The US Is A Bitcoin Whale—Arkham Clarifies BTC Holdings After Brief Panic

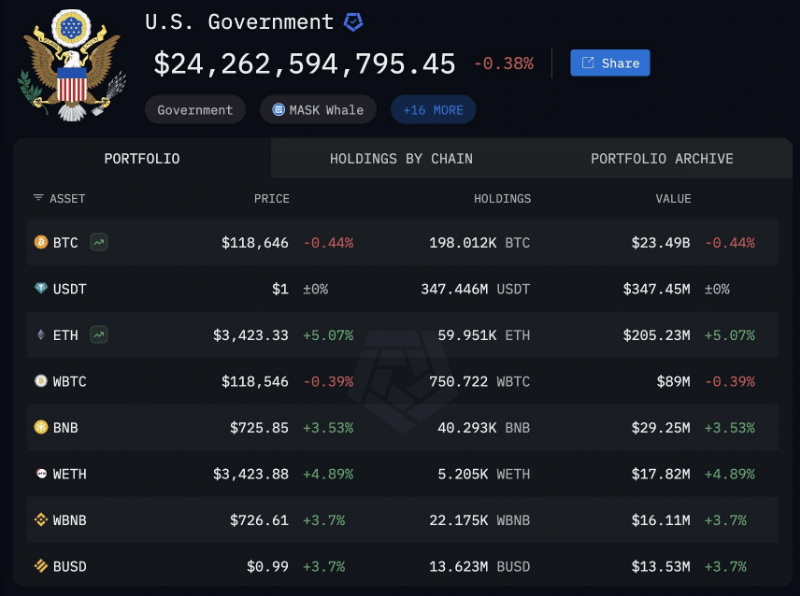

According to Arkham Intelligence, the US government still holds more than 198,000 Bitcoin. That’s around $23.4 billion sitting in digital wallets across several agencies.

A recent public spreadsheet showed just 28,988.356 BTC under the Marshals Service. But looking at FBI, IRS, DEA and Justice Department seizures makes the total jump far higher.

Government Stash Spread Across Agencies

Based on reports from the Marshals Service, 28,988.356 BTC—worth roughly $3.45 billion—has been under its control since July 15, 2025.

Other agencies don’t share that data publicly. They manage coins from crime probes and prize auctions. Arkham gathered on‑chain data and linked addresses tied to each agency. When added, the total hits at least 198,012 BTC.

DID THE US GOVERNMENT JUST SELL 170,000 BTC ($20 BILLION)?

No. This Freedom of Information Request response from the US Marshals Service (USMS) cites them as holding 28,988 BTC ($3.4B), but other departments of the US Government also seize and hold Bitcoin, including the FBI,… https://t.co/8kpjwyKcT9 pic.twitter.com/uB7EejUCVz

— Arkham (@arkham) July 23, 2025

In everyday terms, that means the US is a massive bitcoin “whale” that still owns about 198,000 BTC. It’s not just sitting at the Marshals Service.

The rest is spread out in hidden pockets. Those coins haven’t moved in the last four months. Traders who saw only the Marshals number panicked.

Senator Cynthia Lummis even warned it would be a “total strategic blunder” if the reserves really fell below 30,000 BTC.

Arkham: The US Government currently holds at least 198,000 BTC ($23.5B) across multiple addresses held by different government arms. None of this has moved for 4 months. pic.twitter.com/nhWWeWqhmh

— Wu Blockchain (@WuBlockchain) July 24, 2025

Big Cases Make Up Most Holdings

A huge chunk—114,599 BTC—came from the 2016 Bitfinex hack case against Ilya Lichtenstein and Heather Morgan. That haul alone counts for more than $13.65 billion.

Silk Road‑related seizures add about 94,643 BTC. That breaks down into 51,680 BTC from James Zhong’s theft and 69,370 BTC linked to another hacker, sometimes called “Individual X.”

Other cases help pad the total. Arkham spotted $81.25 million in BTC taken from Alameda Research’s Binance accounts after FTX collapsed.

Another $79.50 million came from HashFlare scammers Sergei Potapenko and Ivan Turogin. Even small hits like 58.7 BTC from Ryan Farace’s case show up in the chain records.

Sales Haven’t Touched Core Supply

The US sold 9,861 BTC worth about $215 million in March 2023 from the Zhong case. In August 2024, another 10,000 BTC went for $594 million.

Then in December 2024, 10,000 BTC sold for roughly $968 million. Despite that activity, the main piles from Bitfinex and Silk Road haven’t moved. Those coins still sit where seizing agencies left them.

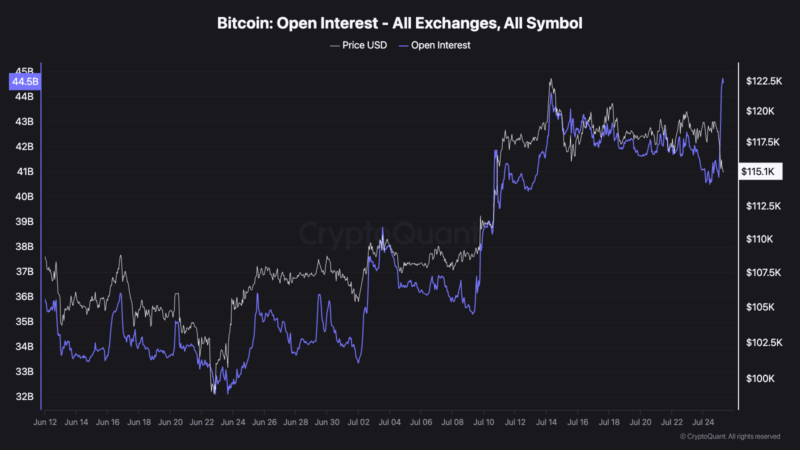

Without a single public ledger, each new FOIA release sparks fresh rumors. Some traders jumped at the Marshals figure and drove prices up or down on the news.

But knowing the real 198,000 BTC figure could calm that. A master dashboard, updated in near real time, would help cut the drama when auctions roll around.

Featured image from Getty Images, chart from TradingView