Is Ripple’s XRP About to Rally Hard? The Metric That Nailed the Top Says Yes

TL;DR

- Ripple’s cross-border payments token has retraced hard after reaching an all-time high a month ago, and this correction was predicted by a popular technical tool.

- Now, though, that same indicator has flashed a buy signal, which could mean the asset’s price trajectory could be on the verge of a major reversal.

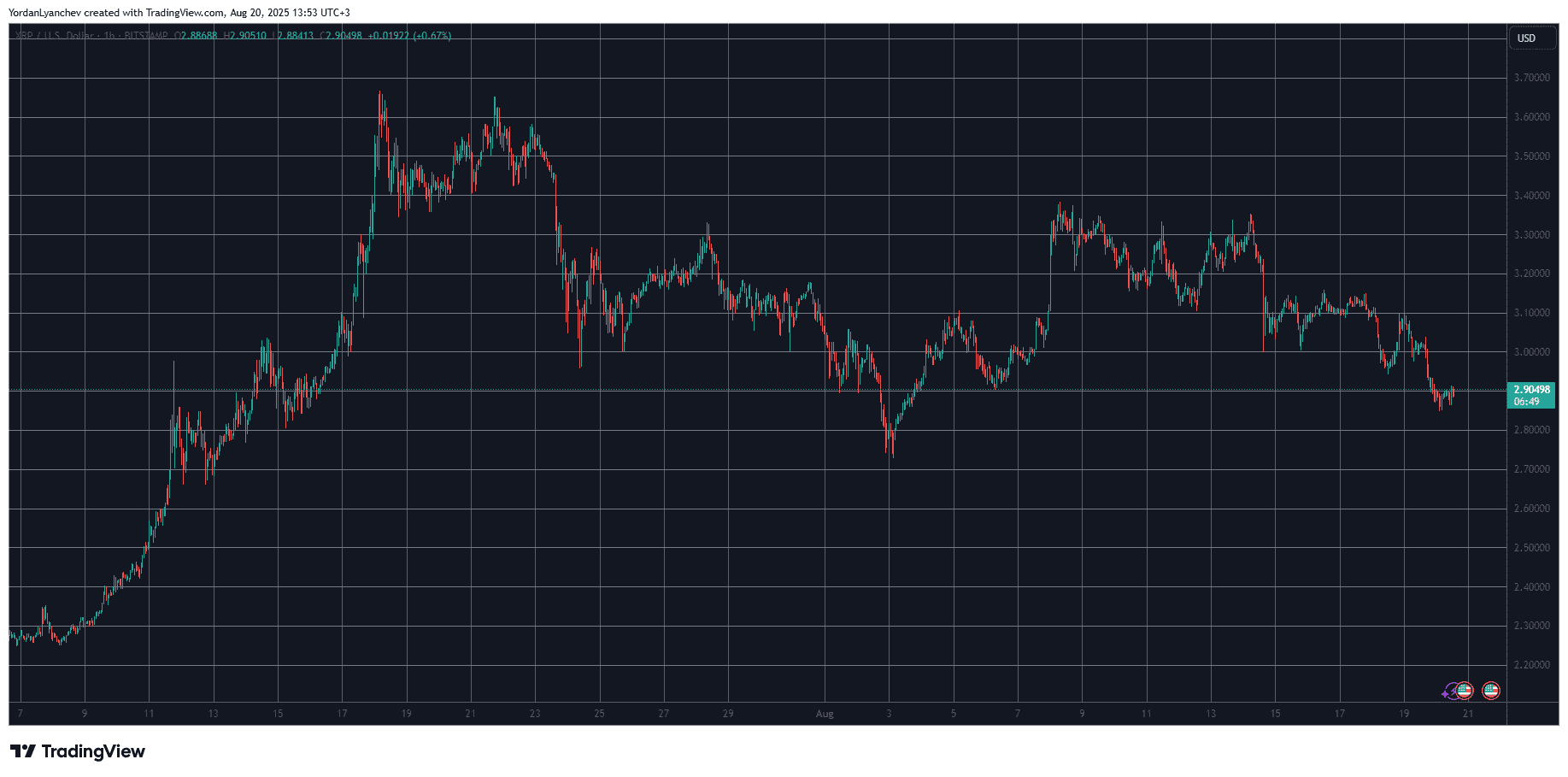

Let’s rewind the clock by about a month. XRP had just broken out of its consolidation range at around $2.20 and $2.30 and was preparing for a massive rally that would take it to unseen heights. This all happened in the span of just a few days in mid-July when the asset flew beyond its 2018 all-time high of $3.40 and set a new record at $3.65.

However, this euphoric run quickly came to a halt and XRP started to retrace almost immediately, dumping to under $2.8 on August 3. This price dump was predicted by the TD Sequential metric, which flashed a sell sign on the 4-hour and the 3-day chart.

Nevertheless, Ripple’s token managed to stop the freefall at that level and even spiked beyond $3.3 after the legal case between the company and the US SEC officially came to an end.

That rally was short-lived once again, though, as XRP, alongside most of the market, started to correct once again at the end of the previous business week. This retracement culminated (for now) earlier today when BTC dipped below $113,000, while XRP plunged to $2.90 amid a substantial whale sell-off.

After losing 20% of its value following the July ATH, though, the third-largest cryptocurrency could be on the verge of another price revival. The same metric that predicted its downfall now flashes a buy signal, according to Ali Martinez, who said, “XRP looks ready to bounce.”

$XRP looks ready to bounce! After perfectly timing the top, the signal now says BUY. pic.twitter.com/NBbQuXd7RG

— Ali (@ali_charts) August 20, 2025

The post Is Ripple’s XRP About to Rally Hard? The Metric That Nailed the Top Says Yes appeared first on CryptoPotato.