Is Ethereum Heading South? Week of Outflows Paint Bleak Picture for ETH USD

US-listed spot Ether ETFs just logged five straight days of net outflows, adding pressure on Ethereum funds and signaling softer risk appetite from smaller investors.

Farside data shows $248.4M left the products on Friday, pushing weekly redemptions to $795.8 million. Ether fell about -10% over the same stretch.

It’s the longest pullback since the week ending Sept. 5, when the token traded near $4,300.

One big question hangs over the market: staking. Traders are waiting to see if US regulators will allow staking inside Ether ETFs. On Sept. 19, reports said Grayscale was preparing to stake part of its large ETH stack, widely read as a vote of confidence that the SEC could allow it.

BREAKING: Grayscale is preparing to stake their $ETH holdings. $ETHE $ETH

They've moved over 40K $ETH in the last hour as they position (1.5M $ETH) for staking rewards.

They are the first Ethereum ETF in the US Markets to do so. pic.twitter.com/vSOmr0vnHQ

— Emmett Gallic (@emmettgallic) September 18, 2025

The timing is unclear. Sentiment is not. “It’s a sign of capitulation as the panic selling has been so high,” crypto analyst Bitbull said of the outflows.

$ETH ETFs just recorded its biggest weekly outflow ever.

This is a sign of capitulation as the panic selling has been so high.

Do you think $3,750 was the bottom for ETH? pic.twitter.com/DRjlSSOKJC

— BitBull (@AkaBull_) September 27, 2025

Bitcoin products felt the chill, too. Spot BTC ETFs recorded $897.6M in net outflows during the same five days. Bitcoin dropped -5.28% on the week and changed hands at around $109,551 at press time.

ETF analyst James Seyffart said on a podcast Thursday that Bitcoin ETFs “haven’t been perfectly hot the past couple of months,” while noting they remain “the biggest launch of all time.”

LIVE NOW – The Crypto ETF Rush Hasn't Even Started@JSeyff joins us to map the crypto ETF boom: what’s real, what’s next, and who’s actually buying.

We dig into how spot Bitcoin and Ethereum ETFs opened the floodgates, how advisors, hedge funds, and even sovereign wealth funds… pic.twitter.com/JNAFGnr7d0

— Bankless (@BanklessHQ) September 25, 2025

Flows may hinge on the SEC’s stance. A green light for staking could steady demand for Ether funds. Until then, price action and ETF data will set the tone.

Could Institutional Buying Push Ethereum Beyond $4,000?

