Analysts Eye $2 for ADA Price as Whales Accumulate

The post Analysts Eye $2 for ADA Price as Whales Accumulate appeared first on Coinpedia Fintech News

Recently, the ADA price surged to $0.92 in the fourth week of July, backed by strong trading volumes and robust on-chain activity.

But, recent profit booking has triggered a mild correction to sideways movement. This occurrence has pulled prices back to $0.85.

Despite the retracement, whale accumulation signals a strong possibility of an extended rally.

ADA Price Rally Slows as Traders Book Profits

After showing impressive momentum through July, the ADA price experienced a temporary cooldown.

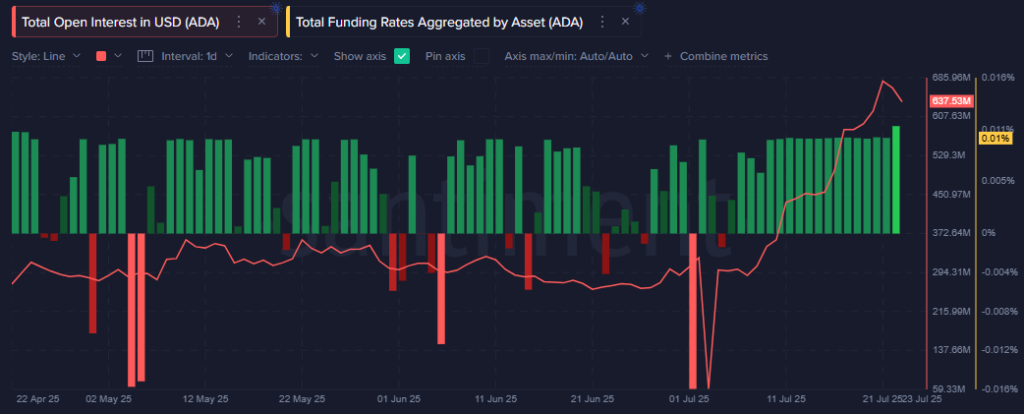

However, the OI has not dipped much, when writing it holds near $637.53 million, signifying a less intense sell-off.

A couple of days back, when ADA crypto climbed to $0.92, it attracted heavy interest in both spot and derivatives markets. The Open Interest (OI) spiked to $675 million, while funding rates remained positive near 0.01%, which is still positive when writing, which means bulls are still actively paying a premium to maintain leverage on long positions.

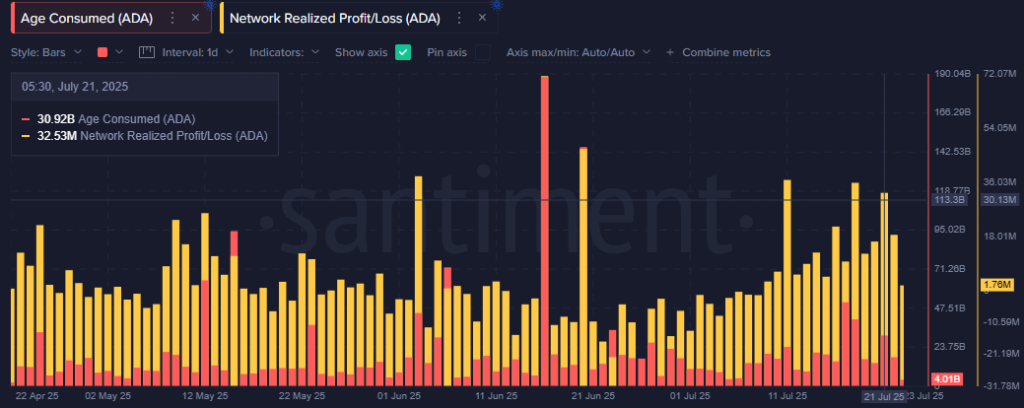

Moreover, this sell-off move was captured in Santiment’s “Network Realized Profit/Loss” metric, which displayed a clear spike. This suggests many short-term holders opted to take profits near recent highs, leading to a pullback to $0.85.

