Bitcoin Is A Lifeline, Says Billionaire, As US Faces Debt Time Bomb

Ray Dalio, the billionaire behind Bridgewater Associates, says people should think about putting 15% of their money into gold or Bitcoin. His call comes as America’s debt nears the $37 trillion mark. He argues that holding hard assets can help when paper money loses value.

“If you were optimizing your portfolio for the best return-to-risk ratio, you would have around 15% of your money in Bitcoin or gold,” Dalio said during the Master Investor podcast this week.

Dalio admits he owns only a little Bitcoin and still leans toward gold. But he’s clear that splitting that 15% between the two is up to each investor.

Optimizing For A Debt‑Strained Dollar

According to Dalio, the US government will need to sell about $12 trillion more in treasuries over the next year to deal with its growing bill.

He pointed out that recent Treasury data shows borrowing in the third quarter of 2025 could hit $1 trillion—$453 billion above earlier estimates—and another $590 billion in the fourth quarter.

He warns that printing or selling more debt tends to weaken a currency. That’s why gold and Bitcoin, which aren’t tied to any central bank’s balance sheet, can act as buffers against plain old dollars.

Balancing Gold And Bitcoin

Dalio said gold remains his go‑to choice. It has centuries of track record against inflation and crisis. Bitcoin, on the other hand, is newer and can swing wildly in price.

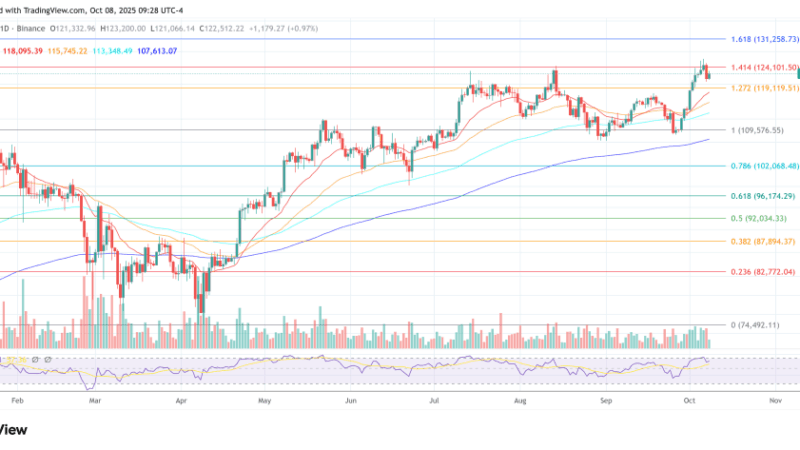

It’s trading around $118,862, roughly 4% below its July 14 all‑time high of $123,250. While its ups and downs can add spice to returns, they can also give some investors sleepless nights.

Dalio suggests you pick a mix that feels right. If you hate big price moves, tilt toward gold. If you can stomach Bitcoin’s roller‑coaster, you might give it a bigger slice.

Midway Through The Conversation On Risk

He raised the idea back in January 2022 with 1% to 2% in Bitcoin. Now he’s tripling that bucket. That jump shows how fast the mood can shift when national debt climbs.

Dalio noted that other Western nations like the United Kingdom face the same “debt doom loop” he sees in the US. He said their currencies may lag behind hard assets, making gold and Bitcoin effective diversifiers when government bills keep piling up.

Role Of Reserve Currencies

Despite his nod to Bitcoin, Dalio said it won’t replace the dollar or euro for central banks. He argued that public blockchains lack privacy. Every transaction is visible, so governments could still watch and intervene.

Gold, in contrast, can change hands in private after it leaves the vault. That gives it an edge when you want to keep your holdings off the radar.

Featured image from Meta, chart from TradingView