Ethereum Price Outpaces Bitcoin and XRP Amid Bullish Momentum

The post Ethereum Price Outpaces Bitcoin and XRP Amid Bullish Momentum appeared first on Coinpedia Fintech News

The Ethereum price has risen 19% in the last 7 days and an impressive 64% over the past 30 days, significantly outperforming Bitcoin’s 1.7% and XRP’s 21.1% in the same period.

From its April 2025 low, ETH has now surged by more than 150%, marking a dramatic reversal from its earlier bearish phase. Until April, ETH hadn’t posted a single positive monthly return. May broke the downtrend with a 41.1% gain, while July has now become the strongest month yet.

Why Ethereum Price is Surging?

Ethereum’s recent performance stands out against the broader market. Over the past week, ETH outperformed both Bitcoin (1.7%) and XRP (21.1%). Over 30 days, Ethereum is up 64%, solidifying its position as the top-performing major crypto asset.

From its April low, ETH has gained over 150%, supported by consistent green daily closes, especially between July 8 and 21 when the price jumped 47.86%.

Hougan attributes much of the current rally to a surge in institutional interest. Since the approval of spot Ethereum ETFs in July 2024, interest had remained modest until recently. Between July 2024 and mid-May 2025, ETFs and corporate buyers accumulated just 660,000 ETH.

But since May 15, that number has exploded. More than 2.83 million ETH has been acquired by ETPs and corporations, equivalent to around $5 billion in inflows. Companies like Bitmine and SharpLink have been publicly increasing their ETH holdings and even staking them to generate yield.

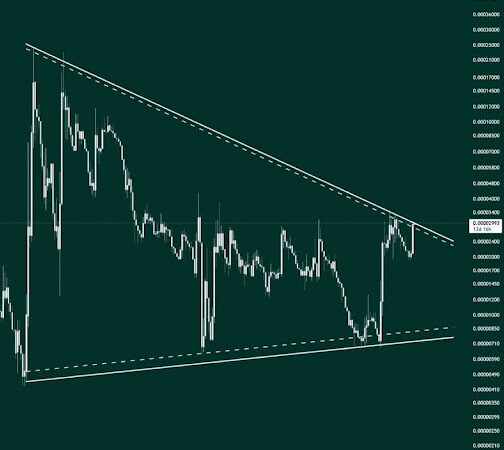

Ethereum Supply-Demand Gap: Is ETH Becoming Deflationary?

While demand has soared, Ethereum’s supply growth has remained extremely limited. In the same period when 2.83 million ETH was bought, only 88,000 new ETH were created by the network. That’s a supply-demand gap of more than 32x.

Hougan notes that this mismatch is a key reason why ETH’s price has been climbing so sharply. The dynamic reflects a growing institutional appetite for Ethereum, both as an investment and a productive asset.

- Also Read :

- After BNB will this Altcoin Hit a New ATH Next?

- ,

Ethereum Price Forecast 2025: Can ETH Hit $10,000?

Looking ahead, the demand trend could intensify. Hougan estimates that another $20 billion could flow into Ethereum via ETFs and corporate treasuries over the next 12 months, translating to about 5.33 million ETH. In contrast, the network is projected to issue just 800,000 ETH during that period.

If this buying continues, ETH’s supply will remain tight, potentially driving further price gains. Whether this results in new all-time highs remains to be seen, but the fundamentals are pointing toward sustained bullish momentum.

Ethereum’s current rally is more than just a market bounce; it’s being driven by strong fundamentals. As institutional demand grows and supply remains constrained, ETH may continue to outperform. For now, all eyes are on whether this rally marks the beginning of a much bigger move.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Ethereum’s surge is driven by high institutional demand from ETFs and corporations, exceeding its supply by over 32 times.

Since May 15, over 2.83 million ETH (worth $5B) has been purchased by ETFs and corporate treasuries.

Yes. In the last 30 days, ETH rose 64%, while Bitcoin gained only 1.7%.

Analysts predict ETH could sharply rise, with demand projected to be 7x higher than supply by next year.