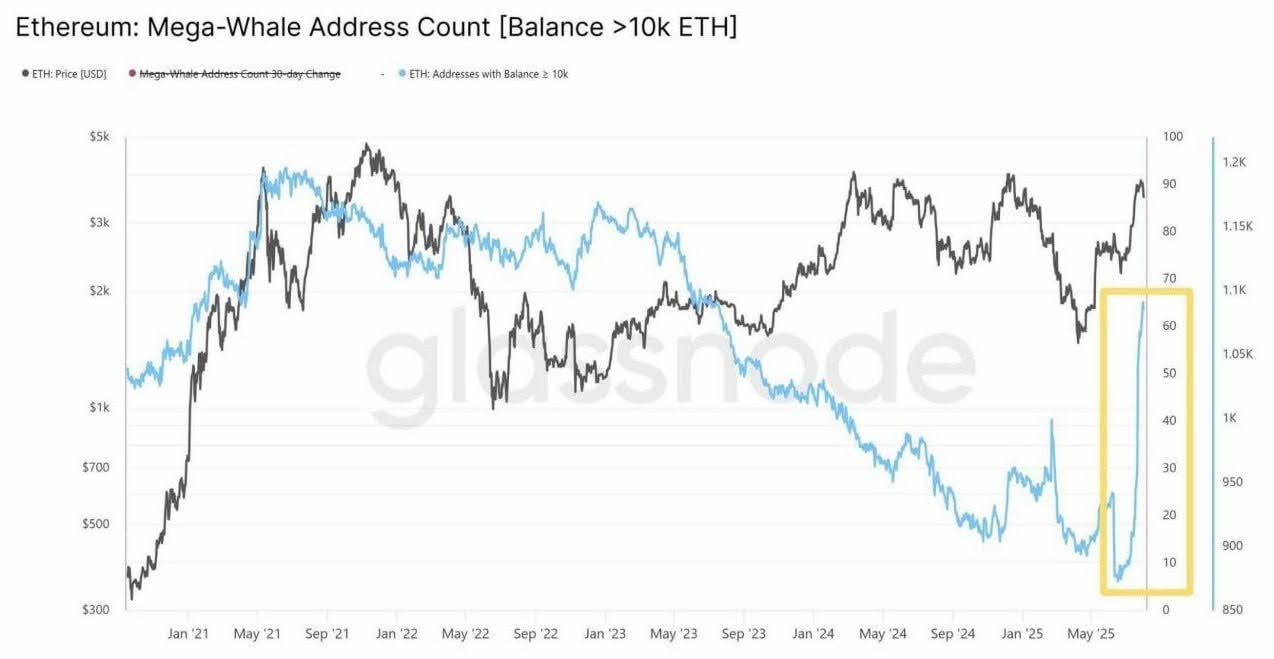

According to Glassnode, Ethereum’s biggest holders are back in buy mode. Wallets with 10,000 ETH or more, often called mega whales, have grown at one of the fastest clips in years.

More than 60 of these addresses appeared in recent weeks, a pace last seen in early 2021.

The shift came after ETH reclaimed the $4,000 mark. It points to renewed confidence from institutions and long-term holders who tend to buy when they see value.

In past cycles, a rising share of coins in large wallets has lined up with accumulation phases that preceded major moves. These entities often include funds, custodians, and high-net-worth investors.

Derivatives add to the picture. Ether futures positioning has swelled alongside spot buying, hinting that big players are building exposure across markets.

That can attract retail later but also make swings sharper if positions flip.

Yes, whales have a history of taking profits near tops. However, the speed and size of the recent additions look more like long-term positioning than short-term trading.

For now, the data suggests deep-pocketed buyers still see ETH as a core asset heading into known catalysts such as broader staking use and any progress on ETF plans.

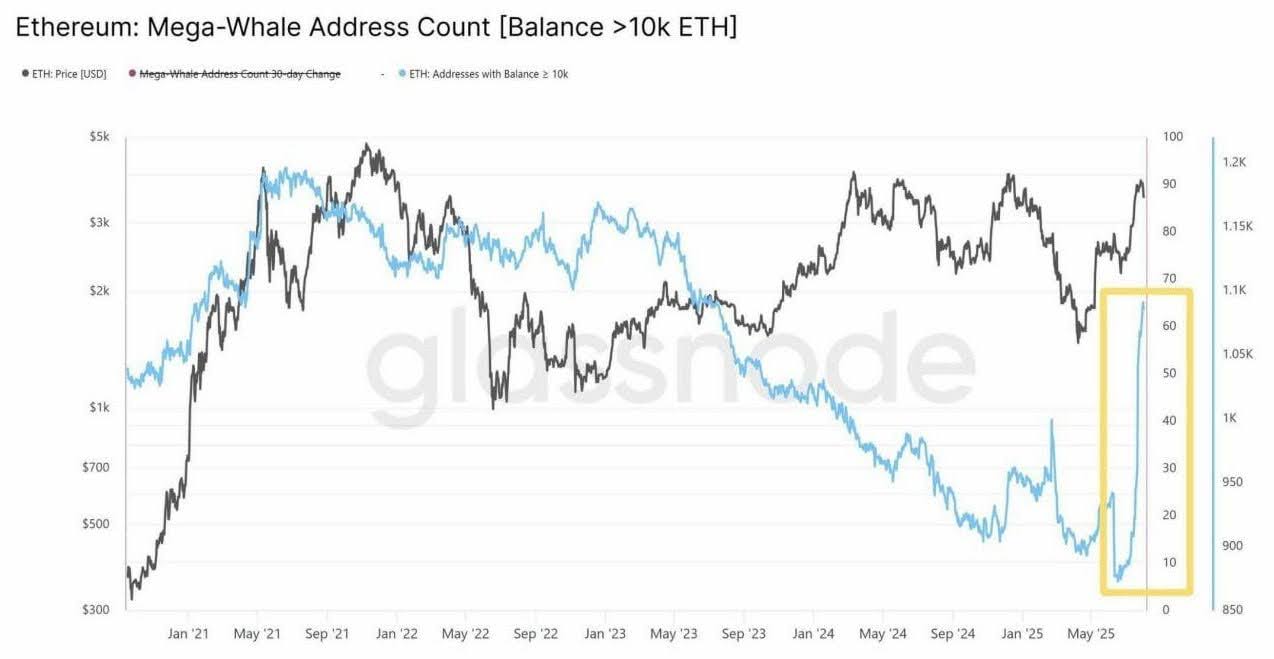

CoinGlass data shows Ethereum futures open interest nearing $70Bn, close to readings seen near the 2021 peak.

