ETH Steals the Spotlight, BNB Taps New Record, BTC Cools Off: Your Weekly Crypto Recap

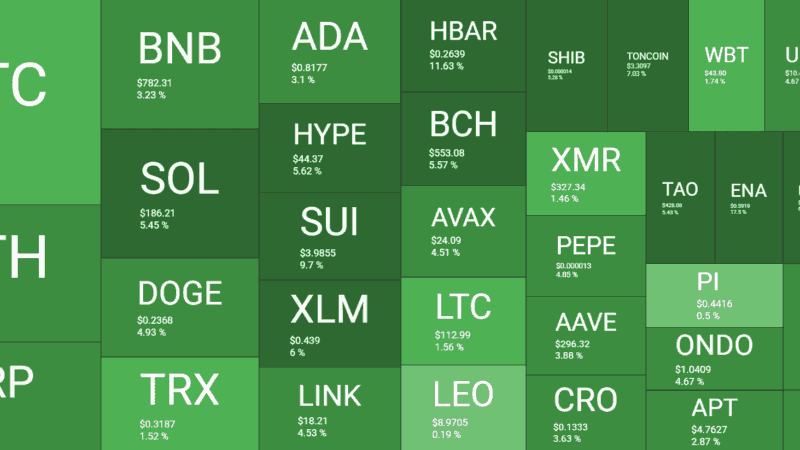

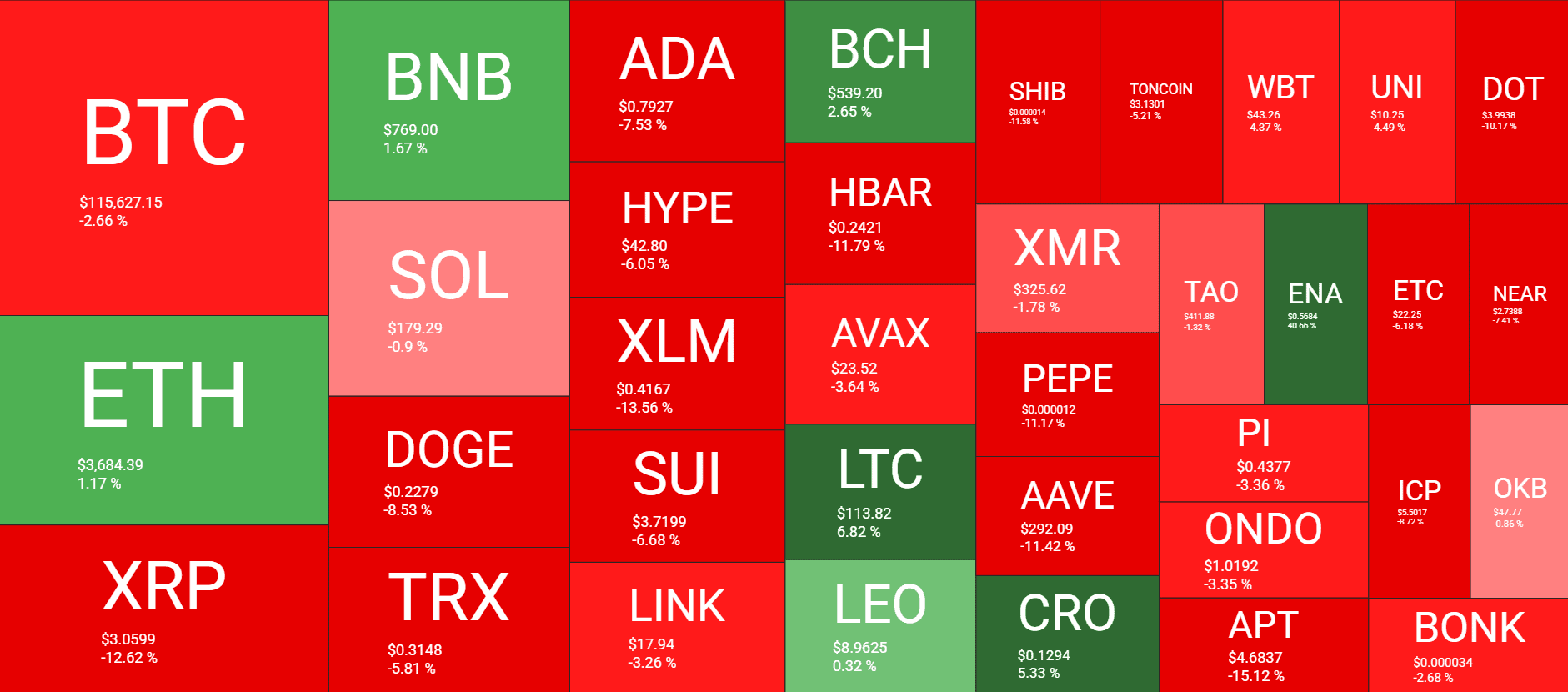

Another volatile and eventful week passed by in the cryptocurrency markets, but the overall sentiment is that the winds are changing as altcoins have emerged in the spotlight.

This is mostly because bitcoin has started to lose traction. Recall that the primary cryptocurrency skyrocketed to a new all-time high at the beginning of last week when it briefly exceeded $123,000. While that was spectacular on its own, it didn’t last long, and the asset retraced almost immediately by seven grand.

What followed for the next ten days or so was sideways trading. BTC remained confined in a relatively tight range between $117,000 and $120,000 as each attempt for a breakout was met with a forceful rejection.

The most violent one took place in the past day. Following reports that Galaxy Digital has started to dispose of its assets by offloading $1.5 billion worth of BTC, the cryptocurrency’s price tumbled and slipped below $115,000 for the first time in two weeks.

Although it has recovered some ground, it’s still struggling to reclaim $116,000 as of press time, and it’s down by over 2.5% on a weekly scale. At the same time, many altcoins, such as LTC, ENA, and CRO, have produced mindblowing gains within the same timeframe. Binance Coin, on the other hand, shot up to a fresh ATH at over $800 before retracing slightly.

Ethereum is also in the green since this time last week. Perhaps driven by the substantial inflows in the spot Ethereum ETFs, the largest altcoin blasted to $3,850 earlier this week. It has lost some ground, but it’s still 1.2% up weekly and now sits close to $3,700.

Some of the altseason speculations that ran rampant for the past week or so came to a halt due to violent corrections from assets like XRP, XLM, HBAR, PEPE, and AAVE, all of which have plunged by double-digits since last Friday.

Market Data

Market Cap: $3.876T | 24H Vol: $265B | BTC Dominance: 59.4%

BTC: $115,670 (-2.6%) | ETH: $3,684 (+1.2%) | XRP: $3.06 (-13%)

This Week’s Crypto Headlines You Can’t Miss

BlackRock’s Ether ETF Becomes 3rd Fastest Fund to Hit $10B in a Year. As mentioned above, the Ethereum ETFs have enjoyed the past few weeks, attracting billions of dollars in net inflows. As usual, BlackRock’s ETHA has stood out the most as it became the 3rd-fastest fund to reach the $10 billion AUM milestone within its initial year.

XRP Longs Crushed on Binance as Analyst Flags Ripple Co-Founder’s $140M Sell-Off. Ripple’s native token was among the top performers lately, but its price suddenly crashed from over $3.4 to $3 within 48 hours. At first, the community blamed it on a speculative move by Upbit, but further reports suggested that one of the company’s co-founders might have sold $140 million worth of XRP.

Robert Kiyosaki Recommends Owning Real BTC, Not ‘Paper’ ETFs. The now-permanent bitcoin proponent, Kiyosaki, believes people should aim to distinguish themselves from the ‘regular investor’ stereotype. As such, they need to focus on accumulating real bitcoin, gold, and silver, instead of opting for ETFs.

Hash Ribbons Signal Ends – Here’s What It Could Mean for Bitcoin’s Next Move. As it appears that BTC’s consolidation may have come to an end, one indicator suggests the asset’s future price performance. The now-completed Hash Ribbons signal indicates that miners may have finished their capitulation phase, which is typically good news for bitcoin’s price.

Retail or Whales? CryptoQuant Analyzes the Forces Behind Bitcoin’s Latest Rally. Whenever BTC pumps hard, analysts and monitoring resources try to determine what’s the primary fuel for that surge. According to CryptoQuant, the latest price revival that took bitcoin to over $123,000 was driven mostly by institutions, as retail is nowhere to be found.

Bitcoin Shows Near-term Fragility as Investors Shift to Altcoins: Bitfinex. The altseason hype really caught on in the past several days as many reps surged to new peaks, including BNB. Analysts at Bitfinex confirmed the narrative, stating that investors have shifted their focus to more speculative digital assets instead of the market leader.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Solana, and HYPE – click here for the complete price analysis.

The post ETH Steals the Spotlight, BNB Taps New Record, BTC Cools Off: Your Weekly Crypto Recap appeared first on CryptoPotato.