Simon Gerovich Celebrates Metaplanet Becoming Fourth Largest Bitcoin Treasury: Company Acquires Another 5268 BTC

Metaplanet has become the fourth largest publicly traded company by Bitcoin holdings with the latest purchase of 5,268 Bitcoin for $623 million on 1 October 2025. The Japan-listed company now holds 30,823 BTC, worth approximately $3.33 billion. Metaplanet CEO Simon Gerovich took to X to celebrate and said, “Metaplanet is now the 4th largest publicly-traded Bitcoin treasury company in the world.”

“Metaplanet has acquired 5268 BTC for ~$615.67 million at ~$116,870 per bitcoin and has achieved BTC Yield of 497.1% YTD 2025. As of 10/1/2025, we hold 30,823 $BTC acquired for ~$3.33 billion at ~$107,912 per bitcoin,” he added.

Metaplanet is now the 4th largest publicly-traded Bitcoin treasury company in the world pic.twitter.com/kg8quw2JYR

— Simon Gerovich (@gerovich) October 1, 2025

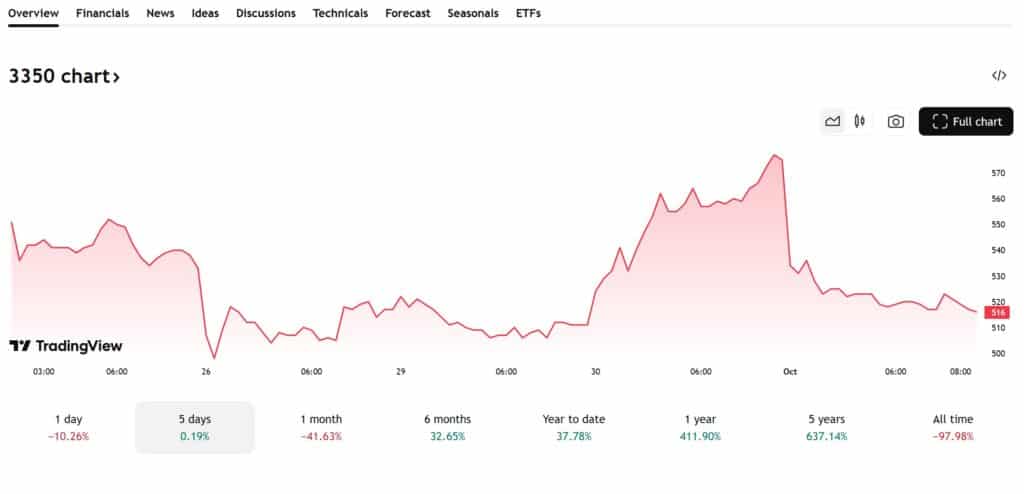

However, in the past five days, the Metaplanet’s stock has seen barely 0.19% in the green.

(Source: TradingView)

The Tokyo-listed company’s aggressive latest purchase of Bitcoin for ¥91.6 billion was at an average price of $116,870. The new purchase was followed by a September buy of 5,419 BTC for $632.53.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Michael Saylor’s Strategy Adds $22 Million In Bitcoin!

Just two days ago, on 29 September 2025, Michael Saylor’s Strategy acquired another 196 BTC for over $22 million, bringing its total to 640,031 BTC. It remains the largest corporate holder.

Strategy, formerly MicroStrategy, has become the market’s main Bitcoin proxy. Shares soared 2,600% since 2020, but in 2025, it’s not all perfect: MSTR Stock is down 20% since June while Bitcoin gained 6%, per Bloomberg.

On September 22, CNBC analyst Jim Cramer said on X to sell both your crypto and gold. Now he’s advocating to buy. So crypto is either going to the moon, or it will be a catastrophic bitcoin liquidation event like no one has ever seen.

Strategy keeps accumulating despite a shrinking MSTR premium.

Strategy declared cash dividends on STRC payable Oct 31, 2025, and increased the STRC dividend rate by 25 bps from 10.00% to 10.25%. $STRC https://t.co/JF6xrtScwm

— Michael Saylor (@saylor) September 30, 2025

Explore: Michael Saylor Bitcoin Calms Holders As He Touts BTC Credit

Metaplanet Now Sits Behind Only Three major Players

On 22 September, the company stunned the crypto world with a record purchase of 5,419 Bitcoin worth over $632 million.

Metaplanet’s rapid accumulation of Bitcoin has been funded through strategic capital raising initiatives. The company raised ¥213 billion through overseas share offerings. The company now sits behind three major players: the Bitcoin behemoth -Strategy, Marathon Digital Holdings with around 50,000 BTC and Twenty One Capital with around 37,230 BTC.

Read More: Eric Trump Attends Metaplanet Shareholder Meeting: Japanese Company Brings BTC Holdings To 20,000

Key Takeaways

- Metaplanet’s rapid ascension to the fourth-largest corporate Bitcoin holder represents a significant milestone for Bitcoin adoption in Asia.

- Metaplanet has undergone a complete strategic transformation. The company pivoted from its traditional hotel management business to become Japan’s first and only publicly listed Bitcoin treasury company in early 2024.

The post Simon Gerovich Celebrates Metaplanet Becoming Fourth Largest Bitcoin Treasury: Company Acquires Another 5268 BTC appeared first on 99Bitcoins.