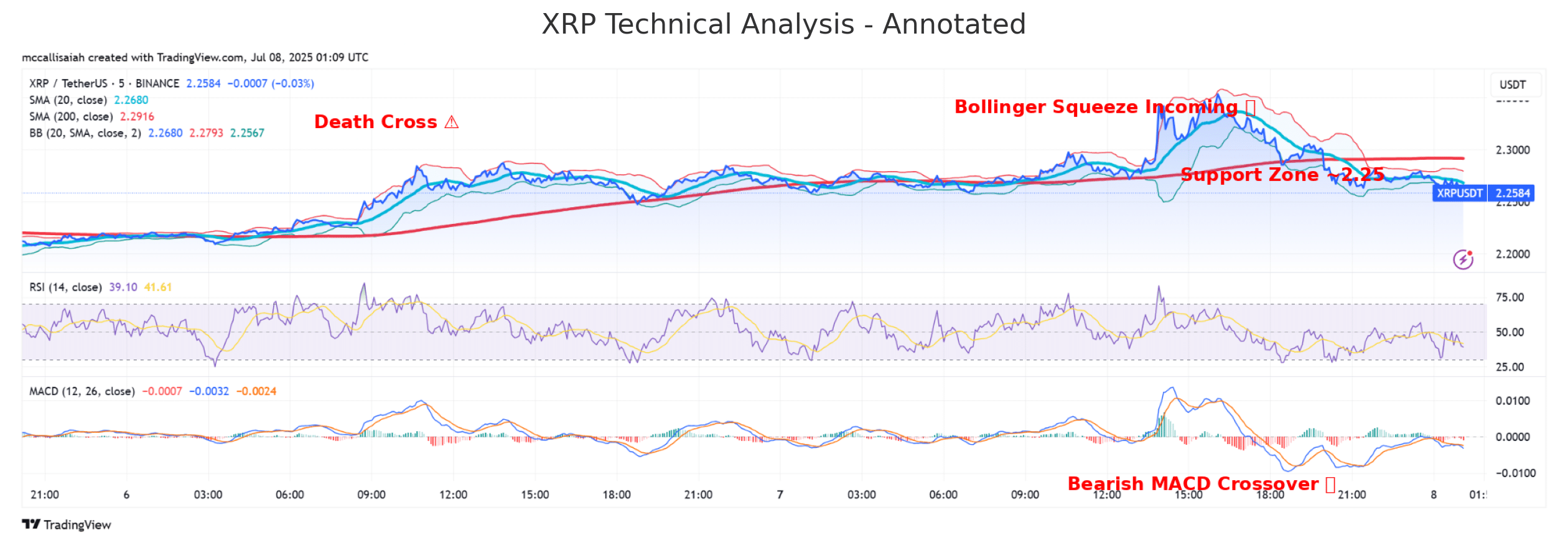

After briefly spiking to $2.32, XRP has slipped toward the $2.25 range. Price action is tightening along the lower Bollinger Band, pointing to volatility compression.

That’s typically a precursor to a major move, and right now, the bias is leaning south. If we won’t moon today, when will we moon then?

The world’s new bank won’t look like a building.

It will look like code.

It will sound like silence.

And it will settle in XRP. pic.twitter.com/cK4Mu9yU3p— ᴍᴇʀʟɪɴ ᴛʜᴇ ᴡɪᴢᴀʀᴅ (@MerlinXRP) July 3, 2025

DISCOVER: 20+ Next Crypto to Explode in 2025

Death Cross and MACD Add Bearish Pressure

Ripple Labs is making a play for Wall Street legitimacy. A July 2 filing with the U.S. Office of the Comptroller of the Currency seeks a national bank charter that would let Ripple operate as a federally regulated trust bank.

If approved, it puts XRP in the running for institutional-grade use, from cross-border payments to potential stablecoin infrastructure.

99Bitcoins analysts see the move as a strategic end-run around slow-moving crypto regulation, potentially clearing a path for Ripple to secure Fed master account access and an eventual XRP spot ETF.

In short: bros, it’s only just beginning for us. Long-term, it could mean a solid tradfi-defi integration for XRP with more liquidity management and use cases for the token.

Conversely, technical indicators aren’t doing XRP bulls any favors. A “death cross” recently formed on the daily chart, with the 20-day moving average crossing below the 200-day. That’s historically a bearish signal, often followed by extended downside.

At the same time, the MACD has flipped negative, crossing beneath the signal line.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Head and Shoulders Pattern Raises Breakdown Risk

Adding to the short-term bear case, XRP is flashing a head-and-shoulders pattern on the daily chart. If $2.23 gives out, the next stop could be $2.20 or lower, with $2.15 waiting in the wings. Volume has also dried up since the last rally.

Lower timeframes show more of the same. XRP’s been boxed between $2.25 and $2.35 for hours now. A brief bounce off $2.26 got smothered at resistance, suggesting the bulls may be losing steam.

XRP pump did NOT die

she’s taking a breather, there’s a difference

— danny (@defiphvntom) July 7, 2025

Despite recent weakness, the broader trend still favors the bulls. The daily chart shows a series of higher lows since XRP bottomed at $1.908, and the 10 to 100-day EMAs continue to flash buy signals. However, the 200-day SMA now sits above current price at $2.36, acting as a lid on further upside.

XRP on the Edge: $2.25 or Bust

XRP keeps climbing out of its $1.90 bottom, marking higher lows and clinging to buy signals from short and mid-term EMAs. Yet the 200-day simple moving average, now at $2.36, isn’t budging.

If support at $2.25 breaks with conviction, the structure risks unwinding toward $2.20 or lower. On the other hand, a bounce with volume could reignite momentum and set up another test of the $2.35–$2.40 range.

Traders should watch $2.25 like a hawk because it’s the fulcrum for what happens next.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- TXRP is applying to become a bank in the latest Ripple SEC news.

- Despite recent weakness, the broader trend still favors the bulls. The daily chart shows a series of higher lows since XRP bottomed

The post Ripple SEC News: XRP Nears Banking License And Faces Critical Support Test appeared first on 99Bitcoins.