The jump tracked ETH’s push above $4,000 and signals fresh money entering the market through derivatives.

Rising open interest tells us that more traders have active contracts. It doesn’t say who will be right, only that a bigger move can follow.

When positioning is crowded, funding and liquidations matter. If longs dominate, a sharp dip can snowball. If shorts lean too hard, a squeeze can run fast.

DISCOVER: 20+ Next Crypto to Explode in 2025

Ethereum Price Prediction: Can Ethereum Close Above the $4,300-$4,400 Resistance?

Trader Merlijn says ETH is pressing against a long-standing ceiling near $4,300-$4,400. His chart shows repeated failures at that band since 2021.

$ETH IS SQUEEZING AGAINST RESISTANCE.

One clean move and price discovery will follow.

Targets: $10K+ and beyond.The rally won’t be big.

It’ll be legendary.Only catch? You need steel balls to survive the FUD. pic.twitter.com/rBvJMVSn85

— Merlijn The Trader (@MerlijnTrader) September 27, 2025

He argues that a clean daily close above it would push ETH into price discovery, opening a path to far higher levels.

He even calls the potential move “legendary,” framing it as a structural break rather than a slow grind.

The risk is noise around the breakout: sentiment can flip quickly, and wicks above resistance have failed. The setup is simple, hold below and range; close through with strength and momentum could expand fast.

