Will FTX Payout Dump Altcoin Markets This Week?

FTX’s bankruptcy estate will begin its third wave of repayments on September 30, sending out $1.6 Bn and lifting total recoveries above $8Bn. Nearly three years have passed since the exchange collapsed, taking $8Bn in client assets.

The payouts mark a step forward in unwinding Sam Bankman-Fried’s mess. But creditors remain divided over whether it’s enough. Moreover, could this trigger further sell-offs in the crypto markets?

“It’s progress, but it doesn’t fully capture the opportunity cost,” one creditor wrote in online forums.

How Much Are FTX Creditors Getting Back? Will This Cause a Crypto Dump?

As of this week, FTX payouts vary widely by jurisdiction and class:

- U.S. customers are set to recover 95% of their entitlements after this round.

- International users on the “dotcom” exchange will reach 78% recovery.

- Some government-related claims could see up to 120% restitution under premium settlement terms.

FTX Claims Portal

Claim portal isn’t updated for 30th Sept

Currently it shows the distribution for 30th May

22nd Sept 25: Update will occur tomorrow

Claims showing Disputed on claims portal may change to Allowed tomorrow pic.twitter.com/svMRjj8SHO

— Sunil (FTX Creditor Champion) (@sunil_trades) September 21, 2025

Distributions will flow through partners like Kraken, BitGo, and Payoneer, typically within three business days of the launch. The August 15 cutoff has passed, so late filers must wait until the next cycle.

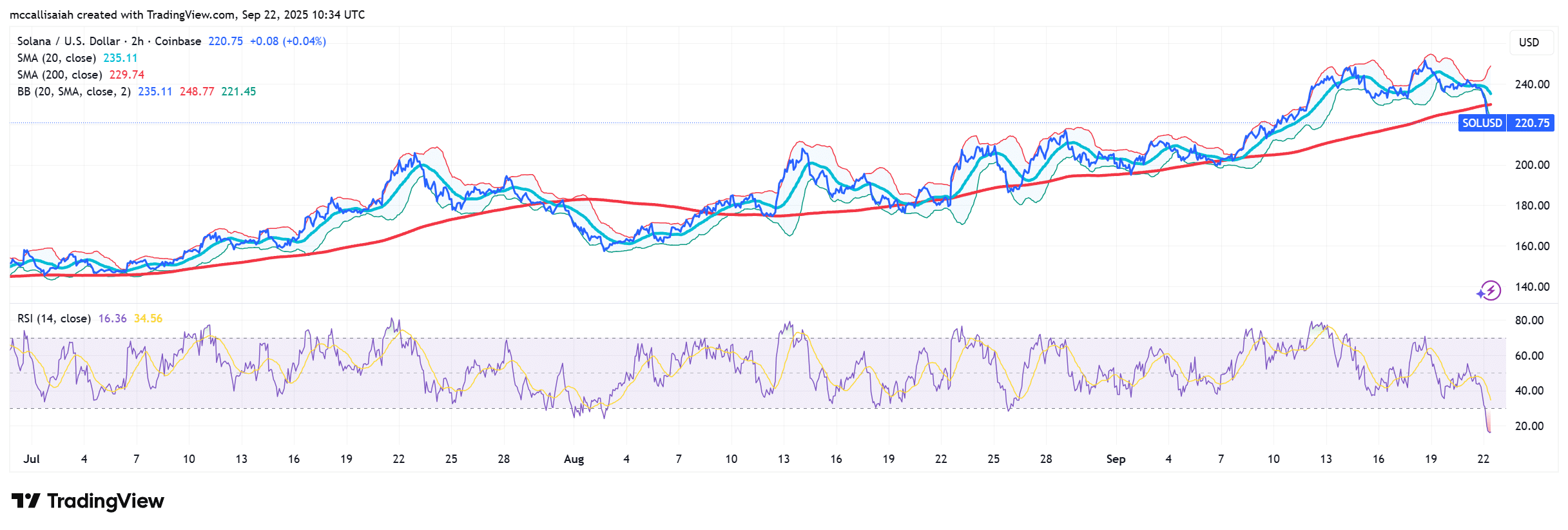

A flood of repayments this size could spark a broader sell-off if markets stay under pressure. The real takeaway is simple: traders should be bracing for the impact of FTX distributions.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Does the FTX Data Reveal About the Recovery?

According to court filings in Delaware, the disputed claims reserve was trimmed from $6.5 Bn to $4.3 Bn, unlocking $1.9 Bn in liquidity for immediate distribution.

DeFi Llama data puts the FTX Recovery Trust’s assets near $16.5 Bn, with administrators expecting to pay all claims by late 2026. By bankruptcy standards, that would count as one of the strongest recoveries the crypto sector has seen.

DISCOVER: 20+ Next Crypto to Explode in 2025

Is This a Win for Justice?

Creditors say repayments based on 2022 prices leave them shortchanged, with Bitcoin more than 200% higher today, per CoinGecko. Demands for inflation adjustments or crypto-denominated payouts have grown in recent years, but the trust continues to prioritize speed and certainty.

The final chapter may not close until 2026, but with billions already flowing, the odds of creditors walking away whole look better than anyone predicted in 2022.

EXPLORE: New Crypto Bill: Coinbase CEO Brian Armstrong Heads to Washington DC

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- FTX’s bankruptcy estate will begin its third wave of repayments on September 30, sending out $1.6 Bn and lifting total recoveries above $8 Bn

- Creditors say repayments based on 2022 prices leave them shortchanged, with Bitcoin more than 200% higher today.

The post Will FTX Payout Dump Altcoin Markets This Week? appeared first on 99Bitcoins.