On-Chain Signals Show Whales Absorbing Retail Sell-Off

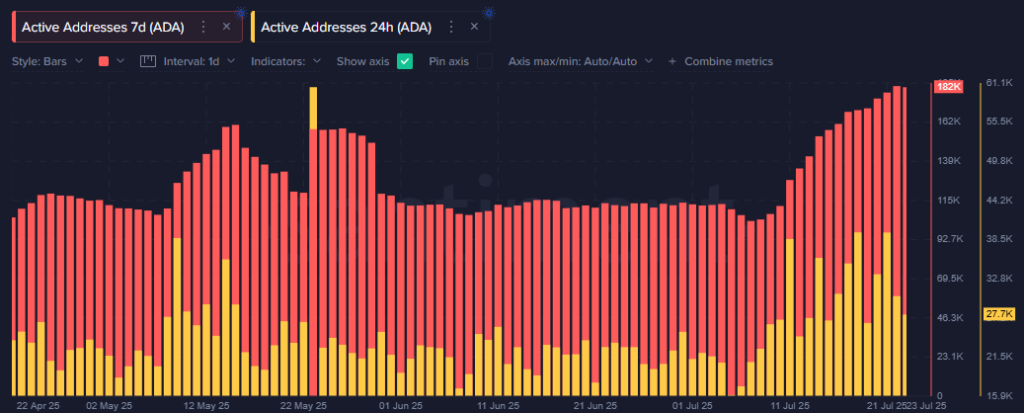

Despite the minor correction, underlying network metrics remain healthy. Santiment data on active addresses in both 7-day and 24-hour periods have remained elevated throughout July.

These are strongly signaling a sustained user engagement on the Cardano blockchain.

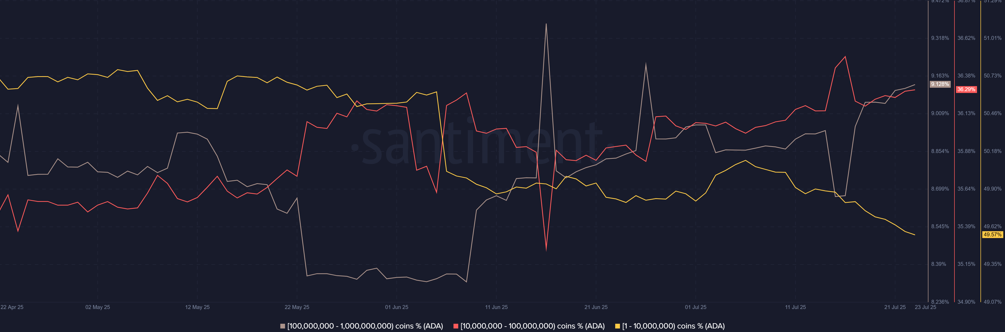

More importantly, wallet data paints a compelling picture of redistribution. As the data shows, the “small to medium” investors’ wallets holding in the range of “1 to 10 million ADA” have shown a steady decline in holdings.

Meanwhile, larger addresses holding “10 million to 100 million”, and even “100 million to 1 billion” ADA coins, have been accumulating aggressively.

This classic absorption pattern points to confidence from whales and institutional players, often seen as a leading indicator for further bullish momentum in the ADA price.

ADA Price Prediction Points to $2, If $1 Barrier Breaks

Looking forward, analysts’ opinions are flooding various social platforms like X, and they strongly believe that this short-term cooldown could pave the way for another leg upward.

If whales continue to accumulate and broader market sentiment stays favorable, clearing the $1 mark next could act as a breakout trigger.

With strong technical structure and continued on-chain support, there’s growing speculation that the ADA price could revisit the $2 mark by year’s end. But, if it falls below $0.85, then lower levels could be revisited.