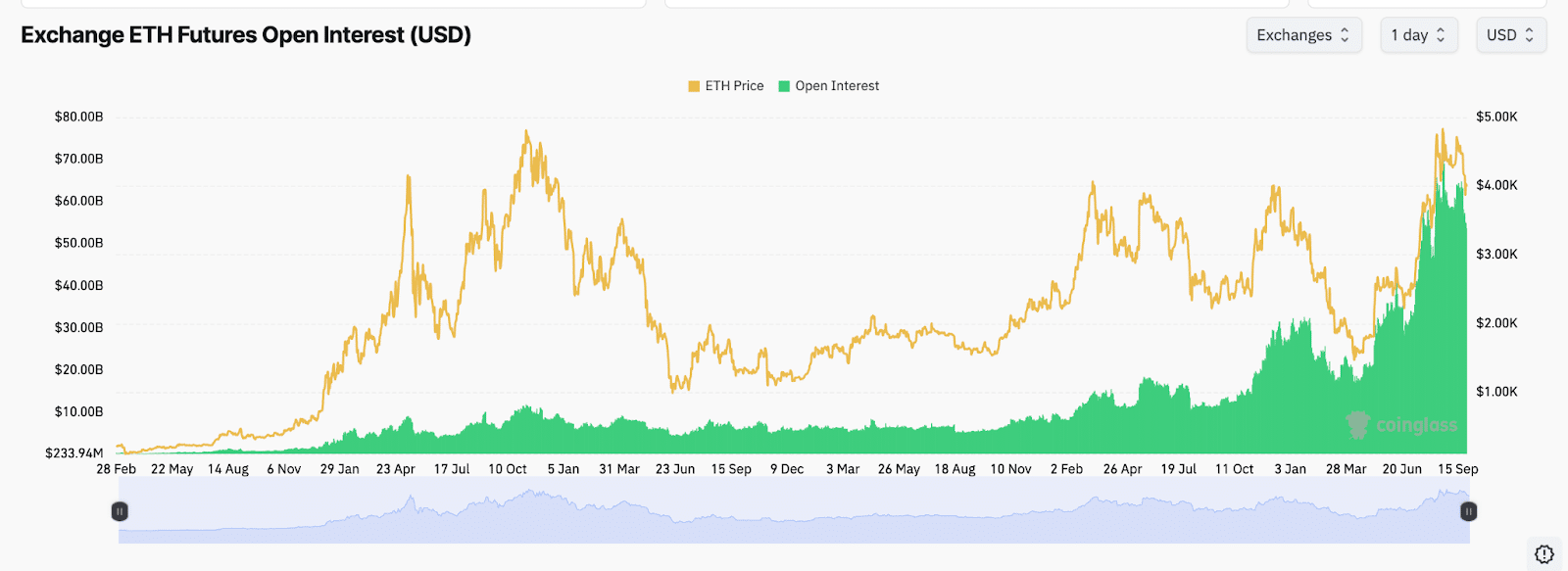

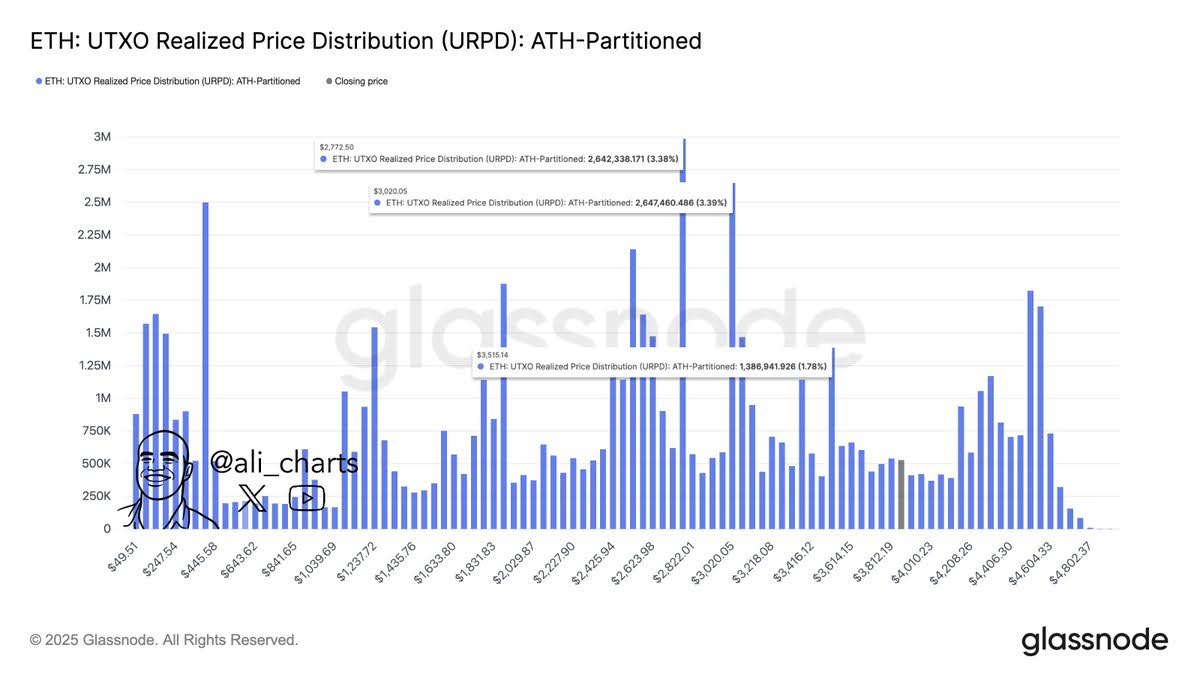

Analyst Ali Martinez flags three areas to watch on the way down: $3,515, $3,020, and $2,772.

Three support levels to watch for Ethereum $ETH: $3,515, $3,020, and $2,772. pic.twitter.com/M6UiTUGvjz

— Ali (@ali_charts) September 27, 2025

His view draws on realized price distribution, which maps where many addresses last bought ETH.

These clusters often act like speed bumps for sell-offs. The $3,020 zone stands out, given the heavy past buying there.

Holding that shelf would keep the trend constructive and limit downside after sharp moves. Lose it, and the market could retest deeper layers of support as late longs unwind.

In short: respect $3,515 on pullbacks, treat $3,020 as the pivot, and see $2,772 as the failsafe in a stress event.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Is Ethereum Heading South? Week of Outflows Paint Bleak Picture for ETH USD appeared first on 99Bitcoins.