Bitcoin Profit-Taking Spikes Without Price Drop – Strong Demand Or Delayed Reaction?

Bitcoin’s (BTC) on-chain activity has accelerated over the past few days, with the leading cryptocurrency by market cap hitting successive new all-time highs (ATHs). As a result, several metrics now indicate renewed interest from both long-term holders and recent participants.

Older Bitcoin Moves Amidst High Profit-Taking

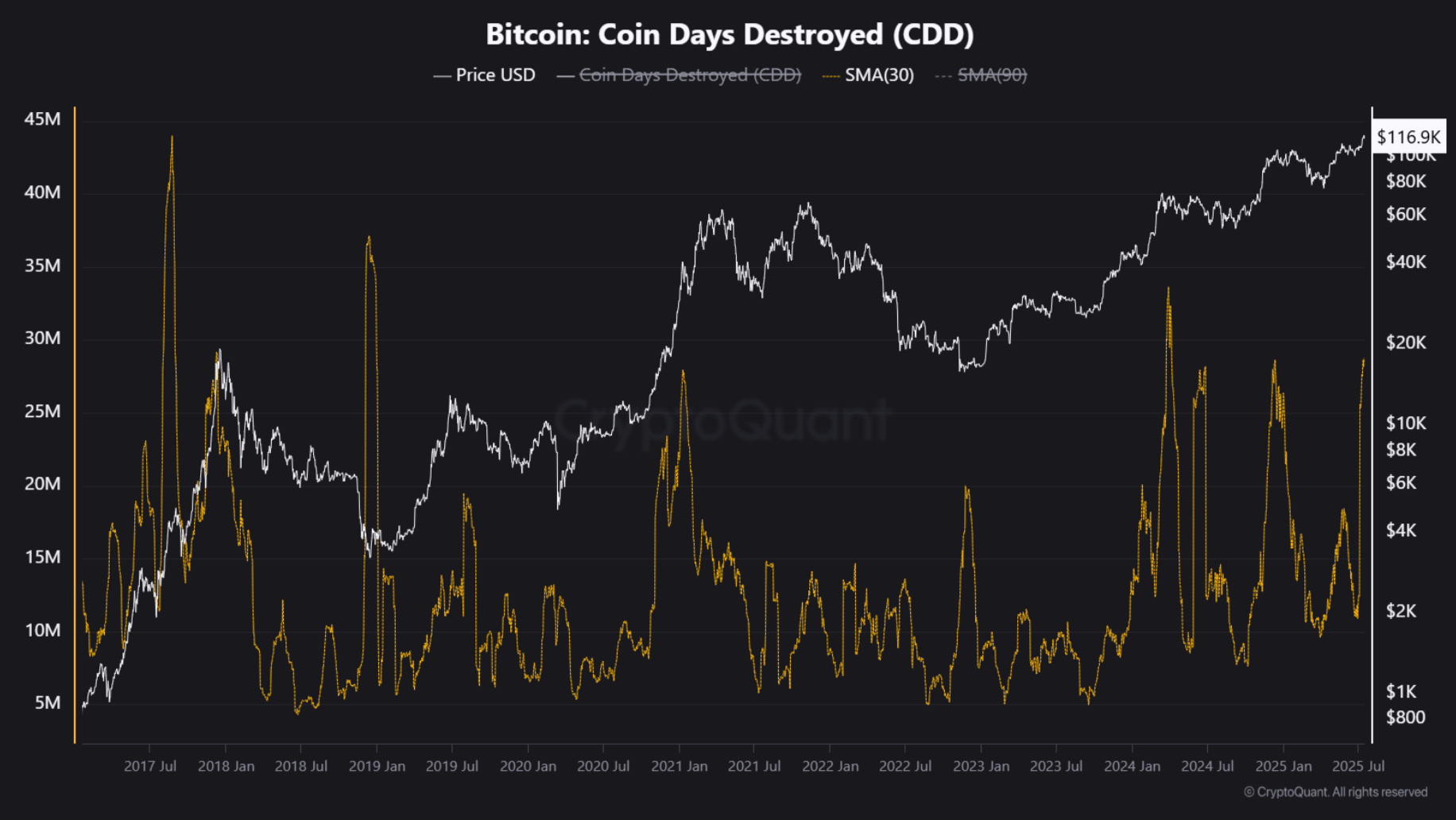

According to a CryptoQuant Quicktake post by contributor Kripto Mevsimi, Bitcoin’s Coin Days Destroyed (CDD) has surged significantly over the past week. The metric climbed to 28 million, signalling that older BTC – dormant for extended periods – has begun moving again.

For the uninitiated, Bitcoin CDD measures the movement of older coins by multiplying the number of coins moved by how long they were held. A spike in CDD indicates that long-dormant Bitcoin is being spent or transferred, often signaling strategic shifts by long-term holders.

Historical data shows that CDD spikes typically precede strategic shifts – often large holders either redistributing supply or repositioning portfolios. Such activity commonly appears near cycle midpoints or local tops.

Besides the rising CDD, Bitcoin Net Realized Profit and Loss (NRPL) has also recorded a steep climb. The metric recently surged past $4 billion, the highest level since Q2 2025.

To explain, Bitcoin NRPL measures the difference between the price at which coins were bought and the price at which they are sold or moved on-chain. A high positive NRPL indicates investors are realizing profits, while a negative NRPL suggests widespread selling at a loss, often tied to market fear or capitulation.

As NRPL hits levels not seen since early Q2 2025, it suggests that Bitcoin whales and recent buyers are actively taking profits. Despite the increased profit-taking, BTC’s price has remained relatively stable, trading between $116,000 and $120,000.

The lack of a sharp price pullback amid such profit-taking points to two possible scenarios – either demand remains strong enough to absorb sell pressure, or a delayed correction could be on the horizon. The analyst noted:

Interestingly, this current wave differs from late June. Back then, NRPL showed a mix of realized losses and modest profits – suggesting capitulation from late buyers while older holders quietly accumulated. Today, the narrative flips: profits dominate, while older coins flow.

Exchange Data Suggests Warning For BTC

While the absence of a sharp decline despite significant realized profits may signal strong underlying demand, recent exchange data raises some concerns. Notably, Bitcoin inflows to crypto exchanges have seen a sharp uptick.

Conversely, other sentiment-tracking indicators suggest that despite BTC’s new highs, retail hype remains subdued – unlike in previous ATH phases – implying potential for further upside. At press time, BTC trades at $116,760, down 2.6% in the past 24 hours.