Michael Saylor Bitcoin Calms Stock Holders As He Touts BTC Credit Products

Michael Saylor will go down in history as the greatest businessman of all time (unironically). We are heading into the first-ever Green September in a year, following a

halving that has occurred for the entirety of BTC’s lifetime. Something has changed.

Meanwhile, Strategy, formerly MicroStrategy, has become the market’s main Bitcoin proxy. Shares soared 2,600% since 2020, but in 2025, it’s not all perfect: MSTR Stock is down 20% since June while Bitcoin gained 6%, per Bloomberg.

The stock’s premium over its BTC holdings has narrowed from more than 2× to 1.46×, with $73B in Bitcoin on the books.

buy bitcoin

— Michael Saylor (@saylor) September 29, 2025

Last week, on September 22, CNBC analyst Jim Cramer said on X to sell both your crypto and gold. Now he’s advocating to buy. So crypto is either going to the moon, or it will be a catastrophic bitcoin liquidation event like no one has ever seen.

Strategy keeps accumulating despite a shrinking MSTR premium. The firm bought 196 BTC for $22.1M last week, bringing its total to 640,031 BTC. It remains the largest corporate holder; here’s whats next for the stock:

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Michael Saylor Bitcoin: Is Institutional Demand for Bitcoin Actually Outpacing Supply?

Saylor argues that ETFs, corporate treasuries, and sovereign funds provide evidence that more Bitcoin is being bought than mined each day. This dynamic, he says, will eventually squeeze supply and push prices higher. He’s also touting digital credit as an exciting new asset class to boost BTC.

“The market is still in the process of digesting new business models. The idea of a Bitcoin Treasury company has only come into the spotlight over the past year or so,” Saylor said.

Digital Credit is an exciting new asset class, enabled by Bitcoin’s emergence as Digital Capital. $MSTR is leading the way with securities such as $STRC — think of it as jet fuel distilled from a barrel of crude oil.pic.twitter.com/gVUqpP9sRT

— Michael Saylor (@saylor) September 29, 2025

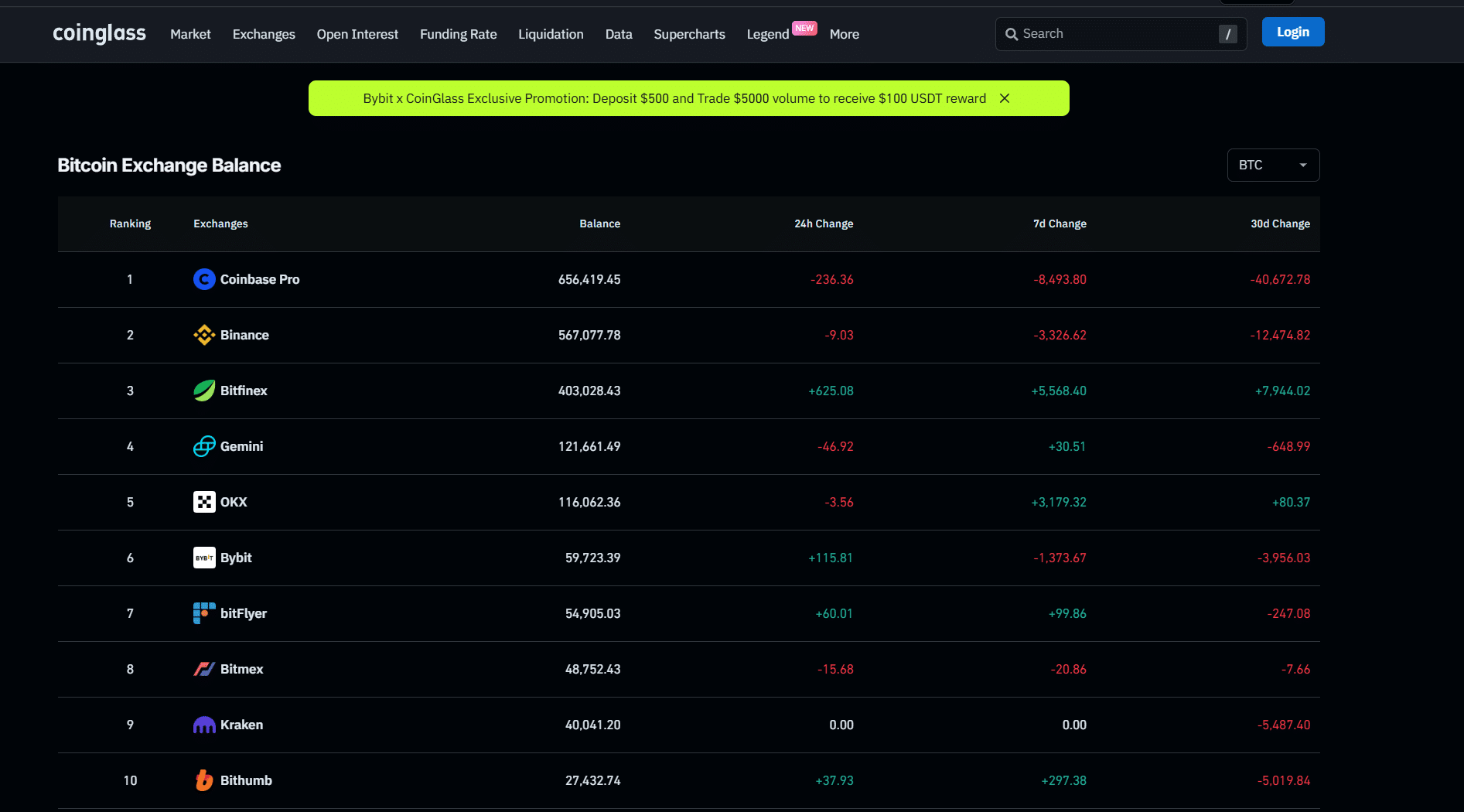

CoinGlass data supports the claim that exchange reserves of Bitcoin have declined steadily throughout 2025, indicating that institutions are buying and holding rather than selling.

The FRED 10-year Treasury yield has risen above +4.6%, applying pressure to risk assets. Historically, Bitcoin has struggled when real yields spike. Yet CoinGecko data shows BTC still trades near $114,300, up 6% year-to-date, with market cap dominance holding above 52%.

DISCOVER: Top 20 Crypto to Buy in 2025

Can Strategy’s Bitcoin Bet Outlast Regulation and Volatility?

With over 3% of mined Bitcoin, Strategy has built the largest corporate treasury in history. Yet if you’re looking to invest, then you should note a fading stock premium and policy uncertainty cloud the upside.

99Bitcoins analysts frame it as a fundamental question: Is Michael Saylor pioneering or crazy? If it’s the former, he might leave a greater impact than Warren Buffett.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Key Takeaways

- Michael Saylor will go down in history as the greatest businessman of all time (unironically). We are heading into the first-ever Green Sept.

- With over 3% of mined Bitcoin, Strategy has built the largest corporate treasury in history.

The post Michael Saylor Bitcoin Calms Stock Holders As He Touts BTC Credit Products appeared first on 99Bitcoins.