Dogecoin Bounce Sparks Hopes of Bullish Wyckoff Rally

TL;DR

- Wyckoff Spring signals potential DOGE rebound, with short-term price projection targeting $0.25 resistance.

- Whale wallets holding 100M–1B DOGE increased share to 16.93%, the year’s highest level.

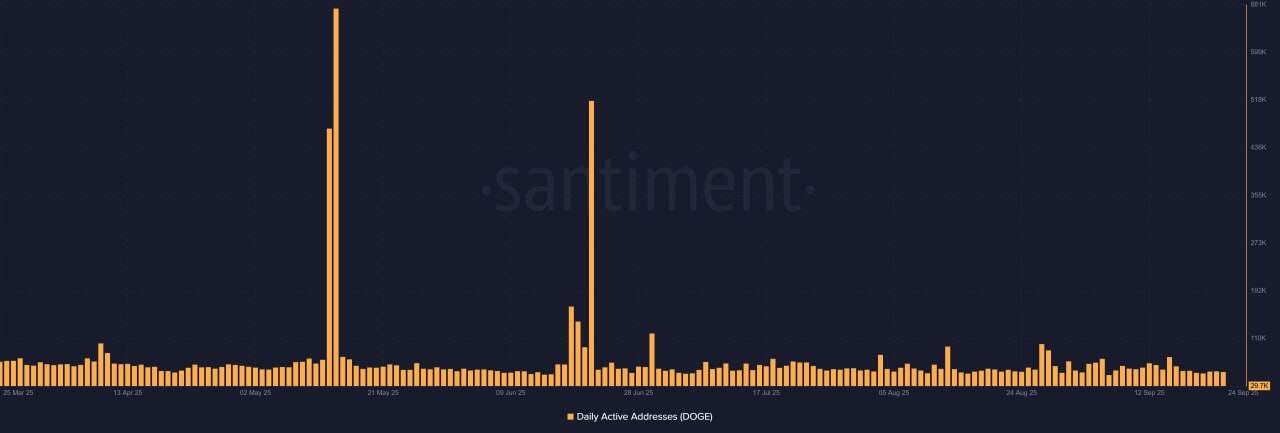

- Dogecoin active addresses spiked in May and June but settled back near 29,700 by September.

Wyckoff Pattern Points to Short-Term Recovery

Dogecoin is showing signs of following a Wyckoff Accumulation pattern on the 1-hour chart. Analysis shared by Trader Tardigrade shows the market moving through phases A and B, where support and resistance levels were tested repeatedly.

Notably, the current move appears to be Phase C, which includes a “Spring.” This is a dip below support that often clears weaker positions before a rebound. Price has bounced from this level, suggesting the possible start of Phase D. If the structure continues to unfold, Dogecoin may see a Last Point of Support followed by a Sign of Strength. The chart projection points to a potential push toward $0.25.

On the daily time frame, Dogecoin is trading inside a rising wedge pattern. The lower line has tracked higher lows since June, while the upper line connects the highs reached in May and September. Price recently pulled back after testing resistance near $0.30 to $0.32.

The projection shows price consolidating around $0.24 to $0.25 before another attempt to break higher. If the wedge holds, a retest of $0.30 is possible.

A drop below the lower wedge line would shift attention to $0.22 as support.

Large Holders Increase Supply Share

Santiment data shows shifts in Dogecoin supply held by major wallet groups. The 100 million to 1 billion DOGE group (yellow line) has been adding steadily since August 2025. Their share has risen to about 16.93% of supply, the highest level shown on the chart.

The 1 million to 10 million DOGE group (red line) expanded its share through September, peaking near 17.6%. Toward the end of the month, this group reduced slightly, suggesting some profit-taking. The data shows the largest whales continue to build positions while smaller groups are less consistent.

Active Addresses Return to Normal Range

Daily active addresses for Dogecoin usually sit between 20,000 and 120,000. Days in the middle of May and late June 2025 showed an exception when activity spiked to over 800,000 and 500,000 addresses, respectively.

By late September, the number fled back to around 29,700. This means that these spikes may have been short-term dirt, and in general, usage has creeped back into stable ranges.

The post Dogecoin Bounce Sparks Hopes of Bullish Wyckoff Rally appeared first on CryptoPotato.