Metaplanet Buys 780 Bitcoin — Now Holds Over 17,000 BTC

The post Metaplanet Buys 780 Bitcoin — Now Holds Over 17,000 BTC appeared first on Coinpedia Fintech News

Monday kicked off with a big purchase in the world of Bitcoin. Japan’s top Bitcoin-holding company, Metaplanet Inc., has added 780 more BTC to its treasury, pushing its total to 17,132 BTC.

But what caught attention was something even bigger, Metaplanet has already seen a massive 449.7% return on its Bitcoin investments in 2025 alone.

Metaplanet Buys 780 BTC

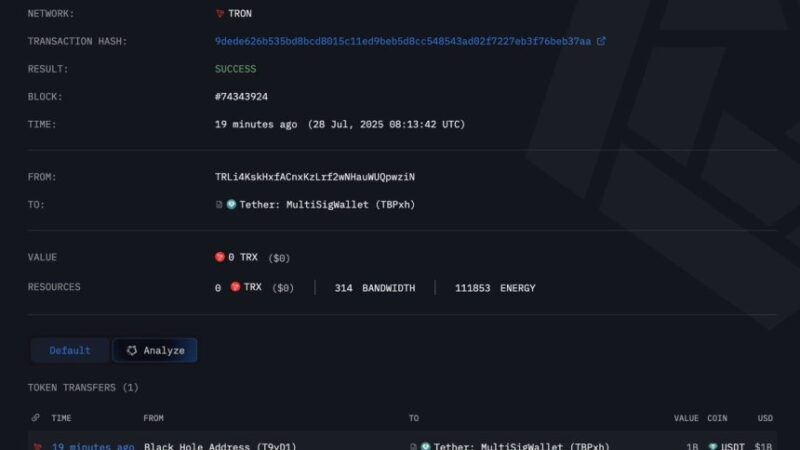

In a recent tweet post, Metaplanet announced that it recently bought 780 BTC for about $92.5 million, paying around $118,622 per Bitcoin. This is one of their highest average prices so far, showing strong belief in Bitcoin’s long-term growth.

With this latest purchase, Metaplanet has climbed up the ranks to become the seventh-biggest company holding Bitcoin, trailing behind Trump Media & Technology Group.

As of July 28, 2025, Metaplanet now owns 17,132 BTC, which they bought for around $1.73 billion. Their average cost per Bitcoin is about $101,030. This makes Metaplanet one of the biggest corporate holders of Bitcoin, joining names like Strategy (formerly known as MicroStrategy) in betting big on BTC.

449.7% Returns This Year

What’s even more impressive is that Metaplanet has already seen a 449.7% return on its Bitcoin investments this year.

With Bitcoin now trading around $119,404, this sharp price rise in 2025 has boosted their profits. It shows that Metaplanet’s early and bold decisions to buy Bitcoin have worked out so far.

Metaplanet Stock Surge by 6%

Metaplanet’s latest Bitcoin move caught the market’s attention, and the reaction wasn’t quiet. Right after the news, the company’s stock price jumped by 6%, now trading around $1,255.

What’s even more surprising is the bigger picture, since Metaplanet first added Bitcoin to its balance sheet, its stock has jumped by over 200% in